Understanding Untrended vs Trended Returns in Real Estate Analysis

First off, it’s worth noting that the Q&A is an engaging educational component of the A.CRE Real Estate Financial Modeling Accelerator. Here, participants pose questions related to the academic and professional training the program offers. This forum serves as a dynamic learning environment where users actively participate by asking questions, which are then addressed by a member of the A.CRE team (such as myself!). Sometimes, we even develop full articles inspired by these inquiries.

What Untrended and Trended Returns Represent

Investment returns measure the financial performance and potential profitability of a real estate investment. Therefore, we evaluate these returns through various metrics that focus on providing information to help make better investment decisions.

While it is true that the choice of calculation method depends on the context in which you are using it, it’s also true that you must properly choose the inputs for an accurate calculation.

With untrended returns, we work with the current situation, so we aren’t accounting for expected changes or trends in the market over the investment period. By contrast, trended returns consider market trends, such as growth rates, these rates help project various factors over the analysis period, such as current rent, post-renovation rent, other income, operating expenses, property taxes, and capital expenditures.

In this sense, untrended and trended returns are synonymous with different ways of evaluating the potential financial performance of a real estate investment.

Calculating Both Untrended and Trended Returns

Regarding best practices, I suggest clearly defining the inputs that make your returns trended or untrended. Allow me to add a bit of color from the real-world perspective.

Imagine you are part of an investment team and calculating untrended and trended returns of a real estate investment. You could start by clearly defining the inputs that make your returns untrended by simply calculating stabilized untrended NOI, and then you could use such a value to calculate the untrended metrics.

With trended returns, you could run a DCF and use the stabilized trended NOI (i.e., a dynamic value depending on when stabilized is) to calculate the trended metrics.

Likewise, metrics like IRR and Equity Multiple are based on all growth metrics (e.g., rent growth, expense growth, etc.) in a trended scenario. In an untrended scenario, all growth metrics are set to zero.

I recommend you consult the series of content of The Road to a Stabilized NOI

Case Study

Let’s put these ideas in context through a case study.

Suppose you are a Senior Development Associate at a privately held real estate development firm. Your firm specializes in the ground-up development of Class A industrial assets throughout the United States, Mexico, Colombia, Chile, Argentina, and Europe.

Recently, the firm acquired a 50-hectare parcel of land to develop 100,000 square meters of class-A industrial building. Once the real estate financial model has been built, you have the role of calculating yield-on-cost to determine the difference between the market yield and the actual yield of the investment (i.e., development spread).

I recommend you consult the post Using Development Spread in Real Estate Analysis

In this way, the first questions that would come to your mind would be:

How to Calculate the Yield on Cost and Which CAP Rate to Use

You could start by reviewing the real estate financial model side by side, understanding what was the reason for building the model, and checking the key assumptions, modules, and outputs.

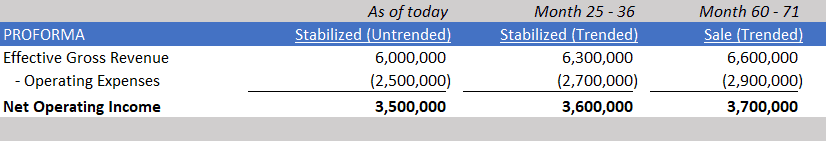

With this you note, among other things, the following key assumptions: operations begin in month 15, stabilization is achieved in month 25, and the expected date of sale is in month 60. Similarly, the trend market shows an annual rental growth rate and expense growth rate of 3%.

After reviewing the real estate financial model side by side, you also realize there are three key moments during the analysis period for the yield on cost calculation: today, the stabilization date, and the sale date.

You then remember that the objective is to calculate the yield on cost, so you note that the total development costs are $50,000,000, but at the same time you realize the following:

You can say there are different types of yield on cost and market cap rates. Based on that, you can conclude that there are also different ways of calculating the development spread based on the three key moments that allow us to differentiate between untrended and trended returns.

Exploring More in Detail

1. Today

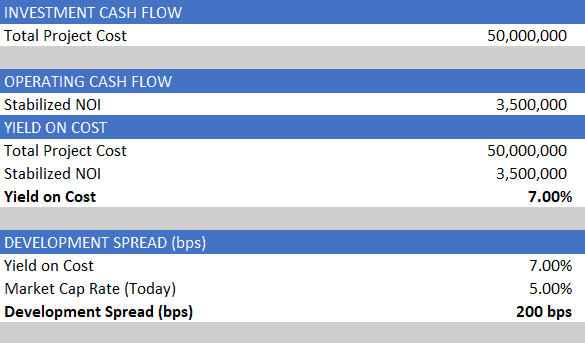

Development Spread = Yield on cost “Untrended stabilized” – Market cap rate (today)

Assuming the NOI proforma stabilized (Untrended) of $3,500,000 and a market cap rate today of 5.0%, the model should take into account the following:

Stabilization is defined after leasing 100% of units, however, the untrended yield on cost is also stabilized. This is because we calculate it using an NOI Pro Forma, which is synonymous with stabilization. So, if untrended (i.e., today before growth), then a market cap rate today would be appropriate.

2. Stabilization Date

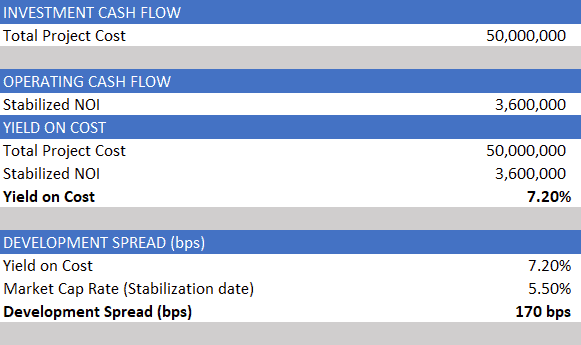

Development Spread = Yield on cost “Trended stabilized” – Market cap rate (stabilization date)

Assuming the NOI proforma stabilized (trended) of $3,600,000 and a market cap rate at the stabilization date of 5.5%, the model should take into account the following:

In this sense, we are calculating a yield on cost “trended stabilized” because we took annualized forward NOI (months 25-36) (i.e., after growth at stabilization). So, a market cap rate at this point of stabilization would be appropriate.

3. Sale

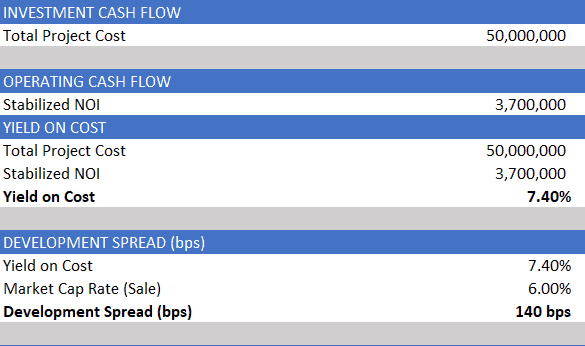

Development Spread = Yield on cost “Trended sale” – Market cap rate (sale date).

Assuming the NOI proforma sale (trended) of $3,700,000 and a market cap rate at this point of 6.0%, the model should take into account the following:

Here, you would calculate the yield on cost using the reversion annualized NOI, so you should use a market cap rate at the sale moment.

Identifying the key moments during the period of analysis of a real estate investment will allow you to use the correct inputs to calculate the untrended and trended returns. For example, if your objective was to calculate untrended yield on cost, it would make more sense to calculate the development spread using the market cap rate today.

Conclusion

Untrended returns give you a snapshot of the current financial performance of a real estate investment. It gives you a more conservative and immediate view of the investment opportunity, focusing on the as-is scenario.

Trended returns provide a more dynamic and forward-looking assessment of the investment. They provide a forecast of the long-term financial performance, factoring in expected market trends and changes.

Real estate professionals calculate untrended and trended returns to get a comprehensive picture of a real estate investment’s potential!