Timing of Preferred Return vs Return of Capital in an Equity Waterfall with IRR Hurdles (Updated May 2024)

Recently, we had an A.CRE reader ask us about the mechanics of Preferred Return distributions in our equity waterfall models with IRR hurdles. Specifically, he questioned the timing of when and how Preferred Return vs Return of Capital were distributed. In this blog post, I’ll share the response I gave him in order to help others using our equity waterfall models with IRR to better understand the methodology we use in those models.

Are you an Accelerator Plus member? If so, check out the Advanced Modeling – Partnership Cash Flows endorsement to learn to breakout preferred return, return of capital, promote, and excess cash flow in your equity waterfall. Not yet an Accelerator Plus member? Consider joining our comprehensive real estate financial modeling training program today.

Understanding the IRR Preferred Return Hurdle

For those who are unfamiliar with the concept of an IRR preferred return hurdle, allow me first to explain. An IRR preferred return hurdle in a real estate equity waterfall is a minimum internal rate of return that one or more of the partners must achieve before a disproportionate share of the excess cash flow (i.e. the promote or carried interest) can be paid to the sponsor/GP.

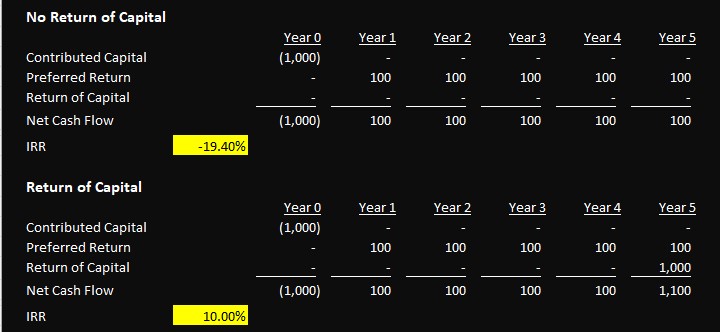

What’s important to remember is that it’s impossible to hit an IRR hurdle without returning 100% of contributed capital. You can test this by running an IRR calculation in Excel. For instance:

- Assume a 10% IRR preferred return hurdle

- Assume an investor contributes 1,000 to an investment

- Assume an investor receives an amount in distributions each year equal to 10% of its initial contribution

- Assume that 0 has been distributed toward returning capital to the investor

What is the investor’s IRR at the end of a five-year period of the scenario above? The answer is NOT 10%, but rather -19.40%. Or in other words, the investor has NOT yet hit the 10% IRR preferred return hurdle.

In order to do so, the investor must a) receive an amount in distributions each year equal to 10% of its initial contribution AND b) receive a full return of its capital. When that is the case, the resulting IRR is 10%.

- Click here to download this example calculated in Excel

As seen in the top scenario, paying out a 10% annual return does NOT result in a 10% IRR. It’s not until all capital contributed has been returned (bottom scenario) that an IRR >0% can be achieved.

Preferred Return vs. Return of Capital Distributions in our IRR Equity Waterfall Models

Returning to the question raised by the A.CRE reader. He presented us with a scenario where the LP must hit an 8% preferred return IRR hurdle before the GP earned a promote. In his specific scenario, the model split distributions to cover both the preferred return and the return of capital contributions, such that the project had an 8% IRR.

- Click here to view the Real Estate Equity Waterfall Model – IRR and Equity Multiple Hurdles that the A.CRE reader was using in his analysis

The question arose about the actual timing of how the distributions were split, as it seemed the preferred return was being front-loaded in the first year vs. being spread out over the hold period. The numbers were specific to the user’s model, but the concepts apply. And so this was my response:

The IRR Hurdle and Time Value of Money

To hit an 8% IRR, two things must happen:

- Some amount of cash flow above capital contributed must be distributed to the partner (i.e. the preferred return)

- The entire amount of any capital contributed must be returned to the partner

Now what’s interesting about an IRR hurdle, because of the time value of money, is that the amount needing to be distributed increases as the time that hurdle goes unhit increases. If the hurdle is hit on day 1, the preferred return amount is approximately 0.

Whereas, if the hurdle is hit on day 3,650 the preferred return amount is several multiples of the total amount contributed. Thus, the two are intertwined and hence both exist in the same tier: as those two forms of distributions are really one and the same.

Which Distribution Happens First – Preferred Return or Return of Capital?

Now the issue users often get caught up on is the timing of how preferred return and return of capital are distributed. Does the first dollar go toward preferred return? Does it go towards return of capital? Or does it go towards some mix of the two?

For instance, if 1,021,352 must be distributed against a 900,000 contribution in order to hit an 8% IRR hurdle, when does the 121,352 of preferred return get distributed and when does the 900,000 in return of capital get distributed?

It doesn’t actually matter whether the preferred return dollar was distributed first or the return of capital dollar was distributed first. Both must occur to hit the hurdle, with the allocation of those distributions to preferred return vs return of capital being irrelevant to hitting the hurdle.

Refer to the Partnership Agreement

Now with that said, the allocation of those distributions is relevant to the extent that the partnership agreement spells out which is paid first (or some mix). In this model, I assume that the partnership agreement calls for the preferred return to be paid first (a common structure I personally use), followed by a return of capital. Again, the order of these two might differ from agreement to agreement, but the end result from the perspective of modeling an IRR hurdle is identical.

Preferred Return First, Return of Capital Second

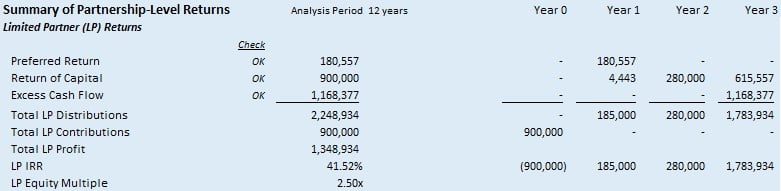

So, let’s take as an example our Real Estate Equity Waterfall Model with IRR Hurdles together with the scenario of an 8% preferred return, over three years, against a 900,000 contribution of capital.Every dollar available to distribute to a partner must be distributed until that partner has hit an 8% IRR.

Preferred return distributed first, followed by return of capital with a look back at the point when the IRR is hit in order to perform the calculation.

In this case, the first hurdle is hit in year three when 1,080,557 has been distributed such that the LP has earned an 8% IRR.

At the point that 1,080,557 had been distributed, the partnership agreement requires the preferred return to be paid first. The accounting group can determine that the first 180,557 distributed is the preferred return, with every dollar thereafter a return of capital.

Since more than 180,557 was available to distribute in year one, the entirety of what constitutes preferred return was distributed. Every dollar thereafter was considered a return of capital.

Or, in other words, the breakout of distributions of preferred return and return of capital are handled as follows.

- At the point that the preferred return hurdle is hit, a look back occurs during which the distributions are split first to preferred return and second to return of capital.

- All distributions first go toward the preferred return required to hit a given IRR hurdle over a given period.

- Once that event has occurred, all distributions thereafter go toward a return of capital.

Hopefully, that provides some greater color on the nature of preferred returns and how they’re accounted for in financial modeling. Getting to this point in your modeling proficiency will really highlight your value among your peers!

Additional Resources

For those intrigued by the nuances of preferred return versus return of capital discussed in this article, the A.CRE AI Assistant can further enhance your understanding of this and other topics. It is a custom GPT we designed to streamline the navigation of real estate financial modeling and other A.CRE resources. By interacting with the A.CRE AI Assistant, you can dive deeper into related subjects, clarify doubts, or extend your learning without manually searching through extensive documentation.

Beyond our AI Assistant, we cover the nuances of Equity Waterfalls (i.e. Partnership Cash Flow Modeling) extensively in our A.CRE Accelerator Core and Advanced Curriculum. Not a member? Consider joining today!

Frequently Asked Questions about Preferred Return vs Return of Capital in IRR-Based Equity Waterfalls

What is an IRR preferred return hurdle in an equity waterfall?

An IRR preferred return hurdle is the minimum internal rate of return that must be achieved by a partner (typically the LP) before the sponsor/GP can receive promote distributions. It ensures the LP receives both preferred return and full return of capital before excess cash flows are shared disproportionately.

Why doesn’t distributing a fixed return (e.g. 10%) annually meet the IRR hurdle?

Because IRR accounts for the time value of money, distributing 10% annually without returning the capital results in a negative IRR. Both a return on capital (preferred return) and a return of capital must occur to achieve a positive IRR and hit the hurdle.

In IRR hurdles, does preferred return or return of capital get distributed first?

It depends on the partnership agreement, but in A.CRE’s waterfall model, preferred return is paid first, then return of capital. Functionally, both must be met to hit the IRR hurdle, and the timing doesn’t affect the IRR calculation, just the reporting.

How are preferred return and return of capital calculated in the waterfall model?

At the point the IRR hurdle is met, the model performs a look-back, splitting all past distributions into (1) preferred return up to the hurdle rate, and (2) remaining distributions as return of capital. This is based on actual cash flows, not pro rata assumptions.

Why does the order of distribution not matter for hitting the IRR hurdle?

Because IRR is a function of total distributed cash flow over time, whether distributions are labeled preferred return or return of capital doesn’t affect the IRR result—as long as both are fully paid by the time the hurdle is tested.

How should I structure my model to reflect IRR-based distribution tiers?

Distributions should be allocated sequentially:

Preferred return first, to the IRR hurdle,

Return of capital to contributed capital,

Then promote splits above the hurdle.

This reflects typical equity waterfall mechanics and conforms with many partnership agreements.

Where can I learn more about modeling preferred return and equity waterfalls?

Check out the A.CRE Equity Waterfall Model with IRR Hurdles, the Advanced Modeling – Partnership Cash Flows course in the Accelerator, and explore related content through the A.CRE AI Assistant for targeted help.