The Road To A Stabilized NOI – Underwriting Real Estate Concessions

The incentives offered to the tenants of a real estate property constitute another of the adjustments that real estate professionals must underwrite to achieve a stabilized NOI, but beyond the adjustment, the concessions represent the cost of reaching a certain occupancy figure for the property.

Note from Arturo: This is the third post of The Road to a Stabilized NOI. This series of content intends to show the road that real estate professionals must follow to reach a Stabilized NOI, in this sense, beyond the calculations, the objective is to reflect what is behind the decisions that must be taken concerning the subscription of each one of the items that make up the proforma of a real estate property.

For example, when we are underwriting “Total Rental Income” on the pro forma of a multifamily real estate property, we begin by considering the gross potential rent, i.e., the absolute maximum we could earn if all units were occupied at market rent, then adjust that value by considering loss to leases, actual vacancy and credit loss, and finally concessions to calculate total rental income.

(+) Market Rent

(+/-) Gain/Loss to Lease

(-) Actual Vacancy & Credit Loss

(-) Concessions

(=) Total Rental Revenue

Now, on the road to a stabilized NOI, concession adjustments are synonymous with the cost of leasing and/or keeping a property occupied. While it is true that, for example, the landlord does not receive rental income during a free rent period, it is also true that they are securing a tenant for the entire duration of the lease, which ensures a stable income flow in the long term.

Concessions In Real Estate Underwriting

In the case of a lease, concessions may be synonymous with free rental periods or, for example, in a multi-family property, an agreement of the property owner that the tenant is exempt from certain charges such as pet or parking fees.

Lease agreements usually handle two terms, the first one “Lease Start” and the second one “Rent Start”, so the difference between both of them is the number of months of free rent offered.

These incentives aim to induce the tenant to sign a lease agreement, either during the initial leasing period or during tenant-favorable periods in the market cycle, to maintain rental prices.

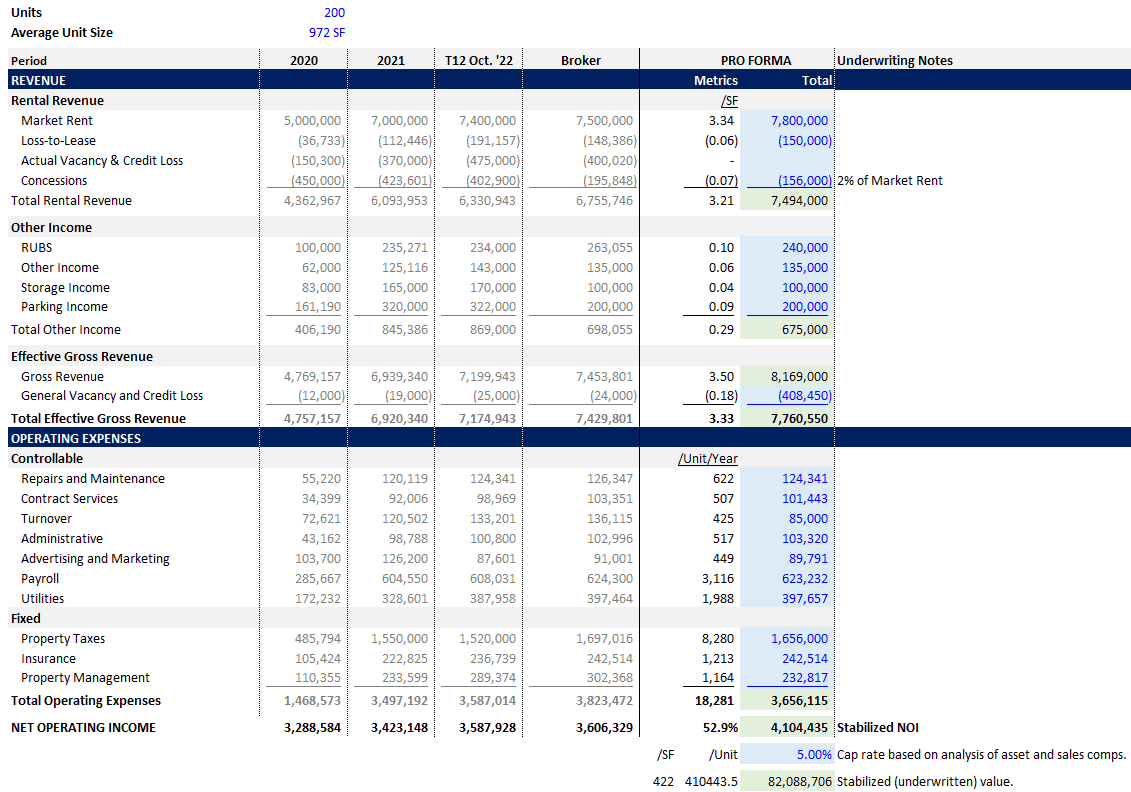

In the following example of a proforma for a multifamily property, you can see how the market rent is adjusted in the Rental Revenue section.

Concessions can also be seen as a gesture of goodwill, which helps to build a positive relationship between the landlord and tenant from the beginning of a lease agreement, contributing to increasing the likelihood of the lease being renewed.

Multifamily pro forma

What sources of information should we take into account when underwriting the value of a concession in the pro forma of a real estate property?

The first thing we should review is the nature of the lease. Certainly, that will depend on the type of property. Then, just like each of the underwriting decisions, the establishment of concessions must be supported by a base that is fed from the following sources:

Internal Data: This is the first source to consult, represented by the historical data of the analyzed property and all the leases that are known directly. For example, think of companies that have a disciplined process of collecting and structuring lease information. Such companies underwrite hundreds of potential investments each year, and during that underwriting process, they gather information about the leasing conditions of tenants.

Networking: One way to enrich internal data, or if it is not available, is to turn to the contact network to obtain information about comparable leases. Brokers and property managers are a very valuable source.

External data: External data providers constitute another source of information, which provides data that is available on the market or, alternatively, data that must be purchased.

Now, the experience on the ground, along with a dynamic understanding of the market and submarket, will determine the proper management of the data provided by each of the sources.

A Look At The Concessions In Real Estate Underwriting In Properties With Short-Term Leases (Multifamily)

Multifamily properties are an example of short-term leases, which means that cash flows are less predictable. In this context, imagine that you are part of the investment team at a real estate company, and your role is to build the acquisition proforma of a multifamily property.

While in reality, the concessions are often a fixed amount per tenant (for example, X months of free rent, free parking, etc.), modeling this reality to calculate the underwritten value of concessions in the proforma will not add a worthwhile value to do so, that is why, in these cases, precision is sacrificed for the simplicity of calculating an amount that approximates the actual concessions given.

So, when you review the historical income statements (Income Statements) of the multifamily property, and you realize that the concessions are perdurable over time, in addition to reviewing the other sources described above (External data and contact network), you might come to the conclusion that, for example, a 2% adjustment of the market rent is a rational adjustment.

Beyond adjusting market rent or rental income, what’s most important is that the resulting value is consistent with the expectation of the real amount of concessions that the property offers.

However, while it is true that in some markets it is necessary to give tenants free months of rent to lease or maintain the property at a certain occupancy level, in other markets existing occupancy levels may require zero concessions.

A Look At The Concessions In Real Estate Underwriting In Properties With Long-Term Leases (Retail, Industrial, Office)

The impact that concessions have on the calculation of the stabilized NOI of a property with long-term leases is represented by periods of free rent. In this sense, the first step in underwriting a concession is to understand the terms of the lease contract.

I recommend you consult the Bite-Sized Real CRE Lessons – A.CRE 30 Second Video Tutorials and our Glossary of Terms, to clarify any doubts regarding a certain term.

Modeling the impact of concessions…

Imagine that as a real estate professional, you are working on the acquisition of a retail property with multiple existing tenants, in this sense, you would need to review or model the rent rolls of the existing long-term contracts, considering concessions for both renewal and signing a new contract.

Modeling short and long-term leases is another of the interesting topics that we cover extensively in the A.CRE Real Estate Financial Modeling Accelerator!

Therefore, in case a tenant renews, the assumptions will be very different compared to when the space is occupied by a new tenant. The most common method to analyze those two possible scenarios is to take a mix between the cost of a renewal versus the cost of a new tenant.

The reason is that for most tenants, vacating a space involves a cost, which represents the financial and logistical cost of moving to a new space. In this sense, it is usually less expensive to renew a tenant than to lease a new one.

One way to calculate the concessions related to the cost of free rent each year could be by calculating the weighted average of the concession months (renewal and contract breakage) and then multiplying it by the adjusted market rent each year. Assuming that the concessions are enduring over time, the subscription of the value in the proforma could be calculated through the average of the concessions over the years of the analysis.

In this way, we will be considering the reduction in income during free rental periods and any rent increases (Escalation) that could offset concessions on the lease terms.

Non-Permanent Concessions In Real Estate Underwriting Over Time

It is also possible that the value of the concession is not included in the proforma for a specific property. For example, imagine you are part of an investment team that is considering the acquisition of an office property of 40,000 SF, with a single tenant, who has recently signed a 15-year lease with annual rent increases of 1.5%. So, you receive the offering memorandum from the broker and decide to build your own proforma.

When you review the broker’s financial projection for the next 10 years, you notice that there is a significant cash flow from concessions present only in the first year. In this case, when you are building your own proforma to calculate the value of the property, you should not include such concession because this cash flow is not durable over time, that is, such value does not contribute to the search for a stabilized NOI.

Capturing The Risk Involved With Leasing Costs (Free Rent Periods, Tenant Improvement Allowances, Leasing Commissions) In The Acquisition Of A Real Estate Property

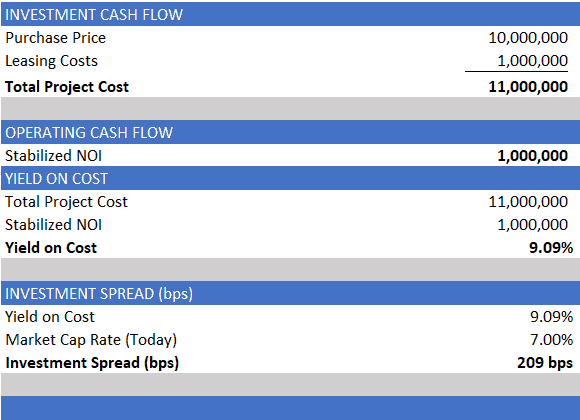

Imagine you are part of an investment team that is analyzing the possibility of acquiring a retail property valued at $10,000,000. This property has multiple existing tenants and vacant spaces, and the leasing costs for the vacant spaces represent a value of $1,000,000.

Assuming that the stabilized NOI is $1,000,000 and that today’s market capitalization rate is 7%, your financial model should take into account the following:

At this point, I recommend consulting the post Using Development Spread in Real Estate Analysis.

In this scenario, you can appreciate the importance of considering leasing costs in the project budget to capture the risk represented by leasing the vacant spaces. And, the stabilized NOI would be calculated once all the leases for vacant spaces are executed, and the new tenants are in place.

Final Notes

Concessions offer a range of benefits both to owners and tenants, think about those cases where tenants need time to establish their operations or renovate the space before they can start generating revenue.

On the road to a stabilized NOI, the underwriting of the concession value in a proforma also depends on the purpose of the analysis, in other words, a seller will be more aggressive in looking for a lower concession in their proforma, while a buyer will be more conservative looking for a higher concession.

While it is true that in some markets it is necessary to grant tenants months of free rent to lease or maintain the property at a certain occupancy level, in other markets it may be that the existing occupancy level requires zero concessions.

Frequently Asked Questions about Underwriting Real Estate Concessions to Reach a Stabilized NOI

What are concessions in real estate underwriting?

Concessions are incentives offered to tenants, such as free rent periods or waived fees (e.g., pet or parking fees). They are considered a cost of leasing and are subtracted from market rent to arrive at total rental revenue on a pro forma.

How do concessions affect stabilized NOI?

Concessions reduce total rental income during the lease term, which impacts the calculation of stabilized NOI. Because concessions are often temporary, it’s important not to overstate income by ignoring them in underwriting.

Where can you source data to underwrite concession values?

You should consult internal data (historical leases), networking sources (brokers, property managers), and external market data providers. These sources help validate and benchmark appropriate concession assumptions.

How should concessions be modeled for multifamily properties with short-term leases?

In short-term leases, concessions are typically modeled as a simple adjustment (e.g., 2% of market rent) rather than modeling each incentive in detail. This balances simplicity with accuracy, especially when concessions are ongoing.

How are concessions handled in properties with long-term leases?

For long-term leases (e.g., retail, industrial, office), concessions like free rent must be modeled directly into the rent roll. This includes differentiating between new tenant and renewal scenarios and calculating the weighted average concession period.

When should a concession not be included in a pro forma?

If a concession is non-recurring or does not endure over time, such as a one-time free rent period in a 15-year lease, it should not be included when calculating stabilized NOI, as it does not reflect the property’s long-term earning potential.

How can leasing costs (including concessions) be incorporated in an acquisition analysis?

Leasing costs—including free rent, tenant improvement allowances, and commissions—should be included in the project budget. These are necessary to stabilize NOI and reflect the real cost of occupying vacant space.

Do concessions vary based on market conditions?

Yes. In some markets, occupancy can be maintained without concessions, while in tenant-favorable markets, concessions are necessary to attract or retain tenants. Underwriting must reflect these market-specific realities.

Why do buyers and sellers underwrite concessions differently?

Sellers tend to be more aggressive, assuming lower concessions to present higher NOI and value. Buyers are typically conservative, assuming higher concessions to account for leasing risk and to avoid overvaluation.