The Road To A Stabilized NOI – Underwriting Real Estate Capital Reserves (Case Study – Case Only)

Achieving a stabilized Net Operating Income (NOI) in real estate requires careful planning and sound execution. One element that can cause confusion is when underwriting capital reserves. Should they go above the line (i.e., as an Operating Expense) or below the line (i.e., as a Capital Expenditure)? And what is the purpose of the Capital Reserve? In this post, I’ll answer those questions and dive deeper into the concept of a Capital Reserve.

Note from Arturo: This is the fourth post in “The Road to a Stabilized NOI” series. This series aims to illustrate the journey real estate professionals undertake to achieve a Stabilized NOI. Beyond the calculations, the objective is to shed light on the decision-making process involved in underwriting each item that constitutes a property’s proforma.

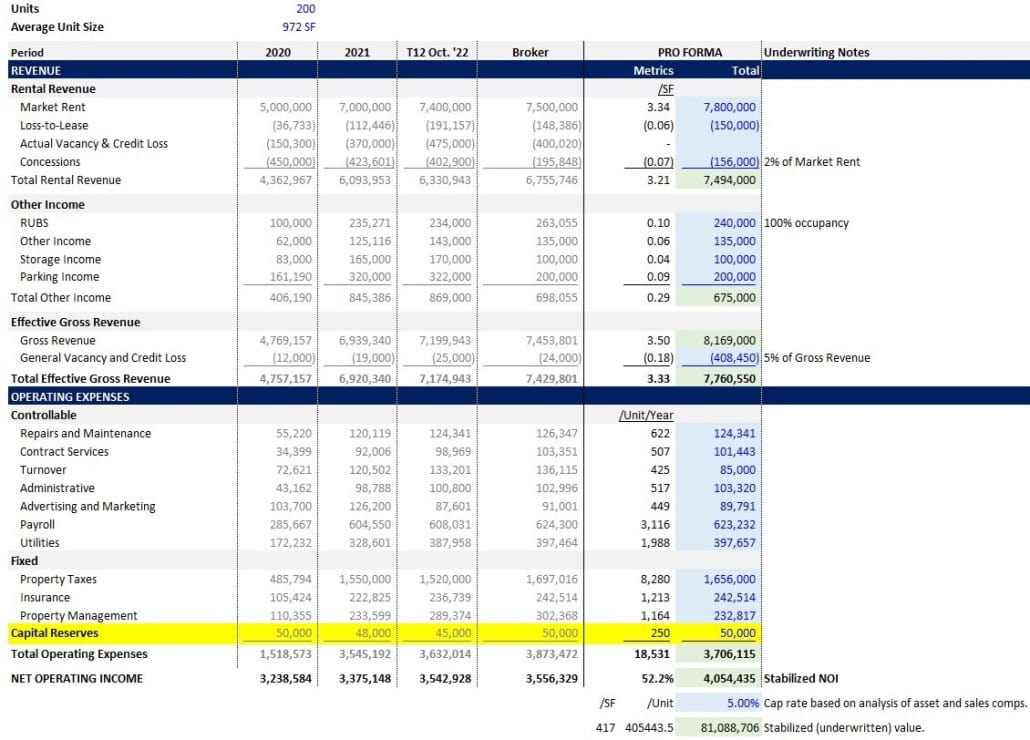

In the following Multifamily pro forma template, you can see the “Capital Reserve” above the line (NOI), synonymous with an operating expense you are likely to encounter when building or reviewing the pro forma for a given property.

Now, the capital reserve is a capital expenditure so why it is included above the NOI?

WHAT IS A CAPITAL RESERVE?

A capital reserve can be thought of as the cash necessary to maintain a property’s market condition. It involves setting aside funds for capital improvements, such as replacing the roof, updating mechanical systems, fixing structural issues, and maintaining the overall condition of the property at a level that commands market rents. This effectively ensures that, at the time of sale, deferred maintenance and below-market rents do not negatively impact the property’s value.

You will see capital reserve modeled both above and below NOI, depending on the property type and specific circumstances. As a general rule, multifamily underwriting places capital reserves above the line (i.e., above NOI) because the agencies often require it as part of their debt underwriting, and leases are generally shorter. In contrast, office, industrial, and retail underwriting typically places capital reserves below the line. Some real estate professionals also reserve for future costs such as leasing costs, property taxes, and insurance, often because a lender requires it, while others reserve only for property upkeep.

CAPITAL EXPENDITURES VS CAPITAL RESERVES?

As a general rule, Capital Expenditures (i.e., below NOI) have a useful life beyond one year, whereas Operating Expenses (i.e., above NOI) have a useful life of one year or less. Capital reserves are considered Capital Expenditures. A Capital Expenditure refers to an amount spent on a tangible asset (e.g., roof replacement, HVAC system upgrade, energy efficiency improvements, new elevator, etc.) that will be used for more than one year in the operation of the property.

From a modeling perspective, we can consider placing all unknown “Capital Expenditures” into the “Capital Reserve” line item. Known Capital Expenditures (e.g., leasing costs, roof repairs, capital improvement plans as part of a value-add strategy) should be placed in separate line items under the Capital Expenditure section.

I recommend consulting the Bite-Sized Real CRE Lessons – A.CRE 30 Second Video Tutorials and our Glossary of Terms, to better understand these and other real estate concepts.

AN APPROACH FOR CAPITAL RESERVE UNDERWRITING – SHORT VS LONG-TERM LEASE

A structured approach for capital reserve underwriting with short-term leases, for example, multifamily properties, is to include a lender-required capital reserve above the line (NOI) and then a “Capital Expenditure” section below the line that includes the actual capital expenditures that are planned. In this sense, the capital reserve is meant to cover the unknowns (i.e. a contingency of sorts), while the Capital Expenditures cover the knowns.

As it relates to leasing costs (e.g., tenant improvements, locator fees, etc.), multifamily leasing costs generally have a useful life of less than one year (i.e., the approximate term of the lease), so they’re modeled above NOI.

In contrast, retail, industrial, and office properties which are synonymous with long-term contracts, generally include both “Capital Reserve” and “Capital Expenditures” below the line. We could include a standard capital reserve as the only “Capital Expenditure” line item at the initial underwriting phase, and once we have a Capital Expenditure schedule from the property condition consultant, we could replace the reserve with that actual schedule.

Leasing costs for such properties generally have a useful life greater than one year (i.e., more in line with the length of the multi-year lease terms), therefore, they are modeled below NOI. When a capital reserve is below the line, it sits within the Capital Expenditures section.

CASE STUDY – CAPITAL RESERVE UNDERWRITING

Overview

Hill Country Realty Partners, a real estate investment firm, is evaluating the acquisition of Barton Grove Apartments, a 150-unit market-rate multifamily property located in the vibrant city of Austin, Texas. The property is characterized by short-term leases typical of multifamily properties, with lease terms generally ranging from 6 to 12 months.

Capital Reserves and Capital Expenditures

In underwriting this acquisition, the investment manager at Hill Country Realty Partners must carefully consider both the capital reserves and the capital expenditures to ensure the property’s long-term financial health and to maximize its value at the time of sale.

Capital Reserves (Above the Line)

For Barton Grove Apartments, the underwriting includes a lender-required capital reserve of $300 per unit per year (Using industry benchmarks and guidelines to inform reserve estimates, ensuring alignment with market expectations). This reserve is considered above the line, meaning it is factored into the Net Operating Income (NOI).

In this sense, this reserve is set aside to cover unexpected capital expenditures that are not immediately known at the time of underwriting. Examples of such expenditures might include sudden repairs needed for common area amenities, unexpected HVAC system issues, or unforeseen roof repairs.

The formula for Capital Reserve:

Annual Capital Reserve = Number of Units × Capital Reserve per Unit per Year

Annual Capital Reserve = 150 units × $300/unit/year = $45,000/year

Capital Expenditures (Below the Line)

In addition to the capital reserves, Barton Grove Apartments will have a planned capital expenditure schedule that is considered below the line, meaning these expenses are not included in the NOI calculation. The investment manager has identified several key capital expenditures over the next five years, including:

Roof replacement: $200,000 (planned for year 3)

HVAC system upgrades: $150,000 (planned for year 2)

Exterior painting and repairs: $100,000 (planned for year 4)

New elevator installation: $250,000 (planned for year 5)

These planned expenditures are critical for maintaining the market condition of the property and ensuring that it remains competitive in the Austin rental market. By including these costs in a detailed capital expenditure schedule, Hill Country Realty Partners can better plan for and manage these significant outlays.

Leasing Costs

Leasing costs for Barton Grove Apartments, such as “make ready” or “turnover” costs and locator fees, are modeled above the line since the leases are short-term and the useful life of these costs is typically less than one year. This treatment aligns with the property’s operating strategy and the nature of the multifamily leasing market.

Financial Impact and Strategy

By separating the capital reserves (above the line) and the planned capital expenditures (below the line), Hill Country Realty Partners ensures that they are adequately prepared for both known and unknown future expenses and align with the underwriting requirements of their lender. This structured approach helps in maintaining a healthy NOI and accurately projecting the property’s financial performance.

For instance, the stabilized NOI for the first year, after accounting for the capital reserve, is calculated as follows:

Stabilized NOI = Effective Gross Revenue − Operating Expenses (inclusive of Capital Reserve)

Assuming the Effective Gross Revenue is $2,000,000 and operating expenses before Capital Reserve is $800,000:

Stabilized NOI = $2,000,000 − $800,000 − $45,000 = $1,155,000

By setting aside $45,000 annually for capital reserves, Hill Country Realty Partners ensures that they have the necessary funds to address unexpected expenditures, while the planned capital expenditures below the line allow for strategic upgrades that protect and enhance the property’s value.

Do you want to create a real estate financial modeling case study that perfectly suits your educational or professional needs? Check out our A.CRE Real Estate Case Studies Creator Assistant!

FINAL NOTES

This hypothetical scenario at Barton Grove Apartments demonstrates how a structured approach to capital reserve underwriting and capital expenditures can effectively manage financial risks and support long-term property value. By understanding and applying these principles, Hill Country Realty Partners can make informed investment decisions that align with their core-plus acquisition strategy.

Underwriting capital reserves is a critical aspect of the road to a stabilized NOI. Accurate estimation and diligent management of these reserves ensure the long-term profitability and sustainability of real estate investments. Well-maintained properties with adequate reserves are essential for maximizing value at sale, making it crucial for real estate professionals to understand how capital reserves influence property valuation.

Frequently Asked Questions about Underwriting Real Estate Capital Reserves

Why are capital reserves sometimes modeled above the line (NOI)?

Capital reserves are modeled above the line in multifamily underwriting because “the agencies often require it as part of their debt underwriting, and leases are generally shorter.” This aligns with industry expectations and allows for a more conservative approach in NOI projections.

What is the purpose of a capital reserve in real estate underwriting?

A capital reserve “can be thought of as the cash necessary to maintain a property’s market condition.” It ensures funds are available for future capital improvements that maintain or enhance the property’s value, such as roof replacements or system upgrades.

How is a capital reserve different from a capital expenditure?

Capital reserves are typically placeholders for unknown future capital needs, while capital expenditures are “amounts spent on a tangible asset… that will be used for more than one year.” Known CapEx items (e.g., roof repair) should be itemized separately, whereas unknowns go under “Capital Reserve.”

How should capital reserves be treated in multifamily vs. commercial underwriting?

In multifamily properties with short-term leases, capital reserves are usually modeled above the line. In contrast, “retail, industrial, and office properties… generally include both ‘Capital Reserve’ and ‘Capital Expenditures’ below the line,” aligning with longer lease terms and asset types.

What is the formula to calculate capital reserves in a multifamily property?

The formula is:

Annual Capital Reserve = Number of Units × Capital Reserve per Unit per Year

In the Barton Grove Apartments case, this was:

150 units × $300/unit/year = $45,000/year

What types of costs are included in planned capital expenditures?

Examples from the case study include:

Roof replacement: $200,000

HVAC upgrades: $150,000

Exterior repairs/painting: $100,000

New elevator: $250,000

These are known costs planned over a 5-year horizon and are modeled below NOI.

How are leasing costs treated in the underwriting of Barton Grove Apartments?

Since Barton Grove Apartments has short-term leases, leasing costs such as “make ready” and “locator fees” are modeled above the line. These expenses generally “have a useful life of less than one year,” consistent with multifamily leasing norms.

What is the financial impact of including capital reserves in NOI calculations?

Including the capital reserve above the line reduces NOI. For example, with $2,000,000 gross revenue and $800,000 in operating expenses, adding a $45,000 capital reserve yields:

Stabilized NOI = $2,000,000 − $800,000 − $45,000 = $1,155,000

Why is separating known and unknown costs important in underwriting?

Separating known (planned capital expenditures) from unknown (capital reserve) ensures the model accurately reflects anticipated and contingent costs. This “structured approach helps in maintaining a healthy NOI and accurately projecting the property’s financial performance.”