Forecasting After-Tax Cash Flow in Real Estate Analysis (Updated May 2024)

When modeling real estate investments, industry practice is generally to stop at before-tax cash flow, rather than after-tax cash flow. And this makes sense in most instances. No two owners of real estate have the exact same tax situation and no two properties necessarily have the exact same tax treatment. So comparing the projected returns of two properties on an after-tax basis isn’t comparing apples-to-apples.

On top of that, government tax policy is ever-changing, making forecasting tax liability into the future a difficult and somewhat unreliable task. This is exacerbated by the fact that real estate professionals are generally not tax professionals, and thus are not suited to the ever-changing tax nuances that go into after-tax analysis.

However, there are situations where forecasting cash flow on an after-tax basis makes sense. And in those cases, it’s helpful for the real estate professional to perform a quick after-tax analysis to sift through opportunities, before consulting with a tax professional.

In this post, I first discuss why most real estate analysis is performed on a before-tax basis. I then share a few cases where modeling taxes is worthwhile (with the support of tax professionals of course). I finish the post by sharing a very basic After-Tax Analysis Module.

This blog post comes in response to a question raised in the Accelerator forums. Are you an Accelerator member? Check out that forum discussion here. Not yet an Accelerator member? Consider joining the real estate financial modeling training program used by top real estate companies and elite universities to train the next generation of CRE professionals.

Real estate investment professionals analyze real estate cash flows on a before-tax basis.

Before-Tax Analysis – The Real Estate Industry Norm

As real estate investment professionals, we perform analysis on a before-tax basis. This is the industry norm. It’s how real estate analysis is taught in schools, and it’s how real estate investment teams operate in practice.

In fact, looking back on my two decades in residential and commercial real estate. Having underwritten tens of billions of dollars in real estate at both boutique and institutional real estate firms. I can count on one hand the number of deals that we spent significant time thinking about the after-tax consequences of a real estate investment.

There are a variety of reasons for this.

Important Note: Adventures in CRE and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any real estate transaction.

1. After-tax cash flow modeling distorts the comparison element of real estate analysis.

Real estate analysis is ultimately the practice of comparing one investment against its alternatives. Because no two taxpayers, no two tax years, and quite frankly no two investments have the same tax treatment, performing analysis on an after-tax basis distorts the comparison.

2. Tax law varies from year-to-year and jurisdiction-to-jurisdiction and is regularly changing.

If you live in the United States for instance, the after-tax cash flow of an investment you analyze today will vary greatly depending on who wins the presidential election every four years. This is even more pronounced in other countries, where tax laws change every couple of years.

Likewise, tax law varies from one jurisdiction to the next and depending on the politicians in power in those jurisdictions. Thus, attempting to accurately forecast 10 years of future after-tax cash flow is largely a fool’s errand.

3. Real estate investment professionals are (generally) not accounting and tax professionals.

Every professional has their role. Accounting and tax professionals analyze taxes while real estate investment professionals forecast before-tax cash flow.

In my experience, after-tax cash flow is handled by the accounting team and isn’t a primary driver of the investment decision; if part of the investment decision at all. Furthermore, after-tax analysis most often comes much later in the underwriting process, after a deal has been selected and only to understand how that property fits into the larger tax strategy of the real estate firm.

4. No two taxpayers nor two tax years are the same.

In the United States (and in many other countries), real estate is often held in a pass-through entity (i.e. meaning the cash flow passes through pre-tax to the partners). As a result, the tax due as it relates to a given real estate investment ultimately depends on the profile of the taxpayer to whom that real estate income passes.

Most real estate investments involve multiple partners/investors, each with differing tax profiles. How is a real estate investment professional analyzing the deal supposed to know what the tax profile is of each of its partners/investors for the upcoming year, let alone for each of the next 10 years!

Imagine that one of the partners/investors in a real estate investment is a Doctor, with his/her practice plus a variety of other investments. The income tax due, as it relates to a real estate investment, will depend on where the property is located, where the Doctor lives, how the Doctor’s practice performed in a given year, and how the Doctor’s other investments performed in a given year. And that doesn’t even consider other deductions the Doctor may have, tax loss carryforward the Doctor may have, etc. In short, it’s a near-impossible task to forecast.

No two taxpayers, nor two tax years, are the same.

When You Might Want to Analyze After-Tax Cash Flow in Real Estate

Now with that said, it doesn’t mean that after-tax analysis in real estate isn’t important. If you’re a mom-and-pop investor looking to minimum your tax liability through a real estate investment, obviously after-tax analysis matters. Or if the real estate strategy you’re pursuing relies on a unique element of the tax code (e.g. opportunity zone investments).

So when does it make sense to model taxes? Here are a few situations I can think of when an after-tax analysis is beneficial (and important) to the early phase of analysis.

Comparing a Real Estate Investment to a Tax-Free Investment

A municipal bond is a debt instrument originated by a state or local government for financing public projects. These bonds are generally exempt from federal as well as state and local taxes, and as a result investors demand a lower yield relative to bonds that aren’t tax-exempt.

An investor may be considering purchasing a relatively low risk real estate investment (e.g. absolute NNN credit deal) and wants to compare that investment to a potential muni-bond investment. To attempt to get a fair comparison, the investor would need to model the real estate returns after tax.

Comparing Two Properties with Distinct Depreciation Profiles

Perhaps you want to compare a retail investment, with its 39 year recoverable life to an apartment investment with its 27.5 year recoverable life. Or perhaps you have an investment with heavy capital expenditure requirements and you want to compare its after tax returns to another property with less CapEx.

Sometimes the final decision between two great investments comes down to the tax benefits of one investment over the other.

Analyzing a Zero Cash Flow Property

Some real estate investments are sold as zero cash flow investments. These properties are generally single-tenant, NNN properties leased to an investment grade tenant. The loan is sized/crafted such that the debt service payments equal the lease payments, and the loan term and amortization match the lease term.

Much of the benefit of owning this type of property comes in the losses, due to depreciation, over the hold period that offset gains on other investments in an investor’s portfolio. Modeling the taxable losses is essential to understanding the yield of such an investment.

Assessing Opportunity Zone and other Tax-Advantaged Investments

Occasionally, governments will incentivize investment through special programs. One example is the opportunity zone tax incentive that was created under the Tax Cuts and Jobs Act of 2017 in the United States. This program allows for large tax deferrals when investments are located with an opportunity zone and meet certain criteria.

Other examples include duty-free or tax-free zones, a common feature found in ports, economic development regions, and even in airports around the world. Assessing the viability and benefits of an investment in a tax-advantaged area can only be done through after-tax analysis.

After Tax Cash Flow Analysis Module

As a companion to this post, I built a quick and dirty module to show you how I learned to model after-tax cash flows. I am not an accountant and I generally don’t model after tax cash flows professionally, so don’t immediately rely on this model for your next investment.

But I think this is a good start and provides some context to the discussion around modeling after-tax cash flows in real estate. I’ve recorded a video that walks you through how to use the model and as always, feel free to reach out if you have any questions, comments, or suggestions.

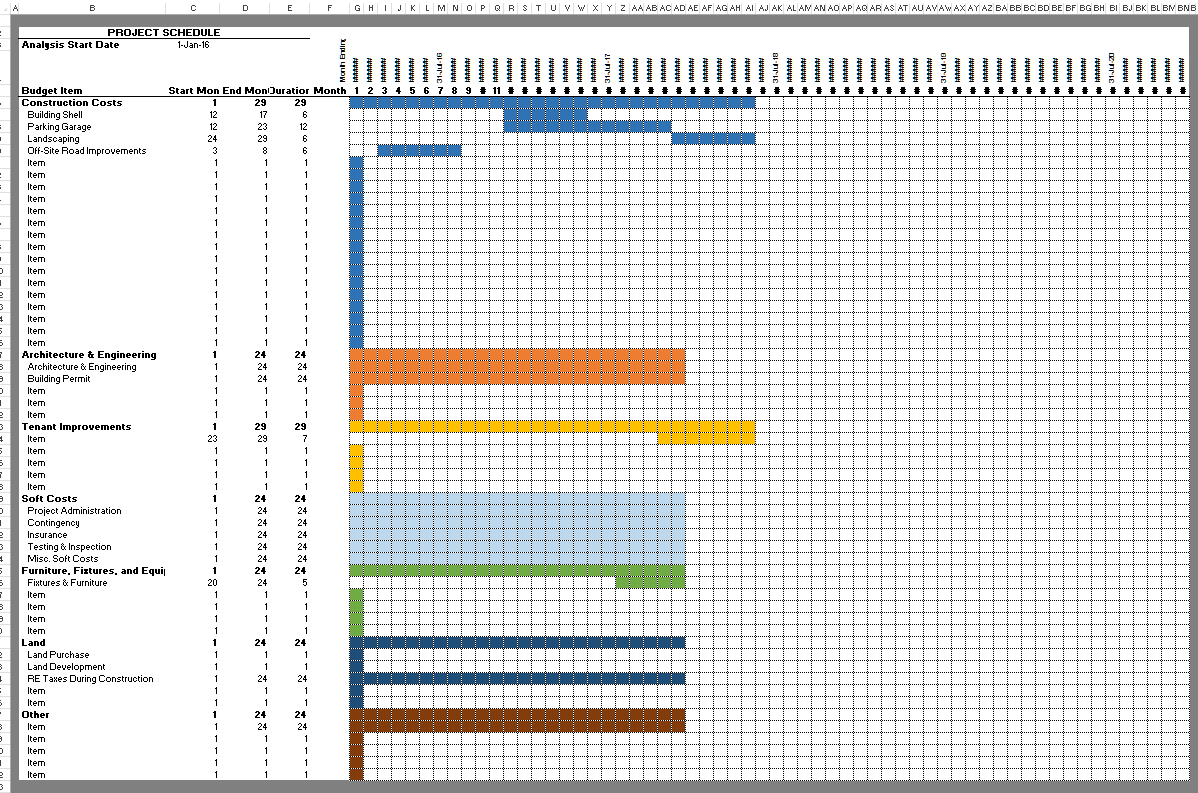

After Tax Cash Flow Analysis module

- Excel workbook that models after tax cash flows

- Analysis on both an unlevered and levered basis

- Use to calculate potential benefit of 1031 exchange

Compatibility

This version of the module is only compatible with Excel 2013, Excel 2016, and Excel 365.

Finally, we suggest looking at some of our other free resources to help you in your CRE journey. We highly recommend you check out the A.CRE AI Assistant. This tool can be an invaluable tool for CRE professionals looking to understand after-tax cash flow. By leveraging this AI tool, users can automate parts of their financial modeling, ensuring accurate calculations and interpretations in various investment scenarios.

Download the After Tax Cash Flow Analysis module

To make this module accessible to everyone, it is offered on a “Pay What You’re Able” basis with no minimum (enter $0 if you’d like) or maximum (your support helps keep the content coming – typical modules sell for $100 – $250+ per license). Just enter a price together with an email address to send the download link to, and then click ‘Continue’. If you have any questions about our “Pay What You’re Able” program or why we offer our models on this basis, please reach out to either Mike or Spencer.

We regularly update the file (see version notes). Paid contributors to the module receive a new download link via email each time the module is updated.

Frequently Asked Questions about Forecasting After-Tax Cash Flow in Real Estate Analysis

Version Notes

v1.0

- Initial release