Tag Archive for: Construction

Real Estate Financial Modeling Accelerator (Updated Jan 2025)

Before launching the Accelerator program, Michael and I received countless emails requesting a more structured, step-by-step real estate financial modeling training program.

Over the years, we've covered hundreds of real estate modeling…

Single Family Home Construction Pro Forma for Home Builders (Updated Feb 2025)

I'm often asked to share models centered around residential development and home building. This is an area of real estate I'm completely comfortable in, since I spent the first 10 years of my career in new residential development.

Not surprisingly,…

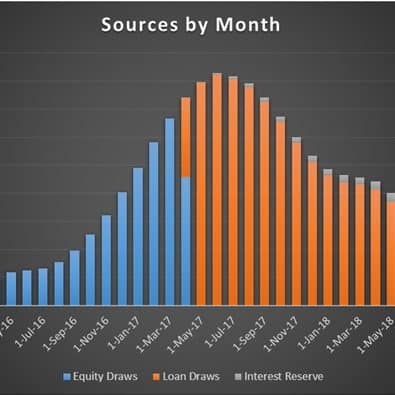

Construction Draw and Interest Calculation Model (Updated Feb 2024)

I originally uploaded this equity/construction loan draw and interest calculation tool to our library of real estate financial analysis models in 2016. Over the years, I've continued to update it as suggestions, comments, and requests…

Real Estate Development Tracker (Updated Feb 2024)

One of the many challenges of both analyzing real estate development deals and managing development projects is understanding and tracking the numerous differing but intertwining work streams. The more a development team takes the time…

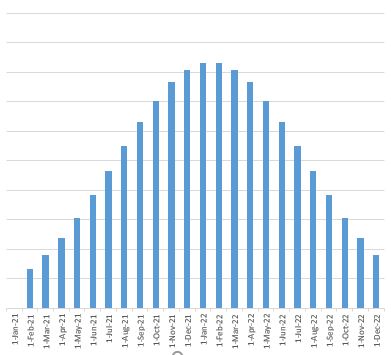

Actual + Forecast Construction Draw Schedule with S-Curve (Updated Dec 2023)

Several times in the last month, I've been asked to tackle an interesting real estate financial modeling challenge - pare actual construction draw cash flows with s-curve cash flow forecasts to create an Actuals + Forecast Construction Draw…

Construction Draw Schedule: Accounting For True LTC (Updated Apr 2022)

When lenders provide debt for a development project, they lend based on a Loan-to-Cost ratio (LTC), which is simply the percent of the total budget the lender will agree to lend to the borrower. So, if a project costs $10MM, and a lender loans…

S-Curve Forecasting in Real Estate Development (Updated Sep 2021)

One of the reasons Michael and I blog, is to force ourselves to be continually learning. I built the first version of my real estate waterfall model, because I wanted to better understand the mechanics of modeling an equity waterfall with IRR…

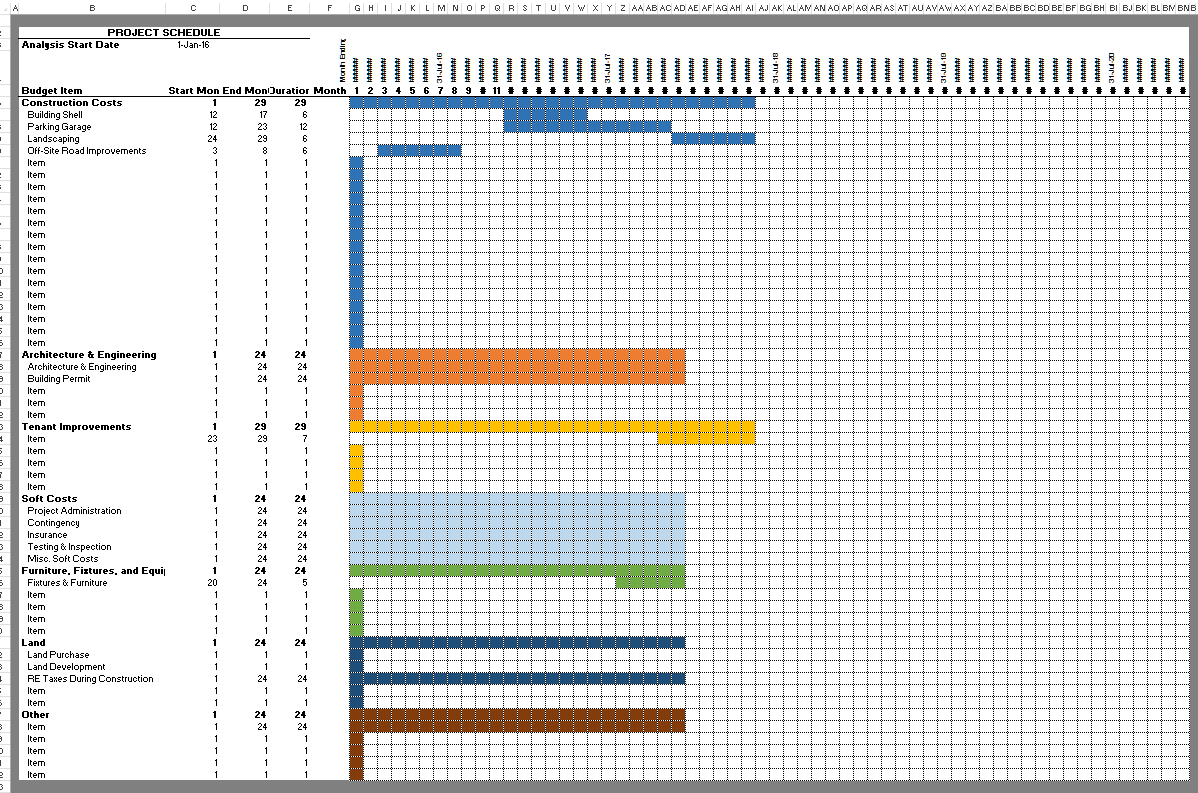

Bonus Content – Gantt Chart and Weighted Average with Multiple Conditions

I have two updates/improvements to previous posts I thought I'd share with our readers today; call it, bonus content! The first, is a dynamic Gantt Chart tool I recently added to my Construction Draw and Interest Calculation Model. The second,…

How to Use the Construction Draw and Interest Calculation Model

As promised, I've recorded a tutorial on how to use my construction draw and interest calculation model. The 20 minute tutorial walks you through how to use the model to forecast construction cash flows during your development period. The model…