The State of Real Estate Crowdfunding

Following the housing crash of 2007 – as regulations were introduced and credit tightened – emerging companies were left with little or no access to the capital markets. In an effort to ameliorate the credit crunch, Congress drew up the Jumpstart Our Business Startups Act (JOBS Act for short), broadening the scope of who can invest in startups. While the legislation was conceived with startup businesses in mind, interested parties quickly realized that the new rules could extend to real estate equity investments, allowing real estate companies to essentially market shares of projects to individual investors – a method of raising capital that had been legally precluded since the Securities Act of 1933.

Note from Spencer: This is a guest post by Soren Godbersen with EquityMultiple.com, a real estate crowdfunding firm based in New York City, NY

While real estate companies are able to broaden the reach of their investor network through this new paradigm, individual investors also gain access to a realm of real estate projects that were previously available almost exclusively to very wealthy individuals and institutional players, lowering the barrier to entry and allowing many investors to participate in commercial real estate investing for the first time. This value was evident enough to encourage a number of hybrid real estate/tech companies to enter the space, with Fundrise, RealtyShares and RealtyMogul emerging as early leaders and raising substantial venture capital.

Growth Trajectory

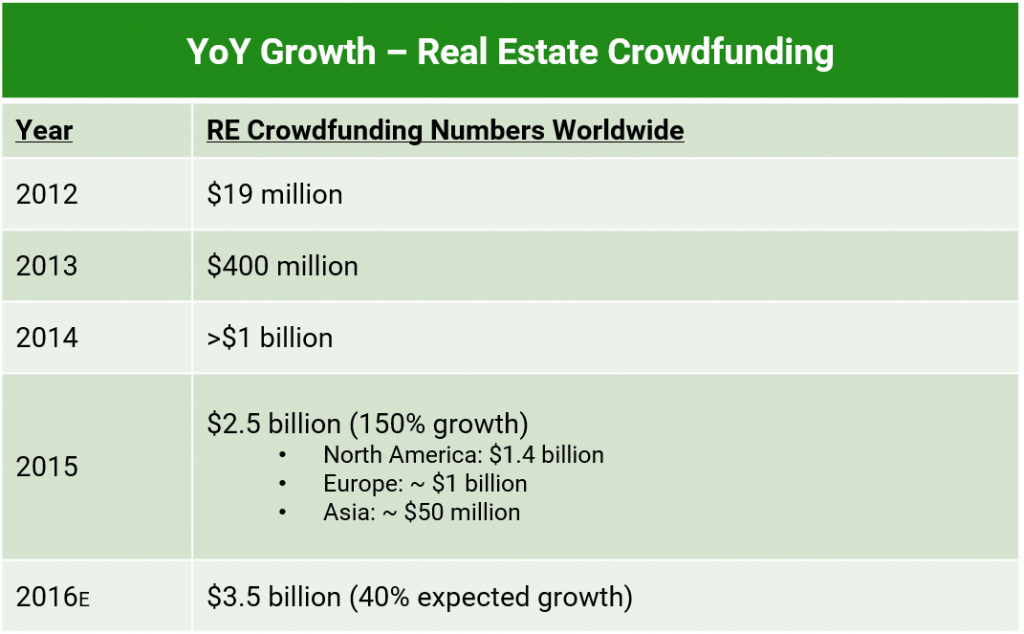

The road hasn’t always been easy. While a handful of companies have grown impressively, many others have fallen by the wayside, as many investors and real estate companies have been cautious in pursuing real estate crowdfunding. Those without the requisite experience in tech and real estate have struggled to find scale. Still, the young industry continues to grow impressively year over year:

While growth slowed somewhat in 2016 (likely in response to top-of-market trepidation) the 40% figure is still robust, and the U.S. accounted for a large share of the $1bn of overall industry growth this year. In 2015, the $1.5bn in volume for U.S. real estate crowdfunding represented only 0.3% of total real estate finance transactions in the U.S., indicating that the sub-industry still has enormous room to grow, even while remaining modest as a share of overall commercial real estate activity in the economy. As time goes by, crowdfunding platforms have specialized and molded themselves around particular niches within the space, focusing the profile of their deals.

While Fundrise and RealtyMogul saw early success marketing the opportunity to invest in distinct, tangible projects, both have pivoted to offering an ‘eREIT’ product that takes asset allocation out of the hands of their individual investors while providing built-in diversification. Meanwhile platforms like PeerStreet, RealtyShares and Groundfloor offer mostly or entirely single-family debt deals, offering investors a steady flow of fixed-rate, relatively-safe, relatively-low-upside investment opportunities. EQUITYMULTIPLE remains focused on institutional-grade commercial real estate projects while offering both debt and equity investments.

What Happens Next?

The trend of division and specialization among real estate crowdfunding platforms is likely to continue, with the potential for consolidation in the advent of a dip in the market. While more established players in the space have raised tens of millions of dollars of capital, even those with extensive track records over the past few years have recently experienced difficulty in sustaining quality deal flow, particularly with respect to high-upside equity deals.

The transition of the executive branch will likely have a major impact on commercial real estate capital markets, and therefore on the prospects for the young real estate crowdfunding industry. The trouble is, no one can credibly claim to know what that impact will be. If initial optimism in the public markets is to be believed, capital markets at large will benefit from a business-friendly regime and reduced regulatory oversight. However, uncertainty in the new regime’s attitude toward trade, fiscal policy and a host of other issues make it difficult to draw any concrete conclusions. What does seem certain is that we’re headed for the long-anticipated interest rate hikes, and that volatility in global markets is unlikely to disappear anytime soon.

In the near term, the real estate crowdfunding industry (and commercial real estate more broadly) should benefit from the age-old axiom that in unsure times, real estate holdings should be prized for their low volatility and the inherent worth of underlying assets.

About the Guest Author: Soren Godbersen heads Marketing and Communications for EquityMultiple, and is a dedicated student of commercial real estate finance and investing.

EquityMultiple is an online platform that connects accredited investors with shares of pre-vetted, institutional-quality commercial real estate deals. The company is based in Manhattan, and partnered with Mission Capital, an established commercial real estate advisory firm.