RV Park Development Model (Initial Release)

Created to underwrite one of my projects, RV@Olympic, the RV Park Development Model is something I built and have been working with frequently over the past year. What’s especially unique about this model is that the template you are getting here actually contains the current underwriting projections of this project as of the date of this release (January 2024).

I’m doing this (putting a live deal into the model) because we at A.CRE thought it would be an incredible opportunity for our readers to follow along with me and my team as we develop an incredible RV Park project at the doorstep of a major American national park, Olympic National Park. This is one piece of content among many that we will be releasing on the website in the coming year or so that gives you an inside look at the project and the process.

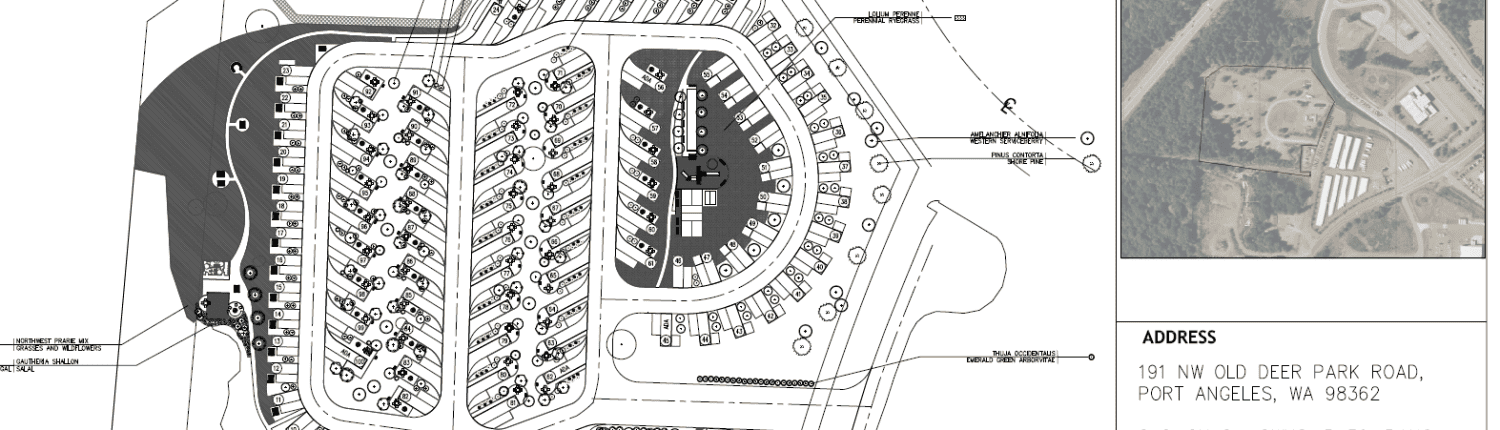

RV@Olympic Site Plan

Additionally, if you’re intrigued by the potential of RV@Olympic and wish to explore co-investment opportunities, we invite you to reach out for more detailed discussions: More Info

And to learn more about why I am pursuing this particular project and to get a detailed walkthrough of the underwriting assumptions in the model, I’m including the final episode from our latest Audio Series season below. A must watch for everyone in my opinion, whether you are interested in joining us in the project or just for educational purposes if you are not. You can find the video and more info towards the bottom of this page.

RV Park Development Model Overview

Summary: On this tab, you input all your assumptions and see all of your returns for the project.

Annual CF: Here you can see your projected cash flows on an annual basis starting with development cash outflows, then operating cash flows, disposition, unlevered and levered cash flows.

Monthly CF: The monthly cash flow tab where you can see your projected cash flows on a monthly basis. Note there are two important inputs on this tab: (1) you copy and paste your SOFR Curve projections here in row 37 and (2) you can alter the seasonality in Cells G49 and H49.

Waterfall: Here you can manage your partnership return structure between a GP and LP. It comes with the ability to alter between IRR and Equity Multiple hurdles, has the ability to model for two hurdles, and also provides the option for a preferred return for the LP. It also includes the ability to input management fees as a percent of NOI in Cell D46.

RV Park Development Video Walkthrough

RV Park Next To National Park Strategy and RV@Olympic Model Assumptions Walkthrough

Download the RV Park Development Model

To make this model accessible to everyone, it is offered on a “Pay What You’re Able” basis with no minimum (enter $0 if you’d like) or maximum (your support helps keep the content coming – typical real estate development models sell for $100 – $300+ per license). Just enter a price together with an email address to send the download link to, and then click ‘Continue’. If you have any questions about our “Pay What You’re Able” program or why we offer our models on this basis, please reach out to either Mike or Spencer.

We regularly update the model. Paid contributors to the model receive a new download link via email each time the model is updated.

Version Notes

beta v1.0

- Initial model launch