Real Estate Financial Modeling Accelerator (Updated June 2025)

Before launching the Accelerator program, Michael and I received countless emails requesting a more structured, step-by-step real estate financial modeling training program.

Over the years, we've covered hundreds of real estate modeling…

Watch Me Build – American-Style Real Estate Equity Waterfall (Updated Apr 2024)

A few years ago, I recorded my screen as I built a 3-tier real estate equity waterfall model. What I didn't mention in that Watch Me Build video, is that the kind of waterfall I built is colloquially called a European-style equity waterfall.…

Advanced Mortgage Amortization Schedule – Custom GPT by A.CRE

At A.CRE, we've built dozens of custom GPTs for internal and external purposes. Some of the GPTs have general application, while others are custom GPTs specifically for commercial real estate. One such CRE-specific GPT that we recently built…

The Definitive Guide to Microsoft Excel for Real Estate (Updated Apr 2024)

Microsoft Excel is the primary tool used by real estate financial modeling professionals. Even while numerous non-Excel alternatives have attempted to de-throne Excel, the 35+ year-old software has shown to be surprisingly resilient to competition.…

The Conditional Weighted Average – SUMPRODUCT with SUMIF (Updated Apr 2024)

Consider this scenario: you have a 50 tenant rent roll, consisting of various tenant types (i.e. small inline, large inline, junior anchor, anchor, etc.), and you want to calculate the weighted average rent for each tenant type. If I asked you,…

How to Prepare for the Real Estate Technical Interview (Updated Apr 2024)

So you've made it past the HR screening interview. You have the education and experience the company is looking for, but now they want to be sure you possess the real estate financial modeling skills necessary to do the job. They've asked…

Multifamily Development Model (Updated April 2024)

Not to be confused with Spencer's masterpiece, The A.CRE Apartment Development Model, I decided to build a second option on our website for multifamily development with a different feel. For us true modeling nerds out there, we know that financial…

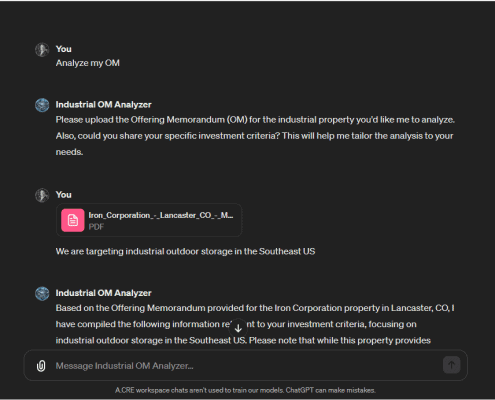

Watch Me Build – Industrial Offering Memorandum Analyzer Custom GPT

In this Watch Me Build session, I'll walk you through constructing a custom GPT that near-instantly sifts through Industrial Offering Memorandums to pinpoint whether an investment aligns with your criteria. At the heart of this build is a tailored…

Retail Real Estate Development Model (Updated Apr 2024)

I'm excited to share my Retail Development Model in Excel. This pro forma analysis tool comes as I've continued to build and share specialty real estate models, tailor-made for specific investment scenarios and property types.

This model…

Commercial Mortgage Loan Analysis Model (Updated Mar 2024)

Over the years, I've received various requests to augment our library of real estate Excel models to include a model for underwriting and analyzing commercial mortgage loans. Specifically, people have asked for a tool to calculate the loan amount…

Announcing the Shine Associates Real Estate Financial Modeling Scholarship

We are excited to announce the launch of the Shine Associates Real Estate Financial Modeling Scholarship! Made in partnership with Shine Associates, this scholarship is set to fuel the dreams of the upcoming stars in commercial real estate.…

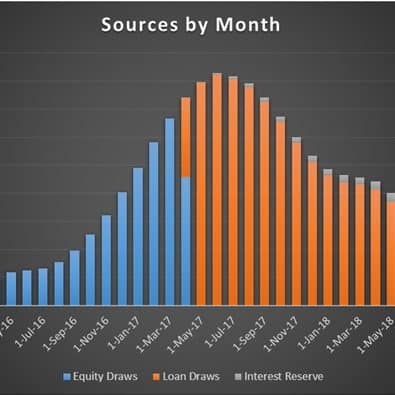

Construction Draw and Interest Calculation Model (Updated Feb 2024)

I originally uploaded this equity/construction loan draw and interest calculation tool to our library of real estate financial analysis models in 2016. Over the years, I've continued to update it as suggestions, comments, and requests…

Real Estate Sources and Uses of Capital Module (Updated Feb 2024)

An important component in any acquisition, development, and value-add model is the Sources and Uses of Capital section. Of course, how the sources and uses are modeled and how those cash flows are visualized will vary from one model to the next.…

A.CRE Self Storage Development Model (Updated Feb 2024)

We've received numerous requests over the years for a Self Storage Development Model in Excel. With strong investment and development activity in this niche property type, I recognize a self storage model on A.CRE is long overdue. But with so…

Real Estate Development Tracker (Updated Feb 2024)

One of the many challenges of both analyzing real estate development deals and managing development projects is understanding and tracking the numerous differing but intertwining work streams. The more a development team takes the time…

Hotel Development Model (Updated February 2024)

Excited to share the new A.CRE Hotel Development Model with everyone. As evidenced by the numerous requests we have gotten for this over the years, this model is long overdue so I'm quite happy to get it out there finally.

At the core, the…