Real Estate Financial Modeling Accelerator (Updated Jan 2025)

Before launching the Accelerator program, Michael and I received countless emails requesting a more structured, step-by-step real estate financial modeling training program.

Over the years, we've covered hundreds of real estate modeling…

Mixed-Use Development Model: Condo and Retail (Updated February 2025)

In this post, I walk you through the A.CRE Mixed Use Development Model for Condo and Retail projects. The model is basically a reworked and expanded version of the Condo Development Model, so if you are familiar with that, this should feel and…

Condominium Development Model (Updated Jan 2025)

After posting the construction draw module that demonstrates how to calculate the true LTC of a development loan, I decided that since we have yet to publish a condo development model, to build upon that module to create one.

This condominium…

Real Estate Asset Management Model

Many of you have run into this scenario: you build out a detailed acquisitions model at purchase. Everything looks great—market rents, lease-up timing, exit cap, all in line. The acquisitions team is convinced this is going to be a home run.…

Introducing the New Accelerator 3.0 Platform

In 2018, Michael and I designed and built the A.CRE Accelerator program. Our goal was to create the preeminent tool for mastering real estate financial modeling—a program that would provide a clear path to expertise and give Accelerator Graduates…

Excel Pro Forma for Flipping Houses (Updated Jan 2025)

Before moving to the principal side of the business, I began my career as a self-described real estate investment specialist, largely working as a land broker but dabbling in other areas including the popular "single-family flip" space. In all…

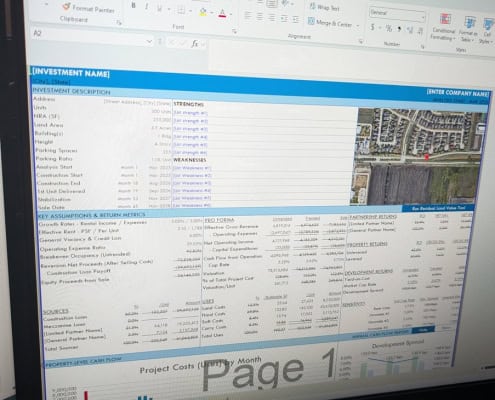

A.CRE Real Estate Financial Models Download Guide (Updated December 2024)

Since I started working with A.CRE, I wanted to find a way to easily find the different models, modules, tools, and tutorials the guys have shared from the Library of Excel Real Estate Financial Models. After some time helping out our readers…

Simple Acquisition Model for Office, Retail, Industrial Properties (Updated Dec 2024)

A few years back, on a sleepy Saturday afternoon while my kids were busy eating Halloween candy, I decided to create a simple real estate acquisition model in Excel for office, retail, and industrial deals.

Since then, I've made various updates,…

Using COUNTIFS, SUMIFS, and AVERAGEIFS Excel Functions in Real Estate Underwriting (Updated Dec 2024)

Why use COUNTIFS, SUMIFS, and AVERAGEIFS functions in real estate? When real estate analysts first start their careers, they're often required to work with large data sets and to transpose property and portfolio information from one format to…

Real Estate Equity Waterfall Model with Catch Up and Clawback (Updated Dec 2024)

A question came up recently in the A.CRE Accelerator's real estate waterfall modeling course regarding how to model GP Catch Up (i.e. Sponsor Catch Up) and LP Clawback provisions. I put together a quick video tutorial in response to that question,…

Excel’s Stale Value Formatting: What It Means and Why It Matters

We recently received an email from an A.CRE reader using one of our real estate financial models with a curious question. He explained that many of the cells in his model suddenly had a strikethrough applied to the text. Naturally, he wondered…

A.CRE Apartment Development Model (Updated Dec 2024)

For several years now, our library of real estate models has been lacking a robust ground-up apartment development model. Sure, our All-in-One (Ai1) model has the capability to model multifamily development deals, but it's more a generalist…

Best Practices in Real Estate Financial Modeling (Updated Nov 2024)

Before you use one of our real estate financial models (i.e. Excel templates), or before you set out to build your own real estate analysis tool in Excel, it's important to keep in mind a few real estate financial modeling best practices. This…

Industrial Real Estate Development Model (Updated Nov 2024)

Allow me to share my Industrial Development Model in Excel. Over the past few years, I've been working to add more specialty real estate models to our library. While our All-in-One model certainly has its place, oftentimes really digging into…

Real Estate Case Studies Creator Assistant – Custom GPT by A.CRE (Updated Oct 2024)

If you've spent any time following us here at A.CRE you know that AI applications in real estate financial modeling is a topic we are fascinated (and excited) about! As a consequence, we're underway with several initiatives to explore AI in…