Real Estate Financial Modeling Accelerator (Updated January 2026)

Before launching the Accelerator program, Michael and I received countless emails requesting a more structured, step-by-step real estate financial modeling training program.

Over the years, we've covered hundreds of real estate modeling…

How to Create Dynamic, In-Cell Buttons and Toggles in Microsoft Excel

Creating intuitive, user-friendly, visually appealing models is one aspect of mastering real estate financial modeling. One way to make your models easy for people to use and more attractive in general is to use dynamic, theme-appropriate, in-cell…

Watch Me Expand the Home Construction Pro Forma

I'm regularly asked to expand my single family home construction pro forma to analyze the construction of more than one home. I've contemplated adding that functionality to the model, but it is such a custom task that no template could really…

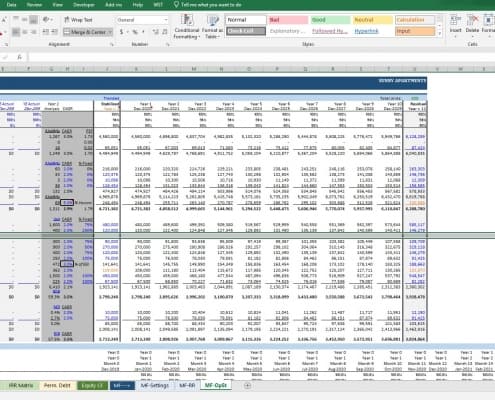

All-in-One (Ai1) Walkthrough #1 – Permanent Debt Tab (Updated Nov 2019)

In an effort to provide greater instruction on how to use our All-in-One Underwriting Tool for Real Estate Development and Acquisition, we've developed a series of walkthrough videos and posts on the methodology behind the various components…

Using Conditional Formatting in Real Estate Financial Modeling

Your real estate financial models are only as good as their ability to be used by others. Or in other words, if others can't figure out how to use your model, it isn't worth much! So when building real estate financial model templates, besides…

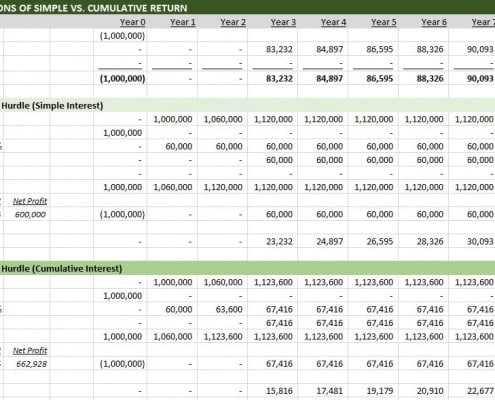

Preferred Return – Simple Interest vs. Compound Interest

A concept common to real estate partnership structures, preferred return refers to the preference given to a certain class of equity partners when distributing available cash flow. The preferred return is generally calculated as either a percentage…

A.CRE Audio Series – Season One

Frequently Asked Questions about A.CRE Audio Series – Season One

Roll Up Your Monthly Cash Flow Line Items Into Annual Periods Using Only One Formula For The Whole Sheet

While building out my hotel development model (currently underway), I decided to take a break and record a video about how I roll up the monthly cash flow line items on my Monthly Cash Flow sheet into annual cash flow line items on a separate…

Hotel Acquisition Model – The Basic Model (Updated 10.9.2019)

The initial goal for the original Hotel Acquisition Model was to design a hotel proforma that would enable users to get deep into the weeds of practically every line item in their hotel analysis. Although I am super happy with how that hotel…

Tutorials For The Hotel Valuation Model (Updated 07.23.19)

Welcome to the A.CRE Hotel Valuation Model's Tutorial Page. On this page you will find all the tutorials for the A.CRE Hotel Valuation model in Excel. There is a lot to learn within this model and over time, I'd like to show you both how to…

Using the Floating Summary Box in Real Estate Modeling

Over the next few minutes, I'll share a great modeling tip for efficiently visualizing the more salient metrics in your real estate models. Now I should mention, this is a tip I shared a few years ago. But given the complexity of many of the…

Using the OFFSET Function in Real Estate Financial Modeling

In a previous post, I showed you how to use the OFFSET function to create dynamic lists in Excel. As you become more comfortable using this function in real estate financial modeling, you'll find that it has almost infinite applications when…

A.CRE 101 – Create Smart Drop-Down Menus in Real Estate Modeling

One Excel feature real estate financial modeling professionals use often is the data validation list. Where data validation is a method of limiting the possible inputs of a cell, the data validation list limits those inputs to a pre-defined…

Create a Dynamic Real Estate Chart in Excel

Most of the real estate financial models we've shared over the years are dynamic to analysis period. Meaning, we've included an input to adjust the length of the analysis period, and the model will adjust the results accordingly.

This is…

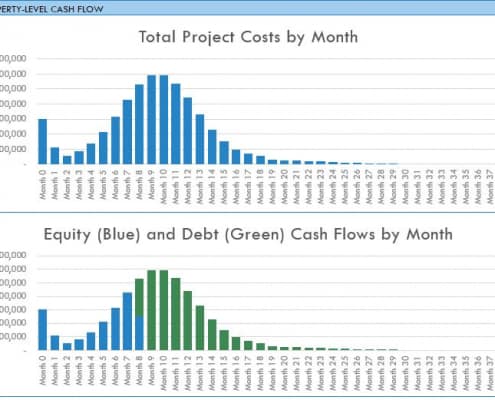

3-Tiered Acquisition Debt Module

This is a 3-tiered debt module that will allow the user to add one to three tiers of debt to his or her real estate DCF model. Includes the option to layer in senior debt, secondary debt, and mezzanine debt; calculate interest on either…

Quick Tutorial: Add Line Items to OpSt Sheet in All-in-One

I was recently asked the question whether it's possible to add more other income or operating expense line items to the MF-OpSt or ORI-OpSt worksheets in my All-in-One Model for Underwriting Acquisitions and Development. Short answer is: out…