Real Estate Financial Modeling Accelerator (Updated Jan 2025)

Before launching the Accelerator program, Michael and I received countless emails requesting a more structured, step-by-step real estate financial modeling training program.

Over the years, we've covered hundreds of real estate modeling…

Keyboard Shortcuts I Use Constantly When Modeling in Excel (Formatting)

The more you model real estate in Microsoft Excel, the faster and more accurate you become - and hopefully as a consequence the more valuable you become to real estate employers and investors. Part of the process of mastering real estate financial…

Using Boolean Logic to Model Multiple Generations of Tenant Improvements

Arguably the most powerful, and least appreciated and understood, functionality in Excel is its use of boolean logic. Or in other words, the use of TRUE and FALSE binary logic. This form of logic can be used to dramatically simplify formulas…

Create Printable and PDF Reports in Excel for Real Estate Financial Modeling

A common question we've been getting recently is, how do I create printable reports from a real estate financial model in Excel? In this written and video tutorial, I share the three basic steps for creating printable and PDF reports in any…

Real Estate Acquisition Due Diligence Checklist

Most of the Excel tools we share on Adventures in CRE are real estate financial models, but occasionally we'll venture into building other CRE-related tools. Over the past several months, I've been working on a real estate acquisition checklist…

Real Estate Development Due Diligence Checklist

Last year, I shared a Real Estate Acquisition Due Diligence Checklist that was quite popular. Soon after its release, we began getting requests for a similar tool, but for development deals. So allow me to share a Real Estate Development Due…

Apartment Acquisition Model with Monte Carlo Simulation Module (Updated Jan 2021)

We have a few stochastic modeling tools for real estate on the website, but none as robust as this Apartment Acquisition Model with Monte Carlo Simulation Module. I originally built the model in 2016 by taking my standard apartment acquisition…

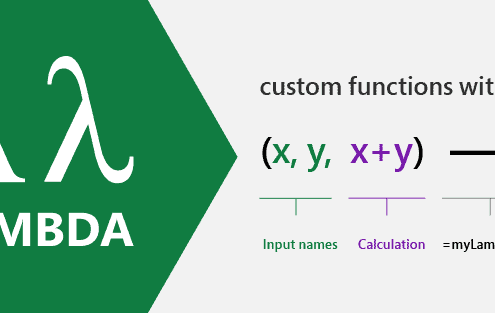

Using Excel’s New LAMBDA Feature to Create Custom Functions for Real Estate Financial Modeling

In December 2020, Excel rolled out a new featured called LAMBDA as part of the Office Insiders (i.e. beta) program. This feature allows the user to create custom functions, which can greatly reduce duplicative formulas and reduce errors.

Well…

DateDif: The “Secret” Excel Formula (Updated 11.14.2020)

For one reason or another, there is a perfectly functioning and pretty valuable formula that can be utilized in Excel that Microsoft has chosen to exclude from Excel's list of functions: the DateDif function. This function is a valuable…

Watch Me Build – IRR Partitioning in Excel

In this post, I'd like to show you how to partition the internal rate of return of your real estate investment in Excel. I also throw in a quick equity multiple partition, to highlight how the time value of money affects your returns. I've recorded…

Announcing the New A.CRE Help Section

At A.CRE, we receive thousands of emails every month from our readers, users of our financial models, and our Accelerator members. The topics of those emails range from career advice, consulting requests, and questions about the Accelerator,…

Real Estate Acquisitions Model #2 for Office, Retail, Industrial (Updated Aug 2020)

I've decided to do a major overhaul of my last acquisitions model for office, industrial, and retail properties. There were a lot of things I wanted to change as well as add to the model and finally had a weekend to do it. This new and improved…

Making the Masters in Real Estate Decision

This topic has come up on Adventures in CRE various times over the years. I first blogged about my decision to pursue a Masters in Real Estate over an MBA five years ago. And last year Michael, discussed his thought process around getting dual…

Multifamily Redevelopment Model (Updated June 2020)

This is an Excel model I originally built from scratch back in 2015 for quickly assessing multifamily redevelopment opportunities. It was designed to work best for scenarios where individual units will be rehabbed over the hold at varying times.…

The “Secret” to Learning Real Estate Financial Modeling

Just like any skill in life, there are tips and tricks to learning that skill. Some suggestions are more helpful than others, although all contribute in some way. In this episode, we share one of the more valuable tips - what our marketing team…

Ask a Pro: How to Hire Your Next CRE Attorney

If you are investing in real estate, it's only a question of when and not if you will need a lawyer. However, many clients do not always have significant experience in the past. As a commercial real estate attorney, I'm going to walk through…