Real Estate Financial Modeling Accelerator (Updated September 2025)

Before launching the Accelerator program, Michael and I received countless emails requesting a more structured, step-by-step real estate financial modeling training program.

Over the years, we've covered hundreds of real estate modeling…

Best Practices in Real Estate Financial Modeling (Updated Nov 2025)

Before you use one of our real estate financial models (i.e. Excel templates), or before you set out to build your own real estate analysis tool in Excel, it's important to keep in mind a few real estate financial modeling best practices. This…

How to Prepare for the Real Estate Technical Interview (Updated Nov 2025)

So you've made it past the HR screening interview. You have the education and experience the company is looking for, but now they want to be sure you possess the real estate financial modeling skills necessary to do the job. They've asked…

The Definitive Guide to Microsoft Excel for Real Estate (Updated Oct 2025)

Microsoft Excel is the primary tool used by real estate financial modeling professionals. Even while numerous non-Excel alternatives have attempted to de-throne Excel, the 35+ year-old software has shown to be surprisingly resilient to competition.…

The Best AI Tools for Excel in 2025

At A.CRE, we offer what we believe to be the best AI training program for real estate and the best real estate financial modeling training program - period! From both sides of that training, we consistently hear the same question:

“What…

Excel Shortcuts For Real Estate Financial Modeling (Updated Oct 2025)

One of the lesser talked about, yet most impactful, skills in real estate financial modeling is keyboard efficiency. If you’ve ever watched one of our tutorials or Accelerator sessions, you’ve probably seen the models flying by, with formulas…

Fix the 0% XIRR Issue in Excel Using XIRR + FILTER

Over the course of my career, I’ve modeled hundreds of real estate investments, from large portfolio roll-ups to complex mixed-use developments. And one issue I’ve consistently run into, especially when modeling portfolio or mixed-use cash…

Supercharge Excel with the ‘Excel 4 CRE’ Add-In – Now with AI (Updated Sept 2025)

Today, we're thrilled to share with the A.CRE community a new timesaving (and free) Excel tool: the 'Excel 4 CRE' Add-in! Over the past few years, we at A.CRE (together with our new favorite companion, ChatGPT!) have been developing and sharing…

Excel’s Stale Value Formatting: What It Means and Why It Matters (Updated Aug 2025)

We recently received an email from an A.CRE reader using one of our real estate financial models with a curious question. He explained that many of the cells in his model suddenly had a strikethrough applied to the text. Naturally, he wondered…

The Conditional Weighted Average – SUMPRODUCT with SUMIF (Updated July 2025)

Consider this scenario: you have a 50 tenant rent roll, consisting of various tenant types (i.e. small inline, large inline, junior anchor, anchor, etc.), and you want to calculate the weighted average rent for each tenant type. If I asked you,…

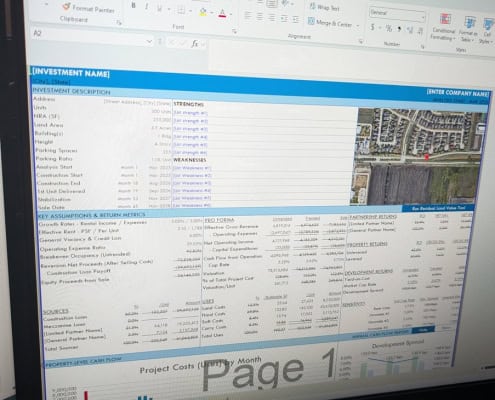

Watch Me Build a Residential Land Development Model (Updated June 2025)

Over the years, we've created a sizable library of Watch Me Build videos covering Excel models for various real estate investment and property types. However, we've yet to create a Watch Me Build involving for-sale product. So this weekend,…

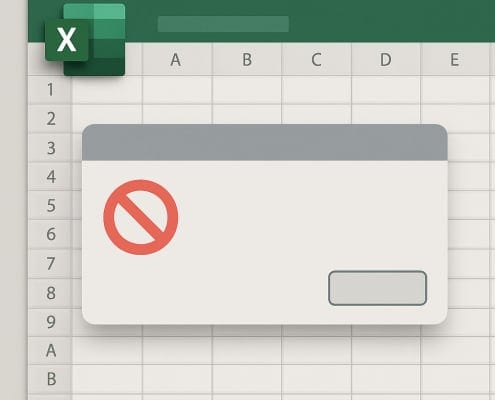

Microsoft has blocked the macros in my A.CRE model – What now?

When downloading and opening an Excel model from A.CRE, some users may get the ominous message: "Microsoft has blocked macros from running because the source of this file is untrusted." If you've received this message, you're probably asking,…

Tutorial on How to Model Irregular Growth Rates in Real Estate

When building a real estate financial model, managing income and expense growth is rarely as simple as applying a fixed growth rate year over year. In real estate investment analysis, growth assumptions need to be flexible, dynamic, and reflective…

Using COUNTIFS, SUMIFS, and AVERAGEIFS Excel Functions in Real Estate Underwriting (Updated Dec 2024)

Why use COUNTIFS, SUMIFS, and AVERAGEIFS functions in real estate? When real estate analysts first start their careers, they're often required to work with large data sets and to transpose property and portfolio information from one format to…

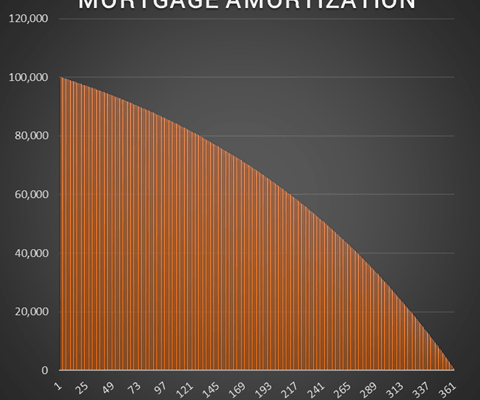

Watch Me Build a Dynamic Mortgage Amortization Table in Excel (Updated September 2024)

There are a few basic, yet fundamental, real estate modeling skills you must master before anyone will take you seriously as a real estate professional. Building a mortgage amortization schedule is one of them.

Virtually every model you…

Watch Me Build a 3-Tier Real Estate Equity Waterfall Model (Updated Aug 2024)

As I've mentioned in other Watch Me Build posts, one way to become a better real estate financial modeling professional, is to watch other professionals model. Thus, the more exposure you can get to other's methods, the more adept a real estate…