Real Estate Financial Modeling Accelerator (Updated Jan 2025)

Before launching the Accelerator program, Michael and I received countless emails requesting a more structured, step-by-step real estate financial modeling training program.

Over the years, we've covered hundreds of real estate modeling…

Hotel Acquisition Model – The Basic Model (Updated 10.9.2019)

The initial goal for the original Hotel Acquisition Model was to design a hotel proforma that would enable users to get deep into the weeds of practically every line item in their hotel analysis. Although I am super happy with how that hotel…

30/360, Actual/365, and Actual/360 – How Lenders Calculate Interest on CRE Loans – Some Important Insights

(Updated August 7, 2019 to include a Watch Me Build video and Downloadable file)

Commercial real estate lenders commonly calculate loans in three ways: 30/360, Actual/365 (aka 365/365), and Actual/360 (aka 365/360). Real estate professionals…

Tutorials For The Hotel Valuation Model (Updated 07.23.19)

Welcome to the A.CRE Hotel Valuation Model's Tutorial Page. On this page you will find all the tutorials for the A.CRE Hotel Valuation model in Excel. There is a lot to learn within this model and over time, I'd like to show you both how to…

Using the Floating Summary Box in Real Estate Modeling

Over the next few minutes, I'll share a great modeling tip for efficiently visualizing the more salient metrics in your real estate models. Now I should mention, this is a tip I shared a few years ago. But given the complexity of many of the…

Using the OFFSET Function in Real Estate Financial Modeling

In a previous post, I showed you how to use the OFFSET function to create dynamic lists in Excel. As you become more comfortable using this function in real estate financial modeling, you'll find that it has almost infinite applications when…

Create a Dynamic Real Estate Chart in Excel

Most of the real estate financial models we've shared over the years are dynamic to analysis period. Meaning, we've included an input to adjust the length of the analysis period, and the model will adjust the results accordingly.

This is…

3-Tiered Acquisition Debt Module

This is a 3-tiered debt module that will allow the user to add one to three tiers of debt to his or her real estate DCF model. Includes the option to layer in senior debt, secondary debt, and mezzanine debt; calculate interest on either…

Quick Tutorial: Add Line Items to OpSt Sheet in All-in-One

I was recently asked the question whether it's possible to add more other income or operating expense line items to the MF-OpSt or ORI-OpSt worksheets in my All-in-One Model for Underwriting Acquisitions and Development. Short answer is: out…

Excel-Based Restaurant Selection Tool for the Overly Indecisive

We're celebrating some much deserved time off from work, and so what better way to spend the time than to make a completely unnecessary (but fun!) Excel model. I call this the indispensable Excel tool for the overly indecisive, and it's basically…

Hotel Proforma Basics – Hotel Cash Flow Projection

Hotels are a unique asset in the commercial real estate world and are underwritten differently as a result. Probably the most obvious difference is the duration of the 'lease term' of the tenant, which is usually daily to weekly. Another major…

Back-of-the-Envelope Office, Retail, Industrial Acquisition Model (Updated 10.1.2018)

I’ve built a new acquisition model that I am excited to share with our readers. This is a back-of-the-envelope (BOE) valuation model that can be used for retail, office, and industrial properties. The goal was to create a sleek and clean look…

Understanding Treatment of Time 0 in the All-in-One Model

I received a very astute question/concern from a user of our All-in-One(Ai1) model in our Ai1 Support Forum late last month. I initially set out to answer the question in writing, but the more I thought about my response, the more I concluded…

All-in-One (Ai1) Walkthrough #10 – Underwriting a Value-Add Office Investment

This walkthrough, our tenth in the series, takes you through the entire process of underwriting a hypothetical office value-add opportunity using the All-in-One (Ai1) Model. This walkthrough comes as a response to a question we recently received…

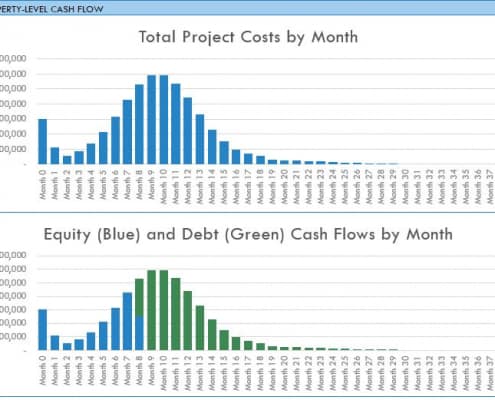

3 Tiered Waterfall Module Added to the Condo Development Model

After receiving a few requests, I've finally gotten around to adding an equity waterfall module to the Condominium Development Model. This module allows you to model partnership splits up to three tiers using either equity multiple hurdles or…

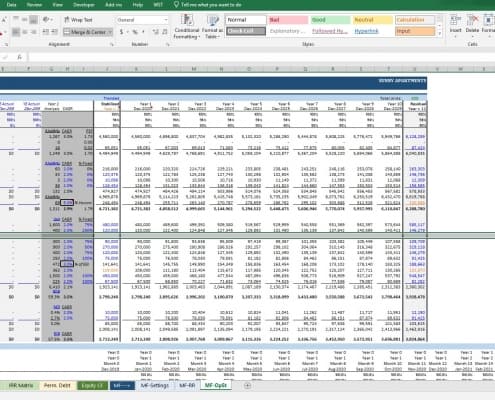

All-in-One (Ai1) Walkthrough #9 – Print Mode and the IRR Matrix Report

This walkthrough, our ninth in the series, touches on the newly added (beta v0.5.3) 'Print Mode' and IRR Matrix Report in our All-in-One (Ai1) model. Print mode further enhances the printability of the model while the IRR Matrix Report adds…