Real Estate Financial Modeling Accelerator (Updated Jan 2025)

Before launching the Accelerator program, Michael and I received countless emails requesting a more structured, step-by-step real estate financial modeling training program.

Over the years, we've covered hundreds of real estate modeling…

Multifamily Redevelopment Model (Updated June 2020)

This is an Excel model I originally built from scratch back in 2015 for quickly assessing multifamily redevelopment opportunities. It was designed to work best for scenarios where individual units will be rehabbed over the hold at varying times.…

Watch Me Build – Capital Stack with Mezzanine Debt

One of the more difficult aspects of modeling a real estate development is figuring out how to handle equity and debt cash flows. This becomes all the more difficult when a second tranche of debt is introduced. In this Watch Me Build video,…

Watch Me Build a Tenant Rollover Analysis Model

The feedback has been positive on the ‘Watch Me Build a Multifamily Model’ video I recorded earlier this year. So I thought I’d follow that up with another. This time I build a Real Estate Tenant Rollover Analysis Model and talk through…

All-in-One (Ai1) Walkthrough #2 – Office, Retail, Industrial Rent Roll Tab

This walkthrough, our second in the series, will detail how to use the office/retail/industrial rent roll (see ORI-RR Tab). The rent roll tab is arguably the most important, and most complex, tab in the All-in-One model. Below we post a video…

LIHTC (Low Income Housing Tax Credits) Overview and Calculator

Below is an overview of how LIHTC (low income housing tax credits) are calculated and applied to affordable housing projects. At the bottom of the post you will find downloadable excel files that correspond with the videos.

LIHTC - An Overview

LIHTC…

Watch Me Build a Multifamily Real Estate Model (Updated Feb 2020)

One way to become a better real estate financial modeling professional, is to watch other professionals model. I know in my career being able to physically see how others tackle different modeling problems has shaped my methods and made me better…

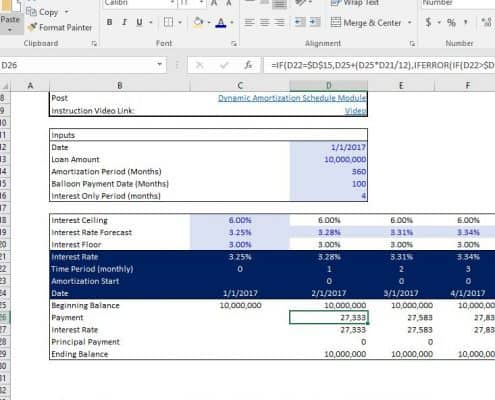

Dynamic Amortization Schedule (Updated 2.06.2020)

This is a dynamic amortization schedule for debt that gives the user the capability to model a loan with an interest only period up front and an amortizing floating rate debt repayment period once the interest only period is over. This module…

Using VBA to Hide Rows in Excel

Over the next few minutes, I will show you two techniques for automatically hiding and showing rows in Excel using VBA code. These techniques I use regularly in my real estate financial models to make for a more intuitive user experience.

In…

Watch Me Build Data Tables For Real Estate Sensitivity Analysis

This is a 3 part mini-series on using data tables in Excel to perform real estate sensitivity analysis. In this series, I'll walk you through how to build both one-variable and two-variable data tables in parts 1 and 2. And in Part 3, I'll walk…

Modeling a Mortgage Loan Assumption Using the All-in-One

I recently had a discussion in the All-in-One support forum about how to model a mortgage loan assumption using my All-in-One Model for Underwriting Acquisitions and Development. Prior to version 0.77, this required manually overriding various…

Watch Me Build A Construction Draw Schedule (Updated Jan 2020)

In the following video, I record my screen and narrative my steps as I build a basic construction draw schedule. I've also included the template and completed worksheets from this Watch Me Build exercise.

Are you an Accelerator member? See…

How to Create Dynamic, In-Cell Buttons and Toggles in Microsoft Excel

Creating intuitive, user-friendly, visually appealing models is one aspect of mastering real estate financial modeling. One way to make your models easy for people to use and more attractive in general is to use dynamic, theme-appropriate, in-cell…

Watch Me Expand the Home Construction Pro Forma

I'm regularly asked to expand my single family home construction pro forma to analyze the construction of more than one home. I've contemplated adding that functionality to the model, but it is such a custom task that no template could really…

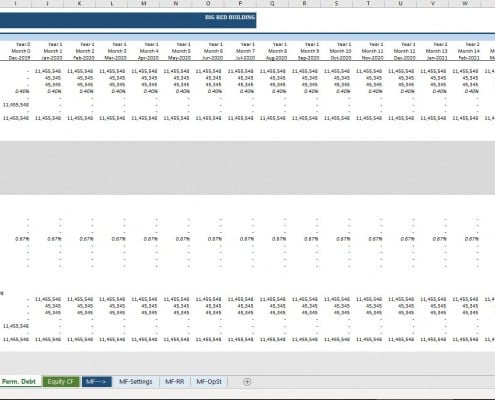

All-in-One (Ai1) Walkthrough #1 – Permanent Debt Tab (Updated Nov 2019)

In an effort to provide greater instruction on how to use our All-in-One Underwriting Tool for Real Estate Development and Acquisition, we've developed a series of walkthrough videos and posts on the methodology behind the various components…

Using Conditional Formatting in Real Estate Financial Modeling

Your real estate financial models are only as good as their ability to be used by others. Or in other words, if others can't figure out how to use your model, it isn't worth much! So when building real estate financial model templates, besides…