Real Estate Financial Modeling Accelerator (Updated September 2025)

Before launching the Accelerator program, Michael and I received countless emails requesting a more structured, step-by-step real estate financial modeling training program.

Over the years, we've covered hundreds of real estate modeling…

4-Tier Equity Multiple Waterfall – Download and Watch Me Build (UPDATED APR 2022)

Here is a simple, yet very powerful, 4-tier equity multiple waterfall module. This post contains both a completed version of the module ready to plug into a real estate financial model as well as a 'Watch Me Build' template and companion video…

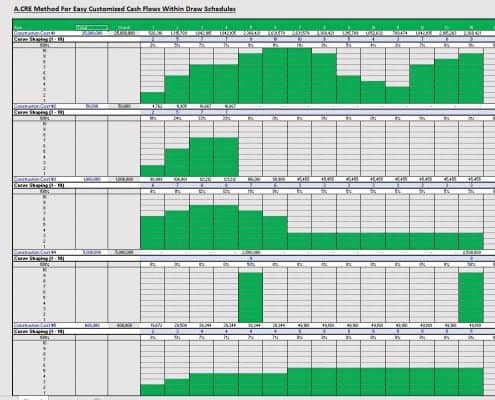

Development Draw Schedule – Visually Customize Each Line Item (UPDATED APR 2022)

Working a lot with development draw schedules, I have always been looking for a catch all solution as to how one could easily model all the unique ways cash actually flows over time during the process. The norm for many is to model cash flows…

Setting Up a New Real Estate Financial Model – Date and Period Headers Plus Formatting (Updated Apr 2022)

We've spent a lot of time here discussing and sharing different real estate models, and we've received a ton of feedback from our readers as a result. In some of that feedback we've received, several people have asked what period and date rows…

Office Purchase and Sales Agreement

This article outlines specific concerns related to an office commercial real estate purchase and sales agreement. Below, we'll discuss the clauses in the agreement to adjust from a neutral agreement between buyer and seller. You can download…

Construction Draw Schedule: Accounting For True LTC (Updated Apr 2022)

When lenders provide debt for a development project, they lend based on a Loan-to-Cost ratio (LTC), which is simply the percent of the total budget the lender will agree to lend to the borrower. So, if a project costs $10MM, and a lender loans…

Convert Monthly Cash Flows to Quarterly and Annual Cash Flows (Updated Mar 2022)

Over the past few years, I've been working to build an ARGUS DCF alternative in Excel - or otherwise known here as the A.CRE All-in-One (Ai1) Model. As I've worked on that model, I've been jotting down modeling techniques I use and think would…

Tutorials for the A.CRE Apartment Development Model

As promised, I'm following up the release of the A.CRE Apartment Development model with a series of walk-throughs and tutorials to help you better understand the various elements of the model. The tutorials start with the basics - a guide to…

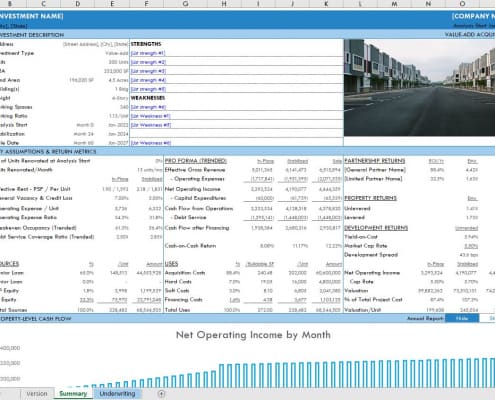

Pro Forma For Multifamily Renovation (Updated 11.17.2021)

I'm excited to share the Pro Forma for Multifamily Renovation model with all of you. This multifamily renovation model is made to analyze value add apartment acquisition opportunities and has a lot of functionality that is meant to provide you…

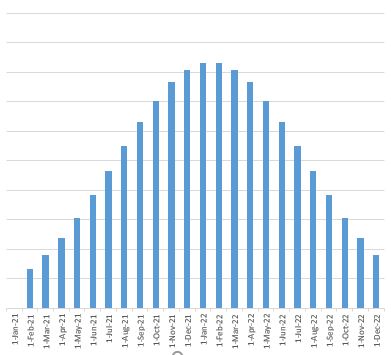

S-Curve Forecasting in Real Estate Development (Updated Sep 2021)

One of the reasons Michael and I blog, is to force ourselves to be continually learning. I built the first version of my real estate waterfall model, because I wanted to better understand the mechanics of modeling an equity waterfall with IRR…

Real Estate Equity Waterfall Model – Monthly Periods (Updated Jul 2021)

When I decided to share my real estate equity waterfall model in Excel, I never imagined it would be as popular as it has. The model has been downloaded thousands times and many of you have written to extend your thanks for sharing. It is gratifying…

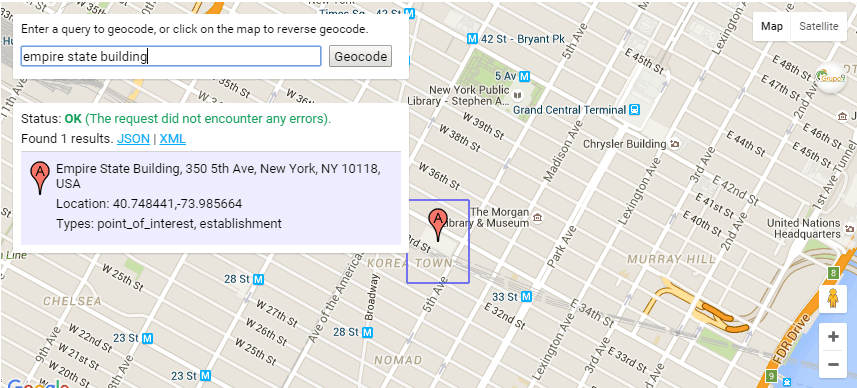

Custom Function to Auto-Populate Latitude and Longitude in Excel (Updated 2021)

When analyzing real estate investments in Excel, it's often necessary to include the latitude and longitude coordinates of the properties we're modeling. To do this, most of us open up Google Maps, or some other mapping tool, and find the…

Could You Be Exiting Too Early? Don’t Forget to Analyze Your Reinvestment Rate

When attempting to maximize the value of your money invested in real estate, the timing of your exit is key to maximize your return. Exit too early, and you might leave money on the table. Exit too late, and you might have better used that capital…

Tutorials for A.CRE Value-Add Apartment Acquisition Model

As promised, I'm following up the release of the A.CRE Value-Add Apartment Acquisition model with a series of walk-throughs and tutorials to help you better understand the various elements of the model. The tutorials start with the basics -…

Using Boolean Logic to Model Multiple Generations of Tenant Improvements

Arguably the most powerful, and least appreciated and understood, functionality in Excel is its use of boolean logic. Or in other words, the use of TRUE and FALSE binary logic. This form of logic can be used to dramatically simplify formulas…

Real Estate Acquisition Due Diligence Checklist

Most of the Excel tools we share on Adventures in CRE are real estate financial models, but occasionally we'll venture into building other CRE-related tools. Over the past several months, I've been working on a real estate acquisition checklist…