Real Estate Financial Modeling Accelerator (Updated January 2026)

Before launching the Accelerator program, Michael and I received countless emails requesting a more structured, step-by-step real estate financial modeling training program.

Over the years, we've covered hundreds of real estate modeling…

Watch Me Build a Residential Land Development Model (Updated June 2025)

Over the years, we've created a sizable library of Watch Me Build videos covering Excel models for various real estate investment and property types. However, we've yet to create a Watch Me Build involving for-sale product. So this weekend,…

Single Tenant NNN Lease Valuation Model (Updated May 2025)

I originally built this single tenant net lease (NNN) valuation Excel model back in 2016. Based on some feedback from a few of our readers, I've since made quite a few updates (see v2.0 updates video below). This model is an attempt to re-think…

Short-Term Rental Acquisition Model

In today’s real estate landscape, short-term rentals (STRs) stand out as one of the most dynamic and potentially high-yield asset classes. From compact urban units serving business travelers to luxury vacation homes attracting high-net-worth…

Tutorial on How to Model Irregular Growth Rates in Real Estate

When building a real estate financial model, managing income and expense growth is rarely as simple as applying a fixed growth rate year over year. In real estate investment analysis, growth assumptions need to be flexible, dynamic, and reflective…

Real Estate Asset Management Model

Many of you have run into this scenario: you build out a detailed acquisitions model at purchase. Everything looks great—market rents, lease-up timing, exit cap, all in line. The acquisitions team is convinced this is going to be a home run.…

A.CRE Real Estate Financial Models Download Guide (Updated December 2024)

Since I started working with A.CRE, I wanted to find a way to easily find the different models, modules, tools, and tutorials the guys have shared from the Library of Excel Real Estate Financial Models. After some time helping out our readers…

Simple Acquisition Model for Office, Retail, Industrial Properties (Updated Dec 2024)

A few years back, on a sleepy Saturday afternoon while my kids were busy eating Halloween candy, I decided to create a simple real estate acquisition model in Excel for office, retail, and industrial deals.

Since then, I've made various updates,…

Real Estate Equity Waterfall Model with Catch Up and Clawback (Updated Dec 2024)

A question came up recently in the A.CRE Accelerator's real estate waterfall modeling course regarding how to model GP Catch Up (i.e. Sponsor Catch Up) and LP Clawback provisions. I put together a quick video tutorial in response to that question,…

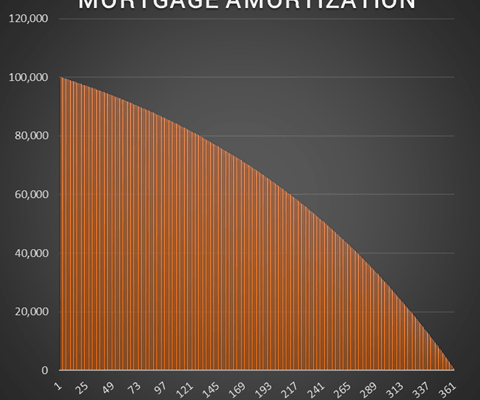

Watch Me Build a Dynamic Mortgage Amortization Table in Excel (Updated September 2024)

There are a few basic, yet fundamental, real estate modeling skills you must master before anyone will take you seriously as a real estate professional. Building a mortgage amortization schedule is one of them.

Virtually every model you…

Deep Dive – Land Acquisition and Assemblage (Updated September 2024)

This is a topic I'm all too familiar with. You see, I cut my teeth in real estate largely sourcing and negotiating residential and mixed-use land acquisition opportunities. I've put land deals together both as a fiduciary and as a principal,…

Watch Me Build a 3-Tier Real Estate Equity Waterfall Model (Updated Aug 2024)

As I've mentioned in other Watch Me Build posts, one way to become a better real estate financial modeling professional, is to watch other professionals model. Thus, the more exposure you can get to other's methods, the more adept a real estate…

How to Run Monte Carlo Simulations in Excel (Updated Aug 2024)

So you want to run Monte Carlo simulations in Excel, but your project isn't large enough or you don't do this type of probabilistic analysis enough to warrant buying an expensive add-in. Well, you've come to the right place. Excel's built-in…

Loan Payment Schedule and Balance Tracking Tool (Updated Aug 2024)

A childhood friend called me this week and asked for a favor. He is the lender on a private real estate loan and was wanting a way to personally service the loan. Namely, he needed a tool to issue monthly invoices, track the principal vs interest…

Real Estate Equity Waterfall Model With Cash-on-Cash Return Hurdle (Updated Jul 2024)

Over the years, Michael and I have built and shared numerous real estate equity waterfall models, all multi-tiered and most with internal rate of return (IRR) hurdles. And as our readers have downloaded those models, I've received dozens of…

Analyzing a Real Estate Investment from the Perspective of an LP

We received a question from an A.CRE reader this week that I thought warranted a thorough response. The question was, and I paraphrase, "I am an LP looking for models to help vet syndication deals. Do you have any models that can be used to…