Real Estate Financial Modeling Accelerator (Updated Jan 2025)

Before launching the Accelerator program, Michael and I received countless emails requesting a more structured, step-by-step real estate financial modeling training program.

Over the years, we've covered hundreds of real estate modeling…

Industrial Real Estate Development Model (Updated Nov 2024)

Allow me to share my Industrial Development Model in Excel. Over the past few years, I've been working to add more specialty real estate models to our library. While our All-in-One model certainly has its place, oftentimes really digging into…

Case Study #13 – “BioMedica” Chain Drugstore – Build-to-Suit Investment in Colombia (Case Only)

In this triple net lease case study, we explore a real-world scenario involving the development of a build-to-suit commercial property for a leading drugstore chain in Colombia. By examining this scenario, you will gain hands-on experience analyzing…

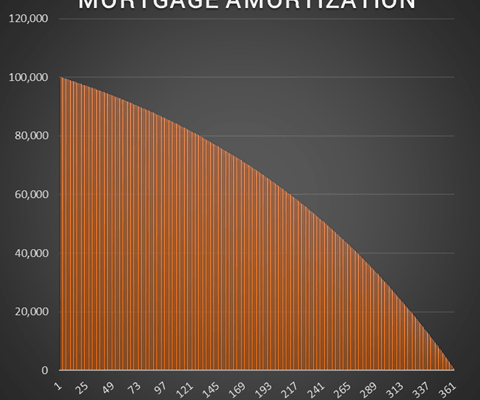

Watch Me Build a Dynamic Mortgage Amortization Table in Excel (Updated September 2024)

There are a few basic, yet fundamental, real estate modeling skills you must master before anyone will take you seriously as a real estate professional. Building a mortgage amortization schedule is one of them.

Virtually every model you…

Deep Dive – Land Acquisition and Assemblage (Updated September 2024)

This is a topic I'm all too familiar with. You see, I cut my teeth in real estate largely sourcing and negotiating residential and mixed-use land acquisition opportunities. I've put land deals together both as a fiduciary and as a principal,…

Watch Me Build a Residential Land Development Model (Updated Sept 2024)

Over the years, we've created a sizable library of Watch Me Build videos covering Excel models for various real estate investment and property types. However, we've yet to create a Watch Me Build involving for-sale product. So this weekend,…

Real Estate Equity Waterfall Model – IRR and Equity Multiple Hurdles (Updated Sept 2024)

Over the years, this real estate equity waterfall with annual periods and IRR or Equity Multiple hurdles has been one of the most popular models in our library of real estate Excel models. It's been downloaded thousands of times and we've received…

Watch Me Build a 3-Tier Real Estate Equity Waterfall Model (Updated Aug 2024)

As I've mentioned in other Watch Me Build posts, one way to become a better real estate financial modeling professional, is to watch other professionals model. Thus, the more exposure you can get to other's methods, the more adept a real estate…

How to Run Monte Carlo Simulations in Excel (Updated Aug 2024)

So you want to run Monte Carlo simulations in Excel, but your project isn't large enough or you don't do this type of probabilistic analysis enough to warrant buying an expensive add-in. Well, you've come to the right place. Excel's built-in…

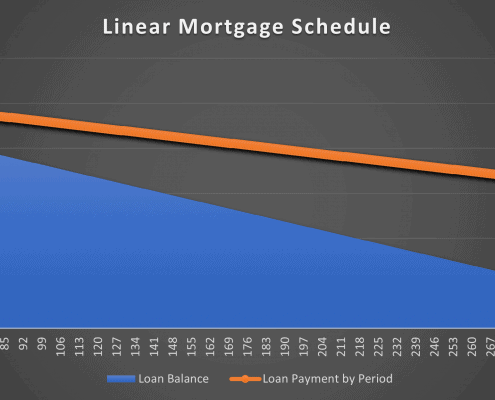

Loan Payment Schedule and Balance Tracking Tool (Updated Aug 2024)

A childhood friend called me this week and asked for a favor. He is the lender on a private real estate loan and was wanting a way to personally service the loan. Namely, he needed a tool to issue monthly invoices, track the principal vs interest…

Real Estate Equity Waterfall Model With Cash-on-Cash Return Hurdle (Updated Jul 2024)

Over the years, Michael and I have built and shared numerous real estate equity waterfall models, all multi-tiered and most with internal rate of return (IRR) hurdles. And as our readers have downloaded those models, I've received dozens of…

Analyzing a Real Estate Investment from the Perspective of an LP

We received a question from an A.CRE reader this week that I thought warranted a thorough response. The question was, and I paraphrase, "I am an LP looking for models to help vet syndication deals. Do you have any models that can be used to…

Linear Mortgage Payment Schedule Tool (Updated July 2024)

We recently shared a new modeling test to our library of real estate case studies entitled UK Debt Advisory Firm Modeling Test. In that case study, the test asked the real estate professional to analyze the returns of three different debt options.…

STNL Sales Comp Analysis Tool – Custom GPT by A.CRE

At A.CRE, we've built dozens of custom GPTs for internal and external purposes. Some of the GPTs have general application, while others are custom GPTs specifically for commercial real estate. And among those custom GPTs specifically for CRE,…

Watch Me Solve a REPE Technical Interview Modeling Test (Updated July 2024)

What better way to spend some free time over the Thanksgiving holiday, than to record myself completing a real estate private equity technical interview exercise! While I've offered help with the real estate technical interview in the past,…

An Overview Of IPMT and PPMT Excel Functions – Uses And Drawbacks (Model + Case Study)

We recently received an intriguing question in the Q&A section of the A.CRE Real Estate Financial Modeling Accelerator regarding the uses of the IPMT and PPMT Excel functions. As such, I’d like to take the opportunity to discuss it.

First…