Real Estate Financial Modeling Accelerator (Updated Jan 2025)

Before launching the Accelerator program, Michael and I received countless emails requesting a more structured, step-by-step real estate financial modeling training program.

Over the years, we've covered hundreds of real estate modeling…

All-in-One (Ai1) Walkthrough #8 – Tenancy Analysis Report for Office, Retail, and Industrial

This walkthrough, our eight in the series, explains how the Tenancy Analysis report for office, retail, and industrial real estate underwriting works in our All-in-One (Ai1) model. The Tenancy Analysis report includes a tenant rollover schedule,…

New Support Forum for the All-in-One (Ai1) Underwriting Model

Since releasing the first beta version of the All-in-One Underwriting Model, we've fielded hundreds of emails related to the model. Inquiries range from questions to feature requests to thank yous. We welcome the chance to interact with our…

All-in-One (Ai1) Walkthrough #7 – Ground Lease Valuation Module

This walkthrough, our seventh in the series, explains how the Ground Lease Valuation Module works and how to implement this tool into your analysis. The All-in-One Model includes two methods to account for a ground lease. The first is to simply…

All-in-One (Ai1) Walkthrough #6 – Underwriting a Hypothetical Multifamily Acquisition

This walkthrough, our sixth in the series, takes you through the entire process of underwriting an apartment acquisition opportunity using the All-in-One Model's new multifamily module. I've created hypothetical assumptions for this exercise…

A Note About The Limitations of Microsoft Excel in Modeling Real Estate

I think its important to point out that my All-in-One (Ai1) Underwriting Model for Real Estate Development and Acquisition is not a surefire replacement for your non-Excel valuation/underwriting solutions. In fact, it's likely you (or your employer)…

All-in-One (Ai1) Walkthrough #5 – The Residual Land Value Calculation Module

This walkthrough, our fifth in the series, explains how the Residual Land Value Calculation module works and how to implement this tool into your analysis. You might recall, a few months back we discussed the concept of residual land value…

All-in-One (Ai1) Walkthrough #4 – The Rate Matrix Module

This walkthrough, our fourth in the series, explains how the Rate Matrix module works and how to implement this tool into your analysis. The rate matrix concept is new to this site, and not commonly used in the industry. Nonetheless, given…

All-in-One (Ai1) Walkthrough #3 – Modeling a Hypothetical Retail Development Investment

This walkthrough, our third in the series, takes you through the entire process of modeling a simple development investment. I've created hypothetical assumptions for this exercise written out in PDF format (download link below) and then use…

Version Notes: All-in-One Underwriting Model

Version notes for the All-in-One Underwriting Model for Real Estate Development and Acquisition are found here as well as in the 'Version' tab of the Excel model.

Download the Model

Version 0.3.1 (March 11, 2017)

Added version notes…

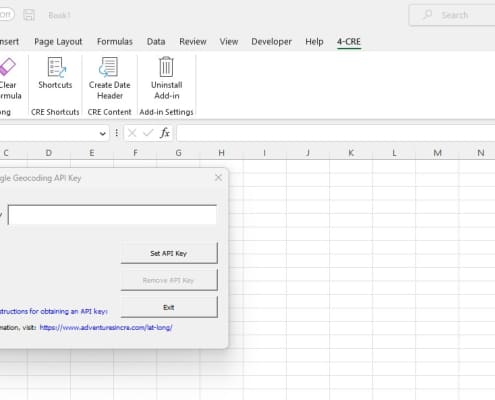

Supercharge Excel with the WST Macros Add-in

In 2016, I wrote about Wall St. Training and their free Excel modeling resources. In that post, I mentioned the free WST Macros and how it is an indispensable add-in; one that I used in my professional life daily.

Unfortunately, as of 2023,…

How to Use the Apartment Acquisition Model’s Monte Carlo Simulation Module

You may recall that a couple of weeks ago, I began to explore Stochastic Modeling concepts, or the idea of adding probability into my models, to get a more complete picture of the risk-return metrics of an investment. I became interested in…

Waterfall Model For Real Estate Joint Ventures with Catch Up

I've just wrapped up a new JV waterfall model with catch up clause that I am excited to share on the site. This model was built as an addition to my back-of-the envelope retail/industrial/office acquisitions model I posted a few weeks back.…

How to Use the Construction Draw and Interest Calculation Model

As promised, I've recorded a tutorial on how to use my construction draw and interest calculation model. The 20 minute tutorial walks you through how to use the model to forecast construction cash flows during your development period. The model…

Real Estate Waterfall Model – Equity Multiple Hurdles

I've created a companion to my real estate equity waterfall model to work with equity multiple hurdles, rather than IRR hurdles. It took me longer than I expected to build this, largely because I was over thinking it. I messed around with…

Apartment Valuation Tutorial Using the Real Estate Acquisition Model

I promised a how-to video for my real estate apartment acquisition model, and so I thought I'd use an actual property to do so. I grabbed a property from Loopnet that is currently for sale, and dropped the information from the listing into…