Real Estate Financial Modeling Accelerator (Updated Jan 2025)

Before launching the Accelerator program, Michael and I received countless emails requesting a more structured, step-by-step real estate financial modeling training program.

Over the years, we've covered hundreds of real estate modeling…

Multifamily (Apartment) Acquisition Model (Updated Apr 2025)

Our library of real estate Excel models has a variety of decent apartment models, including our All-in-One model and our Apartment Development Model - both robust models in their own right. However, if you're looking for a straight multifamily…

A.CRE Value-Add Apartment Acquisition Model (Updated Mar 2025)

We've shared a handful of apartment models over the years. Several of those are capable of analyzing apartment acquisitions but none was built for the express purpose of modeling value-add apartment deals. As a result, each has its limitations…

All-in-One (Ai1) Model for Underwriting Development and Acquisitions (Updated Feb 2025)

As many of you recall, in 2015 I set out to build an Excel alternative to the widely-used (and now discontinued) ARGUS DCF. With career moves and a lot of other A.CRE-related side projects, this undertaking has been slow going. Alas, in 2016…

A.CRE Apartment Development Model (Updated Dec 2024)

For several years now, our library of real estate models has been lacking a robust ground-up apartment development model. Sure, our All-in-One (Ai1) model has the capability to model multifamily development deals, but it's more a generalist…

Multifamily Development Model (Updated April 2024)

Not to be confused with Spencer's masterpiece, The A.CRE Apartment Development Model, I decided to build a second option on our website for multifamily development with a different feel. For us true modeling nerds out there, we know that financial…

Actual + Forecast Construction Draw Schedule with S-Curve (Updated Dec 2023)

Several times in the last month, I've been asked to tackle an interesting real estate financial modeling challenge - pare actual construction draw cash flows with s-curve cash flow forecasts to create an Actuals + Forecast Construction Draw…

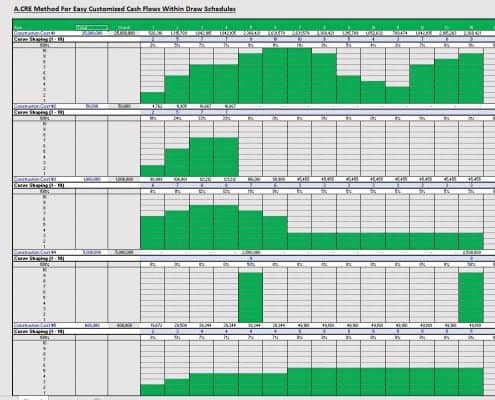

Development Draw Schedule – Visually Customize Each Line Item (UPDATED APR 2022)

Working a lot with development draw schedules, I have always been looking for a catch all solution as to how one could easily model all the unique ways cash actually flows over time during the process. The norm for many is to model cash flows…

Tutorials for the A.CRE Apartment Development Model

As promised, I'm following up the release of the A.CRE Apartment Development model with a series of walk-throughs and tutorials to help you better understand the various elements of the model. The tutorials start with the basics - a guide to…

Pro Forma For Multifamily Renovation (Updated 11.17.2021)

I'm excited to share the Pro Forma for Multifamily Renovation model with all of you. This multifamily renovation model is made to analyze value add apartment acquisition opportunities and has a lot of functionality that is meant to provide you…

Tutorials for A.CRE Value-Add Apartment Acquisition Model

As promised, I'm following up the release of the A.CRE Value-Add Apartment Acquisition model with a series of walk-throughs and tutorials to help you better understand the various elements of the model. The tutorials start with the basics -…

Apartment Acquisition Model with Monte Carlo Simulation Module (Updated Jan 2021)

We have a few stochastic modeling tools for real estate on the website, but none as robust as this Apartment Acquisition Model with Monte Carlo Simulation Module. I originally built the model in 2016 by taking my standard apartment acquisition…

Multifamily Redevelopment Model (Updated June 2020)

This is an Excel model I originally built from scratch back in 2015 for quickly assessing multifamily redevelopment opportunities. It was designed to work best for scenarios where individual units will be rehabbed over the hold at varying times.…

Watch Me Build a Multifamily Real Estate Model (Updated Feb 2020)

One way to become a better real estate financial modeling professional, is to watch other professionals model. I know in my career being able to physically see how others tackle different modeling problems has shaped my methods and made me better…

How to Use the Apartment Acquisition Model’s Monte Carlo Simulation Module

You may recall that a couple of weeks ago, I began to explore Stochastic Modeling concepts, or the idea of adding probability into my models, to get a more complete picture of the risk-return metrics of an investment. I became interested in…

Apartment Valuation Tutorial Using the Real Estate Acquisition Model

I promised a how-to video for my real estate apartment acquisition model, and so I thought I'd use an actual property to do so. I grabbed a property from Loopnet that is currently for sale, and dropped the information from the listing into…