Real Estate Financial Modeling Accelerator (Updated September 2025)

Before launching the Accelerator program, Michael and I received countless emails requesting a more structured, step-by-step real estate financial modeling training program.

Over the years, we've covered hundreds of real estate modeling…

Hold-Sell Analysis in Real Estate (Updated June 2024)

In course 3 of our A.CRE Accelerator, we use a case study that revolves around a hold-sell (i.e. hold vs sell) analysis scenario to teach the anatomy of the real estate DCF. In that scenario, the student is an asset manager working for an open-end…

All-in-One (Ai1) Walkthrough #2 – Office, Retail, Industrial Rent Roll Tab

This walkthrough, our second in the series, will detail how to use the office/retail/industrial rent roll (see ORI-RR Tab). The rent roll tab is arguably the most important, and most complex, tab in the All-in-One model. Below we post a video…

Modeling a Mortgage Loan Assumption Using the All-in-One

I recently had a discussion in the All-in-One support forum about how to model a mortgage loan assumption using my All-in-One Model for Underwriting Acquisitions and Development. Prior to version 0.77, this required manually overriding various…

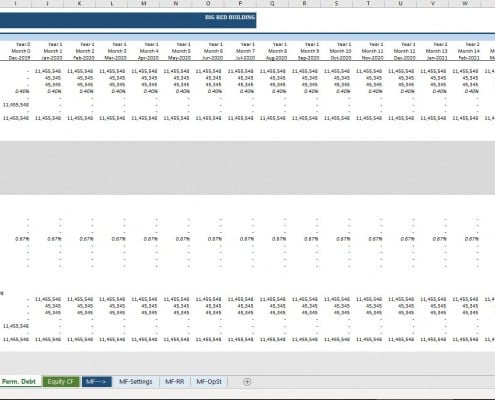

All-in-One (Ai1) Walkthrough #1 – Permanent Debt Tab (Updated Nov 2019)

In an effort to provide greater instruction on how to use our All-in-One Underwriting Tool for Real Estate Development and Acquisition, we've developed a series of walkthrough videos and posts on the methodology behind the various components…

Quick Tutorial: Add Line Items to OpSt Sheet in All-in-One

I was recently asked the question whether it's possible to add more other income or operating expense line items to the MF-OpSt or ORI-OpSt worksheets in my All-in-One Model for Underwriting Acquisitions and Development. Short answer is: out…

Understanding Treatment of Time 0 in the All-in-One Model

I received a very astute question/concern from a user of our All-in-One(Ai1) model in our Ai1 Support Forum late last month. I initially set out to answer the question in writing, but the more I thought about my response, the more I concluded…

All-in-One (Ai1) Walkthrough #10 – Underwriting a Value-Add Office Investment

This walkthrough, our tenth in the series, takes you through the entire process of underwriting a hypothetical office value-add opportunity using the All-in-One (Ai1) Model. This walkthrough comes as a response to a question we recently received…

All-in-One (Ai1) Walkthrough #9 – Print Mode and the IRR Matrix Report

This walkthrough, our ninth in the series, touches on the newly added (beta v0.5.3) 'Print Mode' and IRR Matrix Report in our All-in-One (Ai1) model. Print mode further enhances the printability of the model, while the IRR Matrix Report adds…

All-in-One (Ai1) Walkthrough #8 – Tenancy Analysis Report for Office, Retail, and Industrial

This walkthrough, our eight in the series, explains how the Tenancy Analysis report for office, retail, and industrial real estate underwriting works in our All-in-One (Ai1) model. The Tenancy Analysis report includes a tenant rollover schedule,…

All-in-One (Ai1) Walkthrough #7 – Ground Lease Valuation Module

This walkthrough, our seventh in the series, explains how the Ground Lease Valuation Module works and how to implement this tool into your analysis. The All-in-One Model includes two methods to account for a ground lease. The first is to simply…

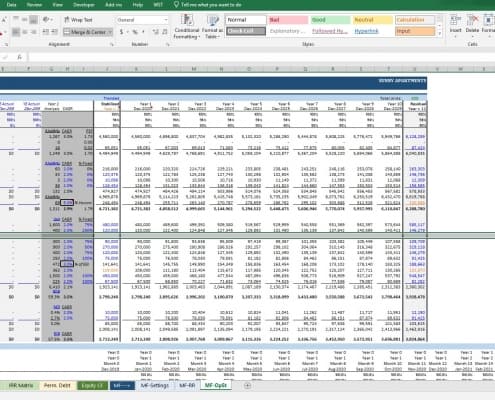

All-in-One (Ai1) Walkthrough #6 – Underwriting a Hypothetical Multifamily Acquisition

This walkthrough, our sixth in the series, takes you through the entire process of underwriting an apartment acquisition opportunity using the All-in-One Model's new multifamily module. I've created hypothetical assumptions for this exercise…

All-in-One (Ai1) Walkthrough #5 – The Residual Land Value Calculation Module

This walkthrough, our fifth in the series, explains how the Residual Land Value Calculation module works and how to implement this tool into your analysis. You might recall, a few months back we discussed the concept of residual land value…

All-in-One (Ai1) Walkthrough #4 – The Rate Matrix Module

This walkthrough, our fourth in the series, explains how the Rate Matrix module works and how to implement this tool into your analysis. The rate matrix concept is new to this site, and not commonly used in the industry. Nonetheless, given…

All-in-One (Ai1) Walkthrough #3 – Modeling a Hypothetical Retail Development Investment

This walkthrough, our third in the series, takes you through the entire process of modeling a simple development investment. I've created hypothetical assumptions for this exercise written out in PDF format (download link below) and then use…