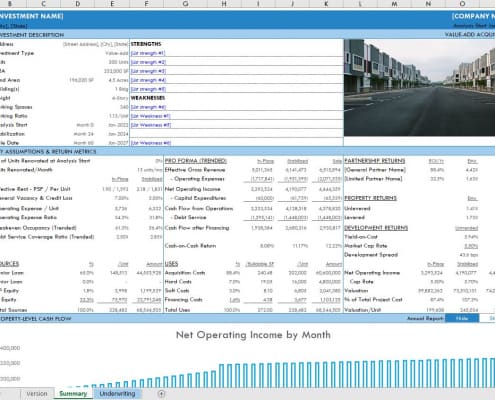

Real Estate Financial Modeling Accelerator (Updated September 2025)

Before launching the Accelerator program, Michael and I received countless emails requesting a more structured, step-by-step real estate financial modeling training program.

Over the years, we've covered hundreds of real estate modeling…

Static Debt Yield or Dynamic Debt Yield?

We recently received an intriguing question in the Q&A section of the A.CRE Real Estate Financial Modeling Accelerator regarding the calculation of debt yield. As such, I'd like to take the opportunity to discuss it.

First of all,…

The A.CRE Method for Doing Cap Rate Math in Your Head

In this post, I'd like to share a method that, with a little practice, will enable you to quickly do cap rate math in your head; whether it’s quickly figuring out what the sale or purchase price would be of a property based on the NOI and…

The Forefront of Climate Solutions for the Built Environment with Jacob Racusin | S3SP8

This episode of the A.CRE Audio Series features Jacob Deva Racusin, a real estate professional and co-founder of New Frameworks. New Frameworks is a worker-owned cooperative focused on climate solutions for the built environment, namely through…

Tenant Sales and Occupancy Cost in Retail Underwriting (UPDATED JUNE 2022)

When underwriting a retail investment, rollover risk is an incredibly important consideration. You, as a prospective debt or equity investor in the property, need to understand how secure the cash flows you're buying are; or in other words,…

Construction Draw Schedule: Accounting For True LTC (Updated Apr 2022)

When lenders provide debt for a development project, they lend based on a Loan-to-Cost ratio (LTC), which is simply the percent of the total budget the lender will agree to lend to the borrower. So, if a project costs $10MM, and a lender loans…

The Acquisition Process | Title Insurance featuring Josh Roling – Contract to Close

Welcome to this episode of the Contract to Close series! This episode features Josh Roling, a real estate attorney and an expert in all things commercial real estate acquisitions. Josh is a close friend and colleague of mine with whom I've done…

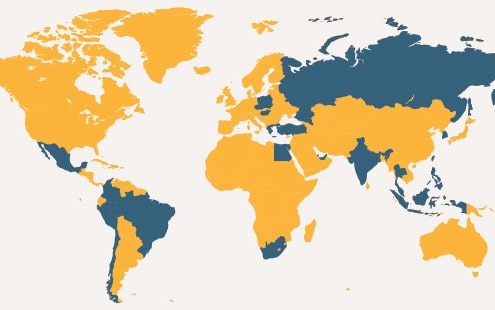

Industrial Real Estate Investments in Emerging Markets

E-commerce isn’t a new innovation, it has been around since the early 90s and was actually first created in the 1960s. Since then, many e-commerce companies have come and gone but in the past few years, there have been a few stable companies…

Could You Be Exiting Too Early? Don’t Forget to Analyze Your Reinvestment Rate

When attempting to maximize the value of your money invested in real estate, the timing of your exit is key to maximize your return. Exit too early, and you might leave money on the table. Exit too late, and you might have better used that capital…

The Earnest Money Deposit – From Contract to Close Series

https://youtu.be/BIrK6pfvqGA

What is an Earnest Money Deposit

The earnest money deposit, also known as the good faith deposit or good faith money, is a sum of money that gets deposited by the buyer of a property into an escrow account…

Using Excel’s New LAMBDA Feature to Create Custom Functions for Real Estate Financial Modeling

In December 2020, Excel rolled out a new featured called LAMBDA as part of the Office Insiders (i.e. beta) program. This feature allows the user to create custom functions, which can greatly reduce duplicative formulas and reduce errors.

Well…

https://www.adventuresincre.com/wp-content/uploads/2019/08/event-calendar.jpg

1080

1626

A.CRE

https://adventuresincre.com/wp-content/uploads/2022/04/logo-transparent-black-e1649023554691.png

A.CRE2020-10-25 04:03:002023-01-18 10:45:56Commercial Real Estate Event Calendar by A.CRE

https://www.adventuresincre.com/wp-content/uploads/2019/08/event-calendar.jpg

1080

1626

A.CRE

https://adventuresincre.com/wp-content/uploads/2022/04/logo-transparent-black-e1649023554691.png

A.CRE2020-10-25 04:03:002023-01-18 10:45:56Commercial Real Estate Event Calendar by A.CRE

How to Quickly Evaluate Real Estate Opportunities (Without Opening Excel)

We regularly respond to questions from A.CRE and Accelerator members as it relates to analyzing and evaluating real estate investment opportunities. Recently, in an Accelerator forum post a young professional marveled at how certain individuals…

All You Need to Know About Real Estate Gross-Ups

"Gross-up" clauses have caused confusion, and occasionally consternation, amongst tenants signing commercial leases for the first time. While many tenants are happy to pay for building services they use on a daily basis, many are riled when…

Roll Up Your Monthly Cash Flow Line Items Into Annual Periods Using Only One Formula For The Whole Sheet

While building out my hotel development model (currently underway), I decided to take a break and record a video about how I roll up the monthly cash flow line items on my Monthly Cash Flow sheet into annual cash flow line items on a separate…

Deep Dive: Understanding Acquisitions: The Letter of Intent (LOI)

The Letter of Intent - Legal Issues

The letter of intent is a critical document that is written up at the beginning of a potential real estate transaction between either a prospective buyer and seller or a prospective tenant and landlord.…