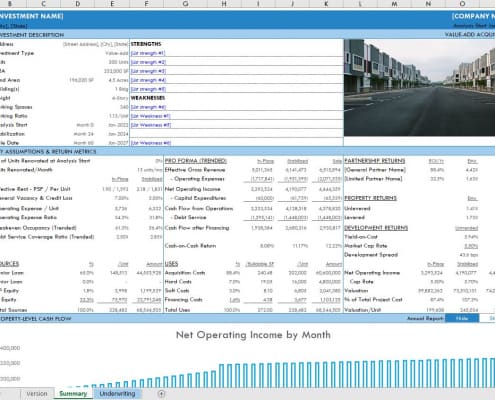

Real Estate Financial Modeling Accelerator (Updated Jan 2025)

Before launching the Accelerator program, Michael and I received countless emails requesting a more structured, step-by-step real estate financial modeling training program.

Over the years, we've covered hundreds of real estate modeling…

Exploring Optionality in Commercial Real Estate (Written by AI)

The term "optionality" may evoke thoughts of financial derivatives, stock options, or complex trading strategies. However, in the context of commercial real estate, optionality is a far more nuanced and potent concept. Simply put, optionality…

ChatGPT vs Bard vs LLaMa Chat (Aug 2023) – AI Chat for CRE Comparison

If you're an A.CRE reader, you know we're actively exploring the numerous use cases for generative AI in commercial real estate. As part of those efforts, we've used ChatGPT to help us build a custom Excel add-in for CRE professionals, used…

Calculate Residual Land Value in Excel (Updated Jul 2023)

Here's the scenario. You're a real estate developer. You spot a prime parcel of land that would be perfect for your real estate project. So you approach the owner of the land about selling and she says, "Okay, bring me an offer." How much do…

Become an AI Expert in CRE: Take Google’s Generative AI Courses

Since diving into the world of commercial real estate (CRE), I've kept my eyes peeled for tools and technologies that can revolutionize the way we conduct business. One of the most exciting developments in recent years is artificial intelligence…

Commercial Real Estate Deal Sheet

As part of our ongoing series of YouTube Shorts, we recently published a video about the importance of keeping a personal commercial real estate deal sheet (see video below). In this context, a real estate deal sheet is a comprehensive list…

Using ChatGPT as a Real Estate Analyst to Create a Lease Abstract

As you may know, we here at A.CRE have been exploring various use cases for AI in commercial real estate. When ChatGPT plugins were released in May 2023, the tool gained an ability to act like a young real estate analyst; namely to source and…

A.CRE 101: CRE Risk Profiles (Updated May 2023)

In this post we will go into detail about the four CRE risk profiles commonly ascribed to commercial real estate opportunities. In order of least risky to most risky, they are as follows:

Core

Core Plus

Value Add

Opportunistic

This…

Static Debt Yield or Dynamic Debt Yield?

We recently received an intriguing question in the Q&A section of the A.CRE Real Estate Financial Modeling Accelerator regarding the calculation of debt yield. As such, I'd like to take the opportunity to discuss it.

First of all,…

The A.CRE Method for Doing Cap Rate Math in Your Head

In this post, I'd like to share a method that, with a little practice, will enable you to quickly do cap rate math in your head; whether it’s quickly figuring out what the sale or purchase price would be of a property based on the NOI and…

The Forefront of Climate Solutions for the Built Environment with Jacob Racusin | S3SP8

This episode of the A.CRE Audio Series features Jacob Deva Racusin, a real estate professional and co-founder of New Frameworks. New Frameworks is a worker-owned cooperative focused on climate solutions for the built environment, namely through…

Tenant Sales and Occupancy Cost in Retail Underwriting (UPDATED JUNE 2022)

When underwriting a retail investment, rollover risk is an incredibly important consideration. You, as a prospective debt or equity investor in the property, need to understand how secure the cash flows you're buying are; or in other words,…

Construction Draw Schedule: Accounting For True LTC (Updated Apr 2022)

When lenders provide debt for a development project, they lend based on a Loan-to-Cost ratio (LTC), which is simply the percent of the total budget the lender will agree to lend to the borrower. So, if a project costs $10MM, and a lender loans…

The Acquisition Process | Title Insurance featuring Josh Roling – Contract to Close

Welcome to this episode of the Contract to Close series! This episode features Josh Roling, a real estate attorney and an expert in all things commercial real estate acquisitions. Josh is a close friend and colleague of mine with whom I've done…

Industrial Real Estate Investments in Emerging Markets

E-commerce isn’t a new innovation, it has been around since the early 90s and was actually first created in the 1960s. Since then, many e-commerce companies have come and gone but in the past few years, there have been a few stable companies…

Could You Be Exiting Too Early? Don’t Forget to Analyze Your Reinvestment Rate

When attempting to maximize the value of your money invested in real estate, the timing of your exit is key to maximize your return. Exit too early, and you might leave money on the table. Exit too late, and you might have better used that capital…