Real Estate Financial Modeling Accelerator (Updated Jan 2025)

Before launching the Accelerator program, Michael and I received countless emails requesting a more structured, step-by-step real estate financial modeling training program.

Over the years, we've covered hundreds of real estate modeling…

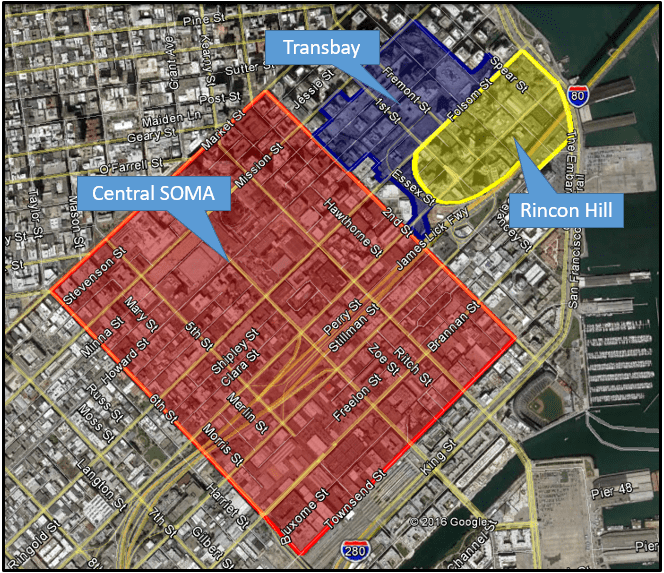

San Francisco Development Explosion! – Interactive Map & Side Project

San Francisco's downtown area is currently going through an unprecedented, skyline redefining transformation. So many incredible developers and architects are in the process of leaving their mark on this city and it's all happening or will…

Understanding Taxes Series: Part 2 – Exceptions to The PAL Rules

The PAL Rules - A Brief Background

The PAL Rules, or Passive Activity Loss Rules, were enacted in 1986 to curb rampant abuses from people using real estate and businesses to generate huge losses to offset income taxes. It used to be that you…

Getting to Know Our Readers – Ben Stevens and The Skyline Forum

Maintaining a vibrant, ever-changing blog is not an easy endeavor, and I’ll be the first to admit that it’s not always fun. But what makes blogging worthwhile for Mike and I is the opportunity the blog creates to interact, either through…

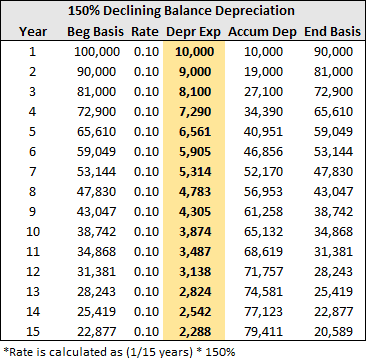

Understanding Taxes Series: Part 1 – Depreciation

Investing in real estate provides some tremendous tax incentives in the USA compared to other investments and is an important component to understanding real estate investing. Given the positive response I've received to my Understanding Leases…

Understanding Leases: Office Buildings – Part 2b

Grossing Up Reimbursable Expenses in ARGUS

This post and video are a follow up to a post written back in late October discussing grossing up reimbursable expenses. If you haven’t gotten to read that yet, you can do so by clicking here:…

Understanding Leases: Office Buildings – Part 2a

Grossing Up Operating Expenses – What, How, Why, and its impact on the Three Common Bill-back Methods

A common practice in office leases is to gross up the variable portion of the reimbursable expenses. Grossing up expenses is when the…

Understanding Leases: Office Buildings – Part 1

Billing Back Reimbursable Operating Expenses – Three Common Approaches for Office Buildings

(ARGUS video example to follow next week)

The three most common approaches to expense reimbursements in office leases are the (1) triple-net,…

Another Shot at Stuy Town – Blackstone’s $5.3 Billion Bet

Styuvesant Town-Peter Cooper Village, otherwise known as Stuy Town, is back in real estate news. Blackstone, together with Ivanhoe Cambridge and CWCapital Asset Management, have agreed to buy the 11,232-unit apartment complex for…

Introducing a New Blog Segment: Understanding Leases

We are rolling out a new segment this week called Understanding Leases. The aim is to help our readers learn about the more nuanced and unique concepts to commercial real estate leasing and provide general tips and understanding. Over time we…

CRE Market Spotlight: Camden, NJ

After decades of being statistically one of the poorest cities in the country, it seems there are finally big changes coming to the city of Camden, NJ. With an extensive and generous state sponsored tax credit program luring big businesses to…

Real Estate Development ROI Models

From time to time, I'm asked to share more complex development models that I've used professional. Unfortunately, most of the models that I've used professionally were built in partnership with others, and so I'm not at liberty to share those…

Free ARGUS DCF Training

UPDATE: ARGUS stopped selling ARGUS DCF at the end of 2015 and will stop supporting the software all together in 2017. The company no longer offers public training for DCF. You'll also note that the YouTube video tutorial for DCF has been taken…

NYC Office Building Brings 2nd Highest Price Ever

If there's one thing I remember from my pre-2008 days, it was seeing a lot of stories like this. Are we in bubble territory yet?

SL Green Realty has agreed to buy CIM Group's 11 Madison Ave. The 29-story office tower in Manhattan,…

Prologis to Acquire KTR Capital in JV with Norges

It was announced last week that Prologis, the world's largest industrial REIT, has agreed to buy KTR Capital Partners for $5.9 billion. KTR owns and operates 70 million square feet of real estate across the U.S.

I think the deal is interesting…

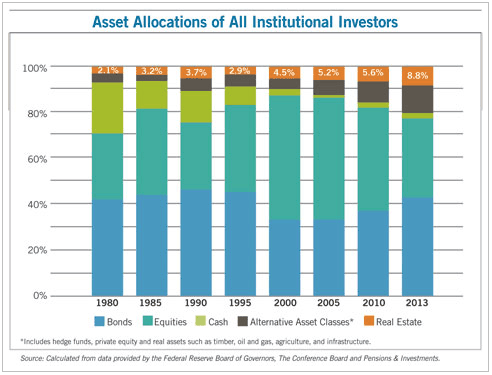

The Fourth Major Asset Class

David Funk, a professor of mine and the former director of the Baker Program in Real Estate at Cornell University, recently published some interesting research into asset reallocation by institutional investors that more heavily favors commercial…