Real Estate Financial Modeling Accelerator (Updated January 2026)

Before launching the Accelerator program, Michael and I received countless emails requesting a more structured, step-by-step real estate financial modeling training program.

Over the years, we've covered hundreds of real estate modeling…

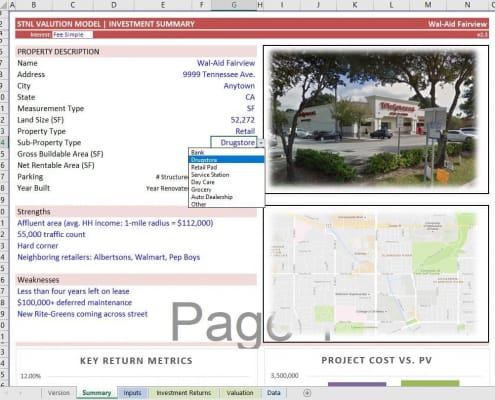

Create Dynamic Sub-Property Type Drop-Down Menus in Excel

A few years ago, I created a tutorial on building smart drop-down menus in Excel using dynamic named ranges and data validation lists. This offered a great way to have drop-down menus in your model that could be easily changed by the user to…

Watch Me Build Data Tables For Real Estate Sensitivity Analysis

This is a 3 part mini-series on using data tables in Excel to perform real estate sensitivity analysis. In this series, I'll walk you through how to build both one-variable and two-variable data tables in parts 1 and 2. And in Part 3, I'll walk…

Watch Me Expand the Home Construction Pro Forma

I'm regularly asked to expand my single family home construction pro forma to analyze the construction of more than one home. I've contemplated adding that functionality to the model, but it is such a custom task that no template could really…

Roll Up Your Monthly Cash Flow Line Items Into Annual Periods Using Only One Formula For The Whole Sheet

While building out my hotel development model (currently underway), I decided to take a break and record a video about how I roll up the monthly cash flow line items on my Monthly Cash Flow sheet into annual cash flow line items on a separate…

Using the OFFSET Function in Real Estate Financial Modeling

In a previous post, I showed you how to use the OFFSET function to create dynamic lists in Excel. As you become more comfortable using this function in real estate financial modeling, you'll find that it has almost infinite applications when…

A.CRE 101 – Create Smart Drop-Down Menus in Real Estate Modeling

One Excel feature real estate financial modeling professionals use often is the data validation list. Where data validation is a method of limiting the possible inputs of a cell, the data validation list limits those inputs to a pre-defined…

All About Cap Ex

In this post, we are going to take a deeper look into capital expenditures. What it is and how we account for it in cre underwriting.

Capital expenditures, commonly referred to as Cap Ex, are expenses that occur outside of normal operating…