Real Estate Financial Modeling Accelerator (Updated Jan 2025)

Before launching the Accelerator program, Michael and I received countless emails requesting a more structured, step-by-step real estate financial modeling training program.

Over the years, we've covered hundreds of real estate modeling…

A.CRE 101: How to Use the Income Capitalization Approach to Value Income-Producing Property (Updated May 2024)

In commercial real estate, there are a few generally accepted methods for appraising (or valuing) real property. The three most common are the Cost Approach, the Sales Comparison Method, and the Income Approach. The Income Approach includes…

Watch Me Build – Modeling a Rent Schedule in Both Excel and Using AI (Updated May 2024)

In this Watch Me Build video I show you how to build a custom rent schedule module for long-term leases. The foundation of the module is a simple INDEX/MATCH combination that takes a rent schedule and models the rent cash flows across the entire…

Watch Me Build – American-Style Real Estate Equity Waterfall (Updated Apr 2024)

A few years ago, I recorded my screen as I built a 3-tier real estate equity waterfall model. What I didn't mention in that Watch Me Build video, is that the kind of waterfall I built is colloquially called a European-style equity waterfall.…

The Definitive Guide to Microsoft Excel for Real Estate (Updated Apr 2024)

Microsoft Excel is the primary tool used by real estate financial modeling professionals. Even while numerous non-Excel alternatives have attempted to de-throne Excel, the 35+ year-old software has shown to be surprisingly resilient to competition.…

How to Prepare for the Real Estate Technical Interview (Updated Apr 2024)

So you've made it past the HR screening interview. You have the education and experience the company is looking for, but now they want to be sure you possess the real estate financial modeling skills necessary to do the job. They've asked…

Terminology Guide for Build-to-Rent Investment

We recently released a Build-to-Rent (BTR) Development model to help students and developers better analyze this emerging investment type in commercial real estate. As we explored this type of analysis, it became clear that terminology is often…

Glossary of Commercial Real Estate Terms (Updated Apr 2024)

Glossary of Commercial Real Estate Terms

Welcome to the A.CRE Glossary of Commercial Real Estate Terms, a practitioner's guide to the most common terms in CRE. This is an ever-growing list of commercial real estate terms and definitions that…

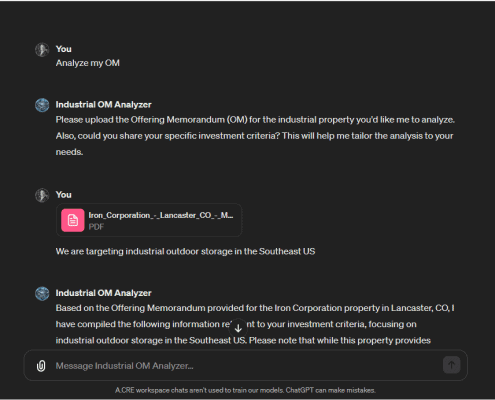

Watch Me Build – Industrial Offering Memorandum Analyzer Custom GPT

In this Watch Me Build session, I'll walk you through constructing a custom GPT that near-instantly sifts through Industrial Offering Memorandums to pinpoint whether an investment aligns with your criteria. At the heart of this build is a tailored…

Modeling a Property Tax Abatement in Real Estate (Updated Jan 2024)

We often field questions about how to model property tax abatements. It's a concept we cover in our the 'Advanced Modeling - Property and Portfolio' endorsement in our Accelerator real estate financial modeling training program and something…

LBO vs CRE Acquisition Models and Using LBO Structure to Acquire CRE

In the world of investment and finance, models play an integral role in guiding decision-making processes, evaluating risk, and forecasting returns. Two such influential models are the Leveraged Buyout (LBO) Model and the Commercial Real Estate…

8 Considerations When Reviewing a Broker’s Financial Model Setup

Whether you’re an analyst, operating in acquisitions, or working in a different property-related role, it’s essential to have the skills required to qualify an opportunity, which typically includes reviewing a broker’s financial model…

The Road To A Stabilized NOI – Underwriting Real Estate Concessions

The incentives offered to the tenants of a real estate property constitute another of the adjustments that real estate professionals must underwrite to achieve a stabilized NOI, but beyond the adjustment, the concessions represent the cost of…

The Road To A Stabilized NOI – Vacancy And Credit Loss In Real Estate Underwriting

Considering the potential vacancy loss as well as tenant default on an income-producing real estate property represents another key underwriting decision that real estate professionals must make when transitioning to a pro forma (Stabilized)…

The Road to Stabilized NOI – Loss to Lease in Multifamily Property Underwriting

The calculation of stabilized Net Operating Income for a property is synonymous with building a stabilized proforma. This modeling process starts by estimating revenues and then the expenses, which means we must adjust the anticipated revenues…

Create Your First AI Tool: Sales Comp Database ChatGPT Plugin

Traditionally in commercial real estate, each organization builds its own proprietary sales comp database and then gives its analysts access to that database in order to perform comp analysis. As AI becomes more and more important, pairing the…