Prologis to Acquire KTR Capital in JV with Norges

It was announced last week that Prologis, the world’s largest industrial REIT, has agreed to buy KTR Capital Partners for $5.9 billion. KTR owns and operates 70 million square feet of real estate across the U.S.

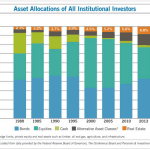

I think the deal is interesting because, besides being one of the largest deals of the year, Prologis plans to buy KTR through a joint venture with Norges Bank Investment Management, which manages the giant Norwegian pension fund. Norges will hold a 45% interest in the venture, which amounts to a $2.655bn investment for the pension fund. This is further evidence that, as large institutional investors continue to reallocate capital away from bonds, stocks, and cash to commercial real estate, real estate is fast becoming the fourth major asset class.

For more information on the Prologis / KTR Capital Partners deal see:

Wall Street Journal: ‘Prologis to Buy KTR Capital for $5.9 Billion‘

PRNewsWire: Prologis Signs Definitive Agreements to Acquire $5.9 Billion Portfolio from KTR Capital Partners

REIT.com: Industrial REIT Prologis Buying KTR Capital for $5.9 Billion