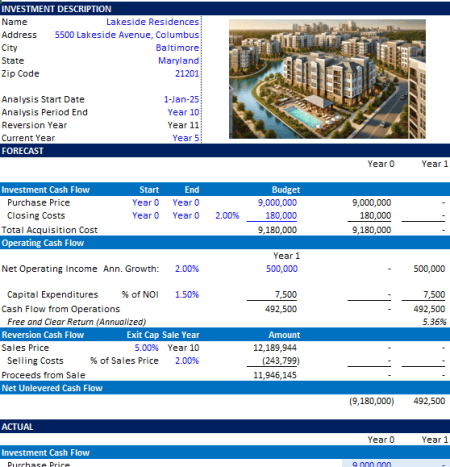

Real Estate Asset Management Model

A practical and intuitive discounted cash flow (DCF) model designed to evaluate investment performance over time through modular systems for forecasts, actuals, and combined analyses. This model tracks the evolving financial outcomes of a real estate investment by seamlessly comparing actual performance data to forecasted projections, helping to ensure the investment stays aligned with the original underwriting assumptions. (View description of model)

Note: Compatible with Microsoft Excel 2013 and newer.

To make this tool accessible to everyone, it is offered on a “Pay What You’re Able” basis with no minimum (choose ‘Free’ if you need) or maximum (your paid support helps keep the content coming – typical real estate Excel tools sell for $100 – $300+ per license).

Instructions: 1) set a price, 2) tell us where (email address) to send the model, 3) enter payment details (if applicable), and then 4) click ‘Proceed with Download’. The system will send you a download link, as well as add the file to your ‘My Downloads’ page.

SKU: N/A

Category: Real Estate Excel Models

Tags: excel, Real Estate Financial Modeling, Models, DCF, Asset Management.

Related products

-

Real Estate Portfolio Valuation Model

From: $0.00Select options This product has multiple variants. The options may be chosen on the product page -

Actual + Forecast Construction Draw Schedule with S-Curve

From: $0.00Select options This product has multiple variants. The options may be chosen on the product page -

Waterfall Model For Real Estate Joint Ventures with Catch Up

From: $0.00Select options This product has multiple variants. The options may be chosen on the product page -

Simple Acquisition Model for Office, Retail, and Industrial Properties

From: $0.00Select options This product has multiple variants. The options may be chosen on the product page