Waterfall Model For Real Estate Joint Ventures with Catch Up

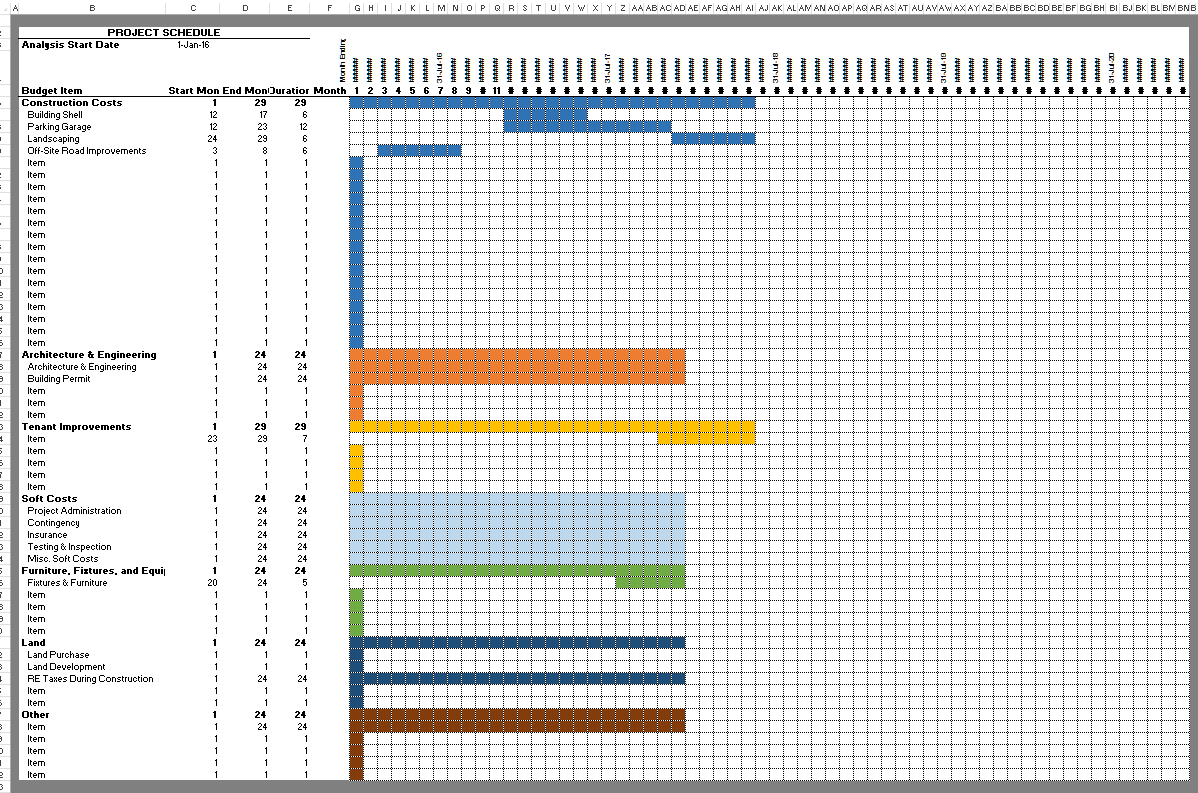

Also like the acquisition model, this entire waterfall model is on one sheet and the user can operate and read it from left to right. It is broken into three main sections: Inputs (left), the Waterfall Model (center), and the Return Summary (right).

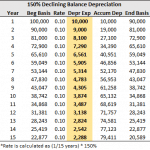

The model gives you the ability to project up to three hurdle rates (tiers) and it has an option to include a ‘catch up’ for the sponsor between the first and second tier. In Tier 1, the user can model for either a pari passu split or for a preferred return for the LPs.

Waterfall with Catch Up Option

The optional Catch Up section, which is positioned under tier 1 in all three sections of the model, is currently ‘turned off’ when you download the model, but can be turned on by answering ‘yes’ to the question ‘Is there a catch up?’ in cell D32. If you are using the catch up section, you must use solver or goal seek to calibrate the waterfall model any time you alter assumptions in your DCF model or in the sponsor fees, equity split, or tier 1 sections of the waterfall (these are all inputs that come before the catch up section).

This is explained fairly thoroughly in the video below and there are also explicit instruction on how to use both solver and goal seek with the model written under the inputs section. Additionally, as an added safety, there are three warning signs placed strategically throughout the model that will remind you to use solver if required. If you are unfamiliar with catch up clauses and how they work, it is explained in the attached video below and will also be laid out in a follow up post.

Modeling More than Two Partners

One final note, the leveraged cash flow coming in from the DCF model can be split between one or two limited partners and the sponsor, but a user should be able to build upon this model to have it account for more partners if necessary.

Also, with a little tweaking of some of the formulas, it is possible to make this model work with any DCF model that calculates returns and payouts annually.

Download the JV Waterfall Model with Catch Up

To make this model accessible to everyone, it is offered on a “Pay What You’re Able” basis with no minimum (enter $0 if you’d like) or maximum (your support helps keep the content coming – typical real estate Excel models sell for $100 – $300+ per license). Just enter a price together with an email address to send the download link to, and then click ‘Continue’.

Video Tutorial of JV Waterfall Model with Catch Up

For more information and general guidance on using the model, please watch the video below:

I hope our readers find this model useful. Again if there are any questions, concerns, or general feedback, feel free to contact me.