Tutorial on How to Model Irregular Growth Rates in Real Estate

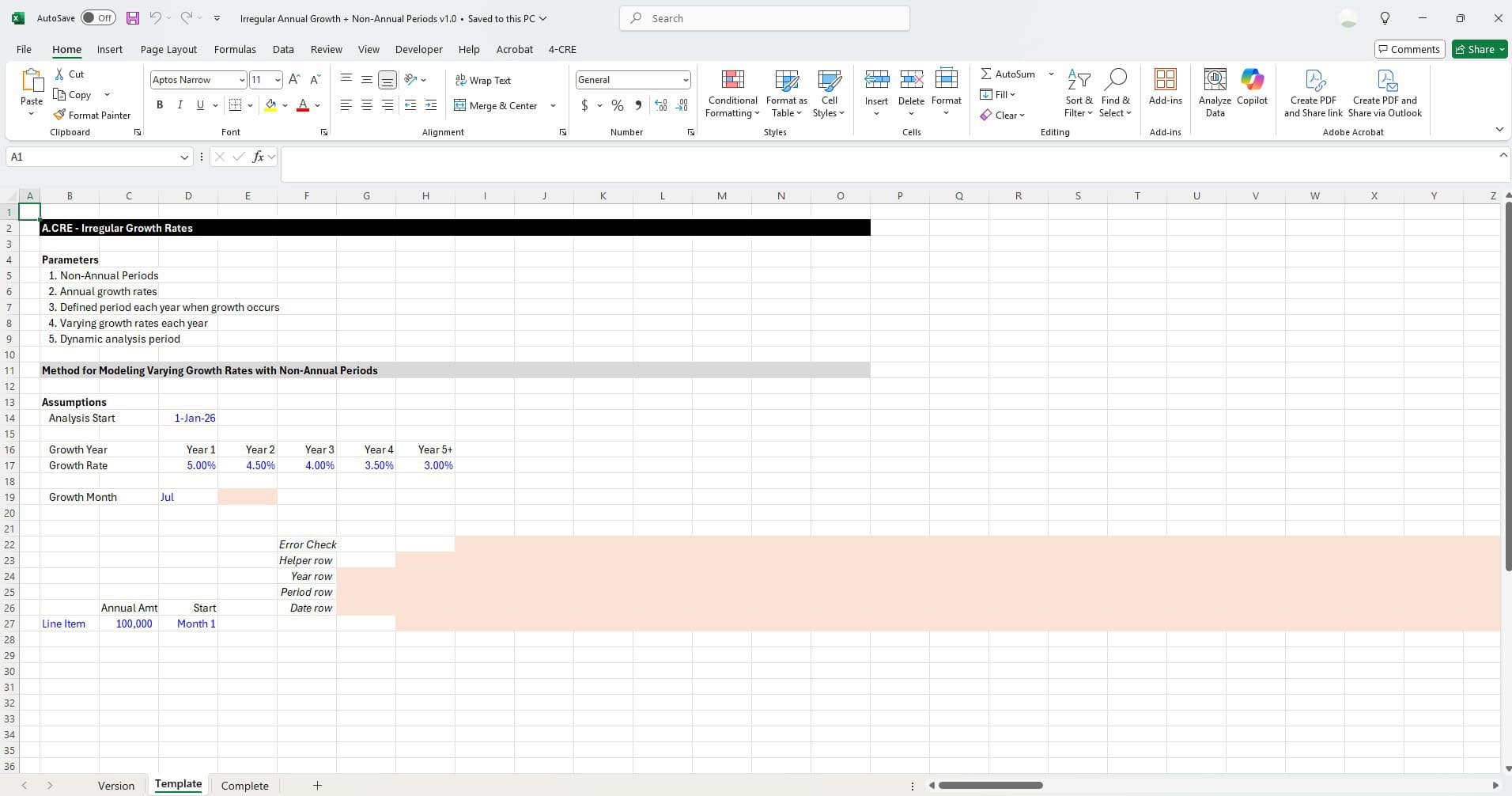

When building a real estate financial model, managing income and expense growth is rarely as simple as applying a fixed growth rate year over year. In real estate investment analysis, growth assumptions need to be flexible, dynamic, and reflective of real-world realities. One common challenge is modeling irregular growth rates, where:

- Growth occurs annually but not necessarily at the start of the year.

- A line item doesn’t begin immediately, meaning growth should only apply after its start date.

- Different years require different growth rates, with later years transitioning to a stabilized rate.

To address these nuances, I created a step-by-step video tutorial demonstrating how to model irregular growth rates in Excel. This post walks through why you’d need to model growth this way and provides a structured video guide with source file to help you implement it.

- Are you an Accelerator member? Check out other Excel tutorials like this one in our Mastering MS Excel for Real Estate Endorsement. Not yet an Accelerator member? Consider joining our A.CRE Accelerator, the industry’s preeminent real estate financial modeling training program.

In this step-by-step tutorial, I show you a method for modeling irregular growth rates in Excel.

When Modeling Irregular Growth Rates Comes into Play

In most real estate financial models, growth rates are assumed to be applied on a fixed, annual basis, starting from the first period. But real-world scenarios often require a more sophisticated approach. Here are a few conditions where this methodology becomes necessary:

1. Growth Occurs Annually, But Not on January 1st

- Your analysis is based on monthly or quarterly periods rather than annual ones.

- You want growth to happen once per year, but that could be in July, October, or any other month rather than January.

2. The Line Item Starts Mid-Analysis

- Not all cash flows begin in Period 1—some expenses, revenues, or investments kick in later in the timeline.

- The model needs to ignore growth until the line item officially starts.

3. Growth Rates Vary by Year

- Instead of assuming a constant growth rate, different rates apply for different years.

- The model needs to dynamically pull in the correct growth rate based on the analysis year.

4. Dynamic Analysis Period

- The start date and total analysis duration may change, requiring growth logic that adjusts automatically.

6. Handling of Partial Years

- If the analysis begins in a partial year, the model should ensure that growth only applies when the next full year starts.

Many real estate and investment professionals struggle with applying growth accurately in models with non-standard periods. The methodology I demonstrate in the tutorial below ensures:

- Flexibility for shifting growth to any month.

- Scalability so it works for multiple line items.

- Accuracy in applying the correct growth only when necessary.

- Automation so adjustments happen dynamically.

Now, let’s dive into the step-by-step tutorial where I walk you through exactly how to build this in Excel.

Step-by-Step Video Tutorial – How to Model Irregular Growth Rates in Excel

To help you master this technique, I created a detailed video tutorial that walks through. In the video, I also include a downloadable Excel template, so you can follow along and apply this method in your own models. Find a link to download that file further below.

Building a flexible growth model is a critical skill in real estate, private equity, and investment analysis. Whether you’re modeling rent, other income, operating expenses, or capital expenditures, or any other cash flow line that grows over time, ensuring that growth occurs at the right time and in the right increments makes your model more accurate.

Happy modeling!

Download the Source File for the Tutorial on Modeling Irregular Growth Rates

To make this tutorial accessible to everyone, it is offered on a “Pay What You’re Able” basis with no minimum (enter $0 if you’d like) or maximum (your support helps keep the content coming – typical tutorials sell for $25- $100+ per license). Just enter a price together with an email address to send the download link to, and then click ‘Continue’. If you have any questions about our “Pay What You’re Able” program or why we offer our models on this basis, please reach out to either Mike or Spencer.

We occasionally update the tutorial (see version notes). Paid contributors to the tutorial receive a new download link via email each time it is updated.

Version Notes

v1.0

- Initial release