How This Land Aggregation Strategy Helps Developers Raise More Debt and Scale Up Fast

Let’s talk land aggregation strategy. Consider this, you have put together a portfolio of some great opportunistic development deals, each with immense upside potential. All you need is the initial big chunk of investment in land to get started. But you know that no bank is ever interested in funding land costs. That’s the prerogative of you and your other equity partners. Equity guys have to prove how much they love their own projects by investing in the land part and thereby creating collateral for debt financing. So how about getting some debt funding for land costs as well by doing some smart business structuring?

Note from Spencer and Michael: This is another post in a growing series that we call ‘International CRE’. Written by CRE professionals based outside of the United States, this series is a collection of deep dives into various CRE topics relevant to real estate professionals all over the world. One of the reasons we love the International CRE series is that things are not done the same in one country to the next, and this series highlights those differing perspectives.

This particular post is written by our friend Padmaa Iyer. Padmaa is an India-based Real Estate Fundraising Strategist and Chartered Accountant. She is also a long-time A.CRE reader and graduate of our Accelerator Program. A huge thank you to Padmaa for sharing her knowledge with the A.CRE community!

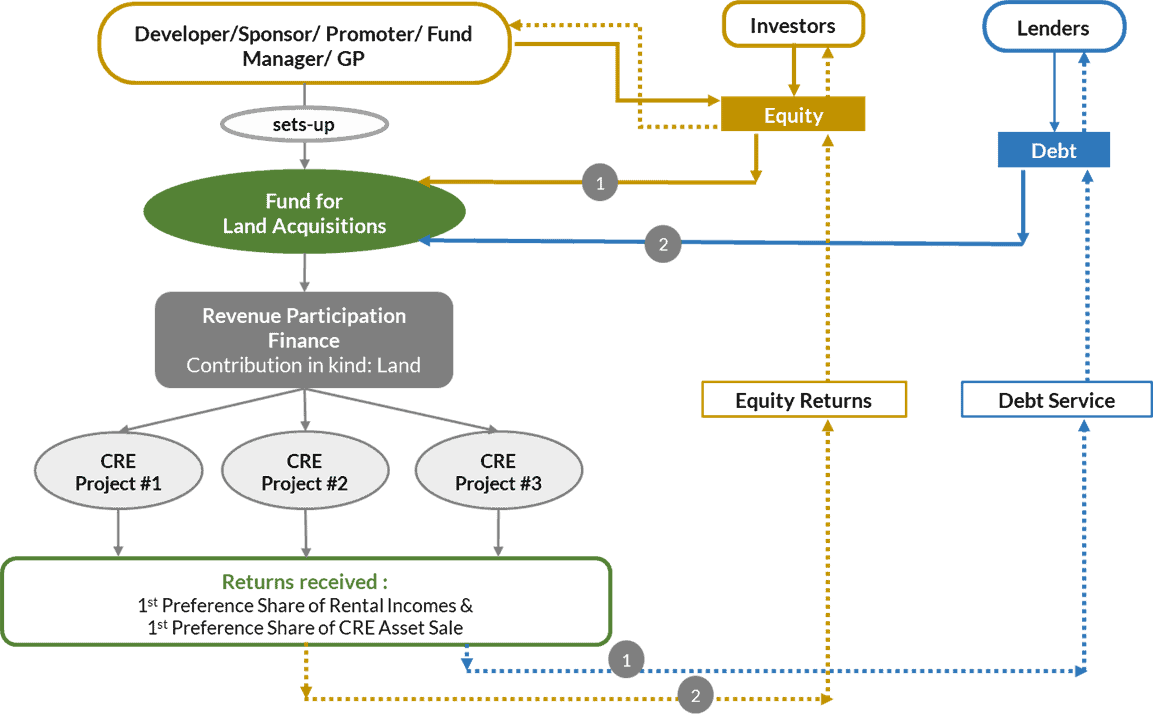

So, you set up a strategic fund with the sole purpose to acquire land parcels and invest them as Land Equity (contribution in kind) in a variety of your dream development projects. Against a mix of fixed (rental) incomes and capital gains from the underlying projects, this land fund may be able to raise debt more easily and thereby raise leverage overall for your projects. You may also run into equity investors who may be interested in investing in just the land rather than the entire development process.

As a sponsor with this land aggregation strategy, you now have 2 distinct businesses, that of land acquisitions and that of CRE asset developments. With clearly delineated profiles of risks and returns, such a structuring can look quite attractive to investors of different risk appetites.

Let’s dive in deeper to evaluate the potential of this idea in the remainder of this post.

- Land Asset Fund: A layered approach to raising more debt

- Structure of the Land Fund

- Prudent Choice of Investee Projects

- Returns for the Land Fund

- Priority Distributions to the Land Asset Fund

- Case Study: Pinkstone Land Asset Fund (Download the excel sheet)

- Conclusion

Land Asset Fund: A layered approach to raising more debt for opportunistic developments

You create a VEHICLE to raise funds with the sole objective of buying land parcels for investment into your development projects. You put down some of your own cash (your proverbial ‘skin in the game’) and pool in money from your other equity investors as well. Let’s say you manage to raise about 50% of the land costs.

Now for the balance funding, you approach a bank.

The underlying investments of this land fund are the variety of your development projects. The development of your CRE projects may take anywhere between 12 – 24 months before they start generating operating cashflows.

Debt financiers are obviously hesitant.

So how do you prove the bankability of this Land Fund? How will you be servicing their debts?

To solve the Bankability aspect: call your Land Fund a “Fixed-Income generating Asset.”

After the initial gestation period, your Land Fund will have 2 choices:

- to continue as an investing partner in those invested CRE projects, or

- to unlock value and take the exit

As a continuing investment partner, the Land Fund will continue to enjoy returns in the form of a share of rental incomes. This can lend a CORE asset-like characteristic to this fund over time.

Selling off stakes upon stabilization from some of the CRE assets will help your Land Fund unlock some value and pare down the debts.

To solve for debt servicing ability:

- Negotiate for grace periods/moratoriums in return for higher interest rates (to cover the lender’s risks).

- Plan for interest service reserves out of the equity and debt funds raised. (Remember your interest outflows are negligible compared to a situation in which 100% of the capital required are to be equity funded!)

Of course, your personal guarantees will be required. How fail-proof is your overall business plan to help you negotiate for a reasonable cap on personal liabilities?

Structure of the Land Asset Fund in Your Land Aggregation Strategy

Source: A.CRE – www.adventuresincre.com

A Prudent Choice of Investee Projects

The success of your Land Asset Fund depends a great deal on how carefully you choose your underlying investible projects, especially the first batch. If everything has to go smoothly, it requires you to take very well-calculated risks and go only for projects well within your forte.

Which real estate classes do you choose to invest in? Of them, how many are ‘for hold’ and how many are ‘for sale’? Are the current and the upcoming market cycles in favor of them? How are the demand and supply factors playing out? How articulated are your development plans? Do you have strong and reliable partnerships with your architects, engineers, general contractors, and the like? Have you factored in all the possible risks that can affect the timely completion of the projects? What is your investment holding strategy? How robust are your marketing strategies? Does your financial model account for all the possible risks such as delays in building approvals, material and labor price rises, working capital gaps, consumer demand swings, any unforeseen contingencies, etc.?

Most importantly, have you already thought out the terms you will offer to your investors and lenders? What is absolutely non-negotiable for all your sweat equity to make sense? Where is the middle ground that you will strive to reach with each financier?

Returns for the Land Asset Fund in Your Land Aggregation Strategy

Your Land Fund contributes the land as a form of quasi-equity loan into your project-specific funds against a pre-agreed share in the rental incomes/sales of the CRE products.

While taking early exits from a few of the projects will help your Land Asset Fund to offload a good chunk of its debts, remaining invested in some will ensure a steady stream of fixed income (in the form of a share of rents). This can be available for servicing the remaining debts as well as paying dividends to the equity investors. Over time, as the equity value of your Land Asset Fund grows, fundraising for future endeavors becomes easier. You already have created a bankable platform for raising money for land.

You have a seat at both tables. As a sponsor of the Land Fund, you are a Lender of resources (land in this case). As a sponsor of your development projects, you are a borrower of resources. The returns you offer in one role must not jeopardize the interests of the other.

How well are you capable of aligning your interests with those of your investors? How will you make sure that you are not short-changing one thing for the other?

A good balance, transparency, and strong groundwork are the way to go.

Priority Distributions to the Land Asset Fund

There can be no development without land. Your Land Asset Fund gives away title to the land parcels to your project firms. Your project firms will then use the land as collateral to obtain construction loans. The distributions your project firms make to your land asset fund are a consideration for the title. This is why the construction loan lenders should have no problem accepting the first priority distributions made to the land asset fund.

Case Study: Pinkstone Land Asset Fund

The Pinkstone guys have identified land parcels in 3 prime locations suitable for the development of some great CRE assets.

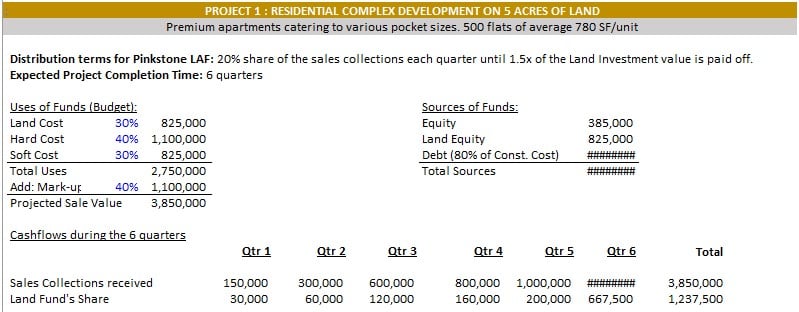

One is a 5-acre plot in the middle of a bustling neighborhood. This is ideal for a 500-unit residential apartment complex development, given the ever-growing housing needs of the city. They look to pre-sell these apartments so as to offload some debts and have some early cashflows in the overall timeline.

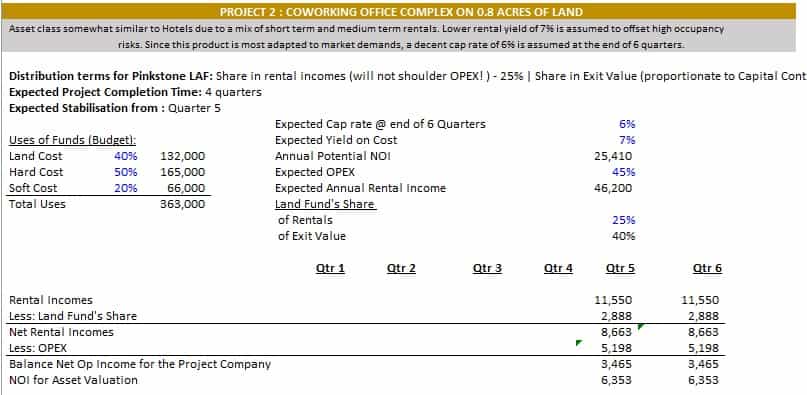

The other is a 0.8-acre piece of land in a commercial hotspot. This is ideal for office development, but given the unprecedented vacancies experienced by some of the biggest, busiest, and most prestigious office buildings in this post-covid world, Pinkstone has realized that some rethinking is essential here. Instead of building a traditional commercial office complex, they have decided to develop it as a co-working space. The growing desire for personal space and resentment towards working in stifling hierarchies have led many to work on their own. A co-working space is an ideal work address for such self-liberated professionals. Even some bigger corporations have started looking for comparatively smaller spaces with flexible lease terms. Therefore, Pinkstone has decided to develop an exclusive co-working office complex that will have the right mix of space offerings to various consumers right from the just-starting-out solopreneurs to the big MNCs.

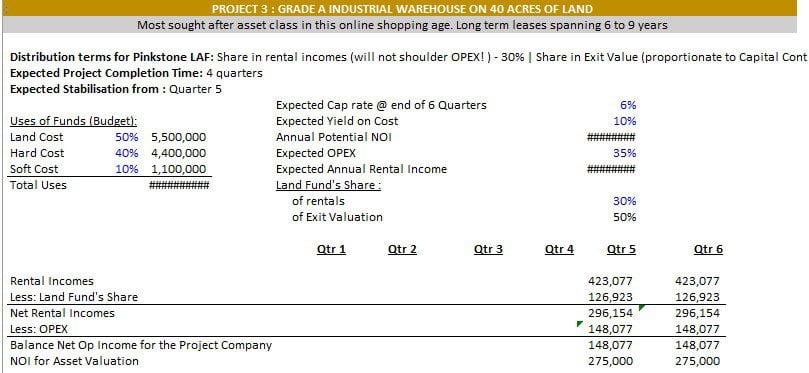

The 3rd parcel of land is where Pinkstone sees all of its real estate gold coming from. It is a 40-acre stretch of land that lies at the junction of 4 major national highways. Pinkstone is looking to develop an investment-grade industrial warehouse for the burgeoning e-commerce industry. In fact, a couple of corporations have already evinced keen interest in entering into pre-leasing contracts for favorable rates on long-term leases.

Pinkstone has already done its due diligence on these land parcels, paid soft deposits, and bought time from the respective land owners. A construction loan is available for all the 3 projects. But only to fund a major portion of the construction costs. All they need now is the money to close these land deals. Their life is on the line!

In the meantime, Pinkstone has thought about setting up a land asset fund exclusively to buy land and invest it into their dream projects. In the enclosed excel sheet, you will see, if all goes well, how the net worth (equity value) of this Land Asset Fund grows year by year.

Conclusion

Given a wise selection of development deals to invest into, this land fund can become a fixed-income generating beast over time and also see its balance sheet grow year after year. And this land aggregation strategy can offer you a reliable growing source of initial capital for your future developments.

But timing is everything. Once the land deals close how soon will you be able to break ground and start building? Sitting over parcels of land without a watertight plan in hand will only bury you under the mountains of wasteful interest load.

After all, leverage is not called a ‘double-edged sword’ for nothing.

Frequently Asked Questions about the Land Aggregation Strategy for Raising Debt and Scaling Development

What is the core idea behind the land aggregation strategy?

The strategy involves setting up a dedicated Land Asset Fund to acquire land parcels and invest them as equity-in-kind into various development projects. This approach enables the sponsor to raise more debt by improving collateral and attracting investors with different risk appetites.

Why do banks typically avoid financing land costs?

Banks usually avoid financing land because it lacks immediate cash flow and poses higher risk. As stated in the post: “No bank is ever interested in funding land costs. That’s the prerogative of you and your other equity partners.”

How does forming a Land Fund help raise more debt?

By investing land into projects as equity, the Land Fund improves the overall capital structure and makes the development projects more bankable. It also allows the Land Fund to be positioned as a “Fixed-Income generating Asset,” which appeals to lenders.

What kind of income can the Land Fund generate?

The fund can earn returns through (1) a share in the rental income of completed CRE assets and (2) capital gains from early exits. Over time, it may become a fixed-income vehicle with characteristics similar to core real estate investments.

How is debt servicing handled within this strategy?

Debt servicing is supported by:

Negotiating grace periods or moratoriums in exchange for higher interest rates,

Creating interest service reserves from raised equity and debt funds,

Relying on personal guarantees with capped liabilities, and

Using project-level cash flows once stabilized.

What determines the success of a Land Asset Fund?

Careful selection of underlying CRE projects is critical. The sponsor must assess project type, market cycles, partnerships, execution risks, and investor terms. “If everything has to go smoothly, it requires you to take very well-calculated risks and go only for projects well within your forte.”

What role does the Land Fund play in project capital stacks?

The Land Fund contributes land as quasi-equity into project-specific funds, receiving agreed-upon shares in rents or sales. These distributions are prioritized, which helps in structuring construction loans and provides clear return streams for land investors.

What is the Pinkstone case study and how does it illustrate this strategy?

Pinkstone identified land for three developments—a residential complex, a co-working space, and a logistics warehouse. They structured a Land Asset Fund to acquire these parcels and invest them into the developments. The case shows how strategic land acquisition can attract financing and unlock early value while building a growing asset base.

What are the risks associated with this strategy?

Major risks include delays in breaking ground, holding undeveloped land with accruing interest costs, and misalignment between the sponsor’s roles as both lender (via Land Fund) and borrower (via project funds). As noted, “Sitting over parcels of land without a watertight plan… will only bury you under the mountains of wasteful interest load.”