Preferred Equity

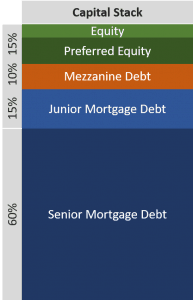

In commercial real estate finance, preferred equity (or pref equity) is a form of capital that sits between debt and common equity in the capital stack. It typically offers investors a fixed return and a priority claim on the property’s cash flows and liquidation proceeds, ahead of common equity but behind debt. Unlike traditional debt, preferred equity doesn’t have a set maturity date and may include participation in the property’s upside beyond the fixed return. It is often used to fill the gap between senior debt and the sponsor’s equity contribution, providing a flexible financing option for real estate transactions.

Preferred Equity is not to be confused with Preferred Return. Pref Equity represents a distinct position within the capital stack with specific rights and priorities while Preferred Return refers to a threshold return that must be paid to certain equity investors before any distributions are made to common equity holders. While Preferred Equity investors have a priority in receiving returns due to their position, Preferred Return is a contractual promise within an equity structure, ensuring that specific investors receive a predetermined return on their investment before the sponsor is eligible to receive a promote/carried interest.

Putting ‘Preferred Equity’ in Context

Scenario Overview:

Wasatch West Alliance, a real estate private equity firm, is evaluating an opportunity to invest in the Gallery at Cottonwood Creek, a 150,000-square-foot grocery-anchored retail center located in a thriving suburban area near Salt Lake City, UT. The center is anchored by a major national grocery chain, which draws a significant amount of foot traffic. Additionally, the property features several inline tenants, including a fitness center, a popular local coffee shop, and a mix of service-oriented businesses.

The Challenge:

The property currently operates at 85% occupancy, with several tenants locked into long-term leases that were signed years ago at below-market rents. The sponsor, a seasoned regional retail operator with a proven track record, has devised a value-add strategy to reposition the asset. The plan includes modernizing the property, enhancing its curb appeal, and negotiating lease renewals or replacing existing tenants with those willing to pay market rents. The sponsor projects that these improvements will increase the property’s occupancy to 95% and align rental rates with the current market within two years.

The Financing Structure:

To finance the acquisition and repositioning of the Gallery at Cottonwood Creek, the sponsor has secured a senior loan covering 60% of the purchase price. However, there remains a 20% gap between the senior debt and the equity the sponsor is willing to contribute. Wasatch West Alliance is considering filling this gap with a $6 million preferred equity investment.

Role of Preferred Equity:

Preferred equity in this context acts as a flexible financing tool that provides Wasatch West Alliance with a fixed return on their investment, typically in the range of 10-12% annually, before the sponsor receives any distribution. Unlike common equity, which shares in the residual profits of the property, the preferred equity investors will have priority over the common equity in receiving cash flows and liquidation proceeds. Additionally, the preferred equity agreement may include provisions for Wasatch West Alliance to participate in the upside of the property’s performance once the fixed return is met, aligning their interests with those of the sponsor.

For example, once the capital improvement plan is successfully executed and the property reaches the projected 95% occupancy with market-rate rents, the increase in Net Operating Income (NOI) will not only cover the debt service but also generate surplus cash flow. As preferred equity investors, Wasatch West Alliance would receive their priority return first. If the property’s value appreciates significantly upon stabilization, Wasatch West Alliance could also benefit from a portion of the profits upon sale, depending on the terms of the preferred equity agreement.

Conclusion:

In this hypothetical scenario, preferred equity allows Wasatch West Alliance to secure a lucrative, relatively low-risk investment position in the capital stack of a promising retail center. The preferred equity investment not only helps bridge the financing gap for the sponsor but also provides Wasatch West Alliance with a structured return and potential upside, making it an attractive option for both parties involved.

Frequently Asked Questions about Preferred Equity in Commercial Real Estate

What is preferred equity in real estate?

Preferred equity is a form of capital that sits between debt and common equity in the capital stack. It offers a fixed return and a priority claim on the property’s cash flows and liquidation proceeds, ahead of common equity but behind debt.

How is preferred equity different from preferred return?

Preferred equity is a specific investment position with rights to receive cash flows before common equity holders. Preferred return is a contractual promise to pay a certain return to equity investors before the sponsor earns a promote. They are distinct concepts.

When is preferred equity typically used in a deal?

Preferred equity is often used to fill the gap between senior debt and the sponsor’s equity contribution. It provides flexible financing without diluting common equity excessively.

What kind of return does preferred equity earn?

Preferred equity typically earns a fixed return, often in the 10–12% range annually, and may also include participation in the upside once the fixed return has been achieved.

Can preferred equity participate in profits?

Yes, preferred equity may include provisions for participating in the upside after the fixed return is paid, aligning interests with the sponsor and common equity holders.

What is the risk profile of preferred equity?

Preferred equity carries more risk than debt (which has collateral and repayment priority) but less risk than common equity. Its fixed return and seniority in distributions offer a favorable risk-adjusted return.

How was preferred equity used in the Cottonwood Creek case?

In the Cottonwood Creek scenario, Wasatch West Alliance invested $6 million in preferred equity to fill the gap between senior debt (60%) and the sponsor’s contribution. They received priority distributions and potential upside upon stabilization and sale.

Click here to get this CRE Glossary in an eBook (PDF) format.