Phase II (ESA)

When the preliminary ESA exposes recognized environmental conditions (RECs), buyers will often require a Phase II ESA to provide a broader assessment of the property. A Phase II ESA includes a subsurface investigation, which tests soil, soil gas, and groundwater to reveal the source of any RECs. Of particular concern is the presence of petroleum products and other hazardous materials that may be on the site.

Putting “Phase II ESA” in Context

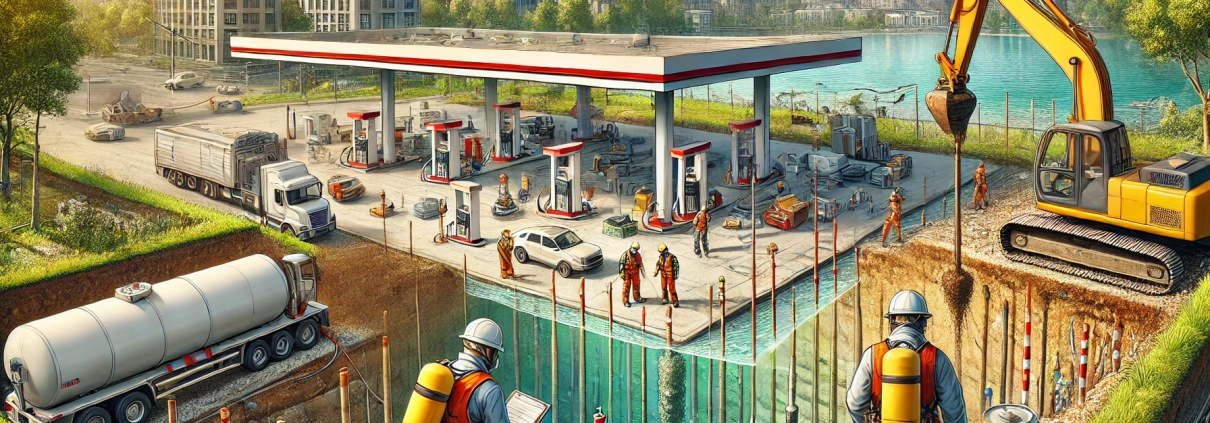

Apex Realty Partners, a real estate investment firm specializing in single-tenant net lease properties, was in the process of acquiring a gas station site in Chicago, IL. The property, named Lakeside Service Station, was intended to be leased to 7-Eleven on a 15-year absolute net lease, offering a stable income stream with a creditworthy tenant. The 0.75-acre site, located in a busy urban neighborhood near Lake Michigan, had historically operated as a gas station since the 1960s.

As part of its due diligence, Apex engaged an environmental consultant to conduct a Phase I Environmental Site Assessment (ESA). The Phase I ESA identified a Recognized Environmental Condition (REC) due to the site’s historical use as a gas station, including the operation of underground storage tanks (USTs). Records indicated that USTs had been removed in the early 2000s, but the lack of documentation regarding proper remediation raised concerns about potential contamination.

To address these risks, Apex commissioned a Phase II Environmental Site Assessment.

Phase II ESA Investigation

The Phase II ESA involved a detailed subsurface investigation:

- Soil Sampling: Multiple soil borings were performed near the areas of the former USTs. Samples were tested for Total Petroleum Hydrocarbons (TPH) and benzene, toluene, ethylbenzene, and xylene (BTEX compounds).

- Soil Gas Testing: Vapor monitoring wells were installed to evaluate the potential for vapor intrusion risks from volatile organic compounds (VOCs).

- Groundwater Testing: Groundwater monitoring wells were drilled to assess contamination from petroleum products or other hazardous substances.

Results and Decision

The Phase II ESA results revealed elevated levels of petroleum hydrocarbons in the soil, exceeding regulatory thresholds set by the Illinois Environmental Protection Agency (IEPA). Additionally, groundwater testing confirmed contamination that would require significant remediation efforts. The consultant estimated that remediation costs could reach $1.5 million and could take up to two years to complete, delaying the project timeline and significantly increasing Apex’s investment risk.

Faced with these findings, Apex Realty Partners opted not to proceed with the acquisition. The decision was based on:

- High Remediation Costs: The estimated $1.5 million remediation expense would erode the investment’s profitability.

- Timeline Delays: The two-year remediation timeline conflicted with Apex’s strategy to secure immediate cash flow from the lease to 7-Eleven.

- Ongoing Risk: Even with remediation, uncertainties regarding future regulatory compliance and potential environmental liabilities posed unacceptable risks.

Key Takeaways

- The Phase II ESA serves as a critical tool to uncover environmental issues that could severely impact a property’s financial viability and usability.

- Elevated contamination levels can significantly increase costs and timelines, making some deals infeasible for investors.

- By choosing not to proceed with the acquisition, Apex Realty Partners avoided substantial financial and operational risks, demonstrating the importance of thorough due diligence in protecting investors and stakeholders.

This case underscores the value of environmental assessments in identifying and quantifying risks before committing to a transaction. While the property’s location and lease terms were initially attractive, the environmental liabilities rendered it unsuitable for Apex’s investment criteria.

Click here to get this CRE Glossary in an eBook (PDF) format.