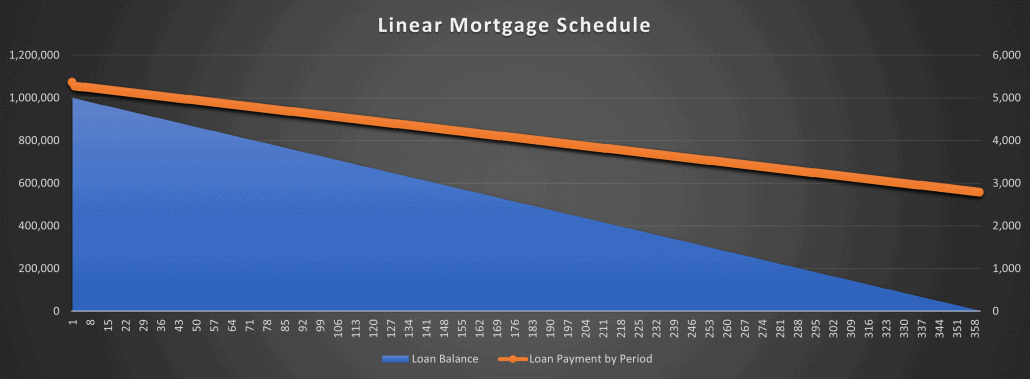

Linear Mortgage

A mortgage loan where the amount of principal due in each period is static. As a result, the loan payment due in each period decreases over time as the amount of interest due decreases and the principal due stays the same. The loan balance likewise decreases in a straight-line (i.e. linear) fashion over the loan term.

Putting “Linear Mortgage” in Context

Scenario Overview

Thames Square Partners, a real estate investment firm, has recently acquired Fleet Street Tower, a 150,000-square-foot Class A office building in the heart of London’s core business district. The property was purchased for £75 million, and the firm secured a £50 million linear mortgage to finance the acquisition. This financing strategy was chosen for its predictable amortization schedule and declining payment structure, which aligns well with the building’s stable rental income.

Loan Structure

The linear mortgage has a 20-year term with a fixed annual interest rate of 5%. Under this structure, the principal repayment is the same each year, while the interest component decreases over time as the outstanding loan balance is reduced. This results in lower total payments as the loan matures.

- Annual Principal Payment: £50,000,000 ÷ 20 = £2,500,000 per year

- Initial Annual Interest Payment: 5% × £50,000,000 = £2,500,000

- Initial Total Annual Payment: £2,500,000 (principal) + £2,500,000 (interest) = £5,000,000

- Final Year Total Payment: £2,500,000 (principal) + £125,000 (interest on remaining £2,500,000 balance) = £2,625,000

Contextual Relevance

This structure benefits Thames Square Partners because the declining payments free up cash flow over time. Early on, when the payments are highest, the building’s NOI (net operating income) is projected to comfortably cover the £5 million payment with a debt service coverage ratio (DSCR) of 1.8x. As rental income increases with annual lease escalations, the reduced debt burden further enhances cash flow available for distributions or reinvestment.

The straight-line reduction in the loan balance also means that Thames Square Partners will benefit from steadily increasing equity in Fleet Street Tower, potentially providing more refinancing or exit options in the future.

Hypothetical Example of First Three Years’ Payments

- Year 1:

- Principal Payment: £2,500,000

- Interest Payment: £2,500,000

- Total Payment: £5,000,000

- Remaining Balance: £47,500,000

- Year 2:

- Principal Payment: £2,500,000

- Interest Payment: £2,375,000 (5% of £47,500,000)

- Total Payment: £4,875,000

- Remaining Balance: £45,000,000

- Year 3:

- Principal Payment: £2,500,000

- Interest Payment: £2,250,000 (5% of £45,000,000)

- Total Payment: £4,750,000

- Remaining Balance: £42,500,000

Conclusion

This hypothetical case demonstrates how a linear mortgage can be a strategic choice for an investor like Thames Square Partners, particularly in a core asset with stable cash flow. The predictable decline in payments provides financial flexibility while ensuring steady equity growth in the property.

Frequently Asked Questions about Linear Mortgages

What is a linear mortgage?

A linear mortgage is a loan structure where the principal repayment amount remains constant each period. As interest is calculated on the decreasing loan balance, total payments decline over time.

How does a linear mortgage differ from an amortizing loan with level payments?

In a linear mortgage, principal payments are fixed and interest payments decline, leading to decreasing total payments. In a level-payment loan (like an annuity), total payments remain the same, but the interest/principal ratio shifts over time.

What are the financial advantages of using a linear mortgage?

Linear mortgages provide declining payment obligations, which free up cash flow over time. This can benefit investors by improving debt service coverage and increasing equity steadily through straight-line principal reductions.

Can you provide an example of linear mortgage payments over time?

Yes. In Year 1 of a £50 million loan at 5% interest and 20-year term, the payment would be £5,000,000 (£2.5M principal + £2.5M interest). In Year 2, interest drops to £2.375M, making the total payment £4.875M. This continues annually as interest declines.

Why might an investor choose a linear mortgage for a commercial property?

An investor may choose a linear mortgage for its predictable principal reduction and declining payment profile. It supports long-term planning, growing equity, and increasing flexibility as the investment matures, especially when backed by stable income.

What risks or considerations come with linear mortgages?

Initial payments in a linear mortgage are higher than in other structures, which may stress early cash flow. Also, refinancing early may be less beneficial since significant principal is paid upfront. Alignment with income projections is critical.

Click here to get this CRE Glossary in an eBook (PDF) format.