Easement

An easement gives an individual or entity the legal right to use or access the property owned by some other individual or entity. Common instances for easements grant public access for roads or access to utility companies to install or maintain gas and power lines or other cables running through the property.

Putting “Easement” in Context

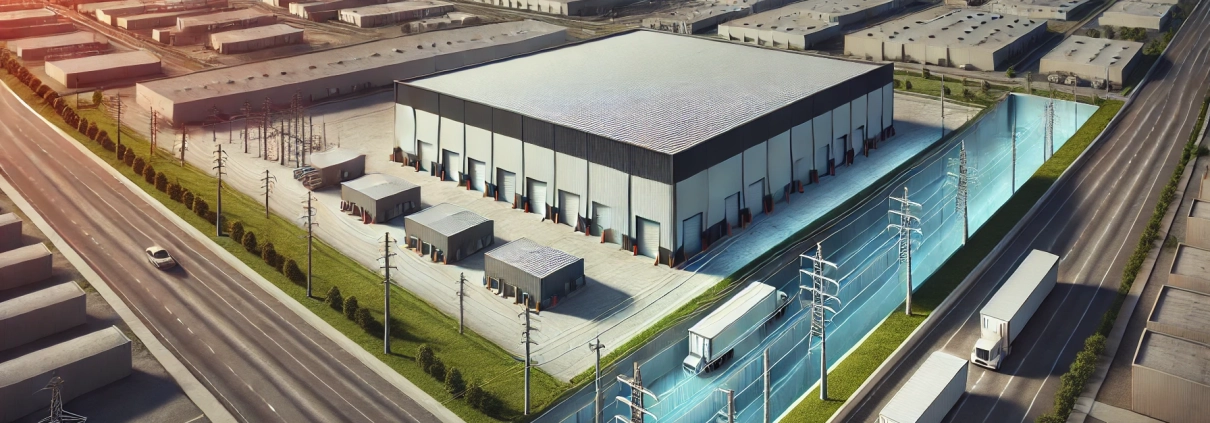

Gulf Shore Capital, a real estate private equity firm based in Texas, is evaluating the acquisition of Coastal Bend Logistics Center, a 150,000-square-foot warehouse/distribution facility located in Corpus Christi, TX. As an acquisitions associate at the firm, you are tasked with analyzing the property’s characteristics, potential risks, and legal encumbrances before making a final recommendation on whether to proceed with the deal.

During the due diligence process, you discover that the property includes a utility easement running along the southern boundary. This easement grants a local utility company the legal right to access a portion of the property to maintain and repair underground power lines that serve neighboring properties. The easement covers approximately 10 feet in width and spans the full length of the southern edge, totaling about 1,000 linear feet.

Understanding the Easement’s Impact on the Property

From a financial standpoint, the easement itself doesn’t directly reduce the building’s leasable square footage since it lies outside the main warehouse area. However, it does affect the site’s usability in a few key ways:

- Land Use Restrictions: The easement restricts Gulf Shore Capital from building on or making any permanent improvements within the 10-foot-wide strip. While the warehouse and parking lots are not affected, the area with the easement cannot be used for future expansion or additional site development.

- Access for Maintenance: The utility company retains the right to access the easement at any time to perform maintenance or repairs. This could lead to temporary disruptions to the property’s operations if heavy equipment or vehicles need to be brought in.

- Liability Considerations: As the new owner, Gulf Shore Capital would be responsible for ensuring that no activities on the property interfere with the utility company’s ability to access and maintain the easement area.

Evaluating the Risk

Given that the easement is clearly defined and located along the periphery of the site, its presence represents a low-risk factor in the acquisition. The primary concern is the restriction on future development within the easement zone, but this should have minimal impact on the current investment strategy. The property’s current use as a logistics center remains highly functional, and the presence of the easement does not significantly hinder its operations. However, Gulf Shore Capital would need to disclose the easement to any future tenants and include language in lease agreements that ensures the easement is respected.

Conclusion

In this hypothetical scenario, the easement on the Coastal Bend Logistics Center property highlights a common issue that investors encounter when acquiring commercial real estate. Although the easement limits the land’s potential for future expansion and may cause occasional operational disruptions, it does not materially impact the property’s current use as a warehouse and distribution facility. Gulf Shore Capital should factor in these considerations but can likely proceed with the acquisition without significant concern regarding the easement’s impact on value or operations.

Frequently Asked Questions about Easements in Commercial Real Estate

What is an easement in commercial real estate?

An easement gives an individual or entity the legal right to use or access the property owned by someone else. Common examples include easements for roads or utility companies to install or maintain infrastructure.

How can an easement impact property development?

Easements can restrict the property owner from building on or making permanent improvements within the easement area. In the example provided, “the easement restricts Gulf Shore Capital from building on or making any permanent improvements within the 10-foot-wide strip.”

Does an easement affect property operations?

Yes, utility companies or other easement holders “retain the right to access the easement at any time to perform maintenance or repairs,” which may lead to temporary operational disruptions.

Does an easement reduce a property’s leasable area?

Not necessarily. In the provided case, the easement “doesn’t directly reduce the building’s leasable square footage since it lies outside the main warehouse area.”

Should tenants be informed of existing easements?

Yes. Gulf Shore Capital “would need to disclose the easement to any future tenants and include language in lease agreements that ensures the easement is respected.”

Is an easement always a high-risk factor for acquisition?

No. In this case, the easement “represents a low-risk factor in the acquisition,” since it’s clearly defined, does not affect current operations, and is located at the edge of the property.

Who is responsible for maintaining easement access?

The property owner must ensure that “no activities on the property interfere with the utility company’s ability to access and maintain the easement area.”

Click here to get this CRE Glossary in an eBook (PDF) format.