Exploring Latin America’s Real Estate Markets: Colombia

Latin America’s real estate markets are as diverse as its economies, influenced by factors like economic cycles, supply and demand dynamics, and shifting political landscapes. While some may see these conditions as risky, Colombia Real Estate investment offers strong opportunities for portfolio diversification and access to high-growth markets.

From fast-growing urban centers to emerging secondary cities, the region presents challenges and potential for investors, developers, and real estate professionals.

Introducing our new series, ‘Exploring Real Estate Markets,’ where we analyze key Latin American real estate markets, uncovering trends, risks, and opportunities in the region. As part of this series, we take an in-depth look at Colombia Real Estate Investment, examining the macroeconomic forces, sector performance, and foreign capital flows shaping the country’s real estate sector.

Our first stop: Colombia, one of Latin America’s fastest-growing real estate markets. This article explores the Colombia Real Estate Investment landscape, covering economic conditions, market dynamics, and the latest real estate developments.

Note from Spencer and Michael: This is another post in a growing series that we call ‘International CRE’. Written by CRE professionals based outside of the United States, this series is a collection of deep dives into various CRE topics relevant to real estate professionals all over the world. One of the reasons we love the International CRE series is that things are not done the same in one country to the next, and this series highlights those differing perspectives.

This particular post is written by our team member, Emilio Tovar, based in Bogotá, Colombia.

The Current Economic Climate and Its Impact on the Colombia Real Estate Market

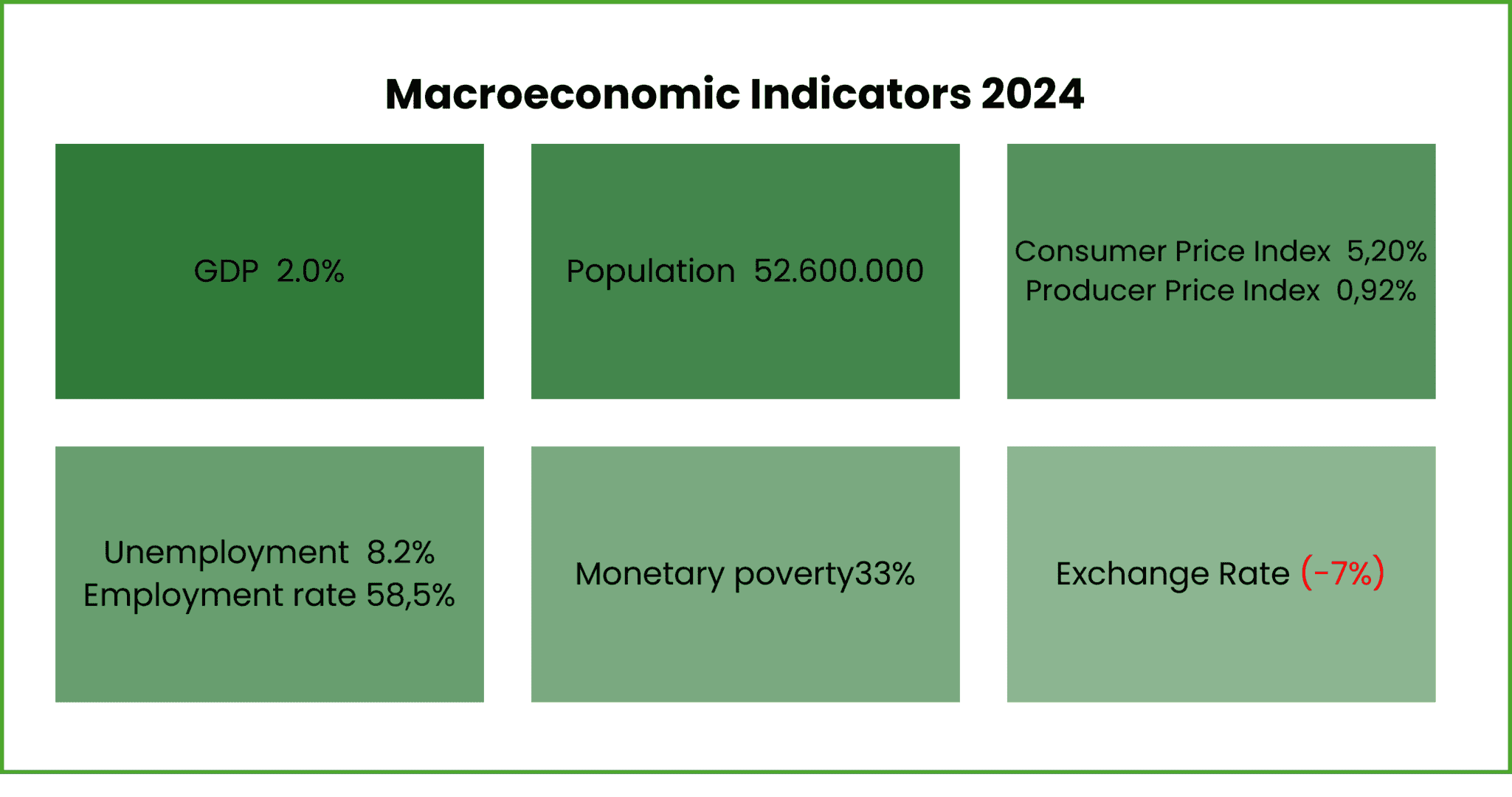

The Colombian real estate market presents a combination of opportunities and challenges, determined by moderate GDP growth (2.0%), controlled but persistent inflation (5.2%) and currency depreciation of 7%, which makes the market more attractive to foreign investors, while increasing the costs of new developments.

The unemployment rate of 8.2% and the poverty level of 33% indicate affordability issues, suggesting increased demand for rental properties and affordable housing initiatives rather than widespread home acquisition.

Meanwhile, a stable employment rate (58.5%) supports urban rental markets, especially in economically resilient cities such as Bogotá and Medellín. With inflation contained and currency depreciation favoring foreign capital, foreign investment and rental-driven real estate projects appear to be the most promising segments, although investors should remain cautious in the face of economic volatility and potential policy changes.

Fiscal policy: The nation is facing a substantial fiscal deficit, with reports indicating a deficit of more than 21 trillion pesos in 2024 ($4.98 billion USD. To address this situation, the government has proposed a tax reform aimed at generating an additional 12 trillion pesos to finance the 2025 budget. However, this proposal was recently rejected by lawmakers, complicating efforts to balance public finances. The Autonomous Committee on Fiscal Rule (CARF) estimates that an adjustment of approximately 52 trillion pesos (2.9% of GDP) in 2025 is necessary to comply with fiscal rules.

International trade: Colombia’s international trade results in 2024 reflect moderate export growth of 5%, driven by energy products (55%) and agricultural goods (15%), while imports reached $50.2 billion, resulting in a trade deficit of $4.4 billion.

The United States (28% of exports, 32% of imports) remains Colombia’s main trading partner, followed by China (18% of imports) and the European Union (15% of exports). Despite heavy dependence on imports of oil, coal, and machinery, the government actively pursues market diversification and non-traditional exports to reduce dependence on volatile commodity markets and improve industrial competitiveness.

Monetary policy: The Bank of the Republic (Central Bank) maintains a strategy focused on keeping inflation low and stable while achieving production levels close to the country’s potential. Recent data indicate a decrease in inflation from 13.3% to 5.21%, which has led the bank to reduce the benchmark interest rate to 9.25%. Despite these positive trends, the bank remains cautious due to global economic uncertainties and domestic fiscal challenges.

These fiscal and monetary policies directly impact investment in the Colombia real estate market, influencing both local and foreign investment. Fiscal challenges, such as a 21 trillion-peso deficit and possible tax hikes, could slow new developments by reducing liquidity for developers, although infrastructure spending could boost demand for industrial and logistics properties.

The Government’s business strategy, focused on reducing dependence on imports and diversifying export markets, is driving the growth of the industrial real estate sector, especially in logistics centers and free-tax zones.

Overall, Colombia’s economic outlook presents opportunities in the industrial, logistics, and foreign-investor-driven real estate sectors, while the residential and commercial markets remain sensitive to macroeconomic fluctuations.

Keys to the Colombian real estate market sector and statistics

New Home Price Index (IPVN)

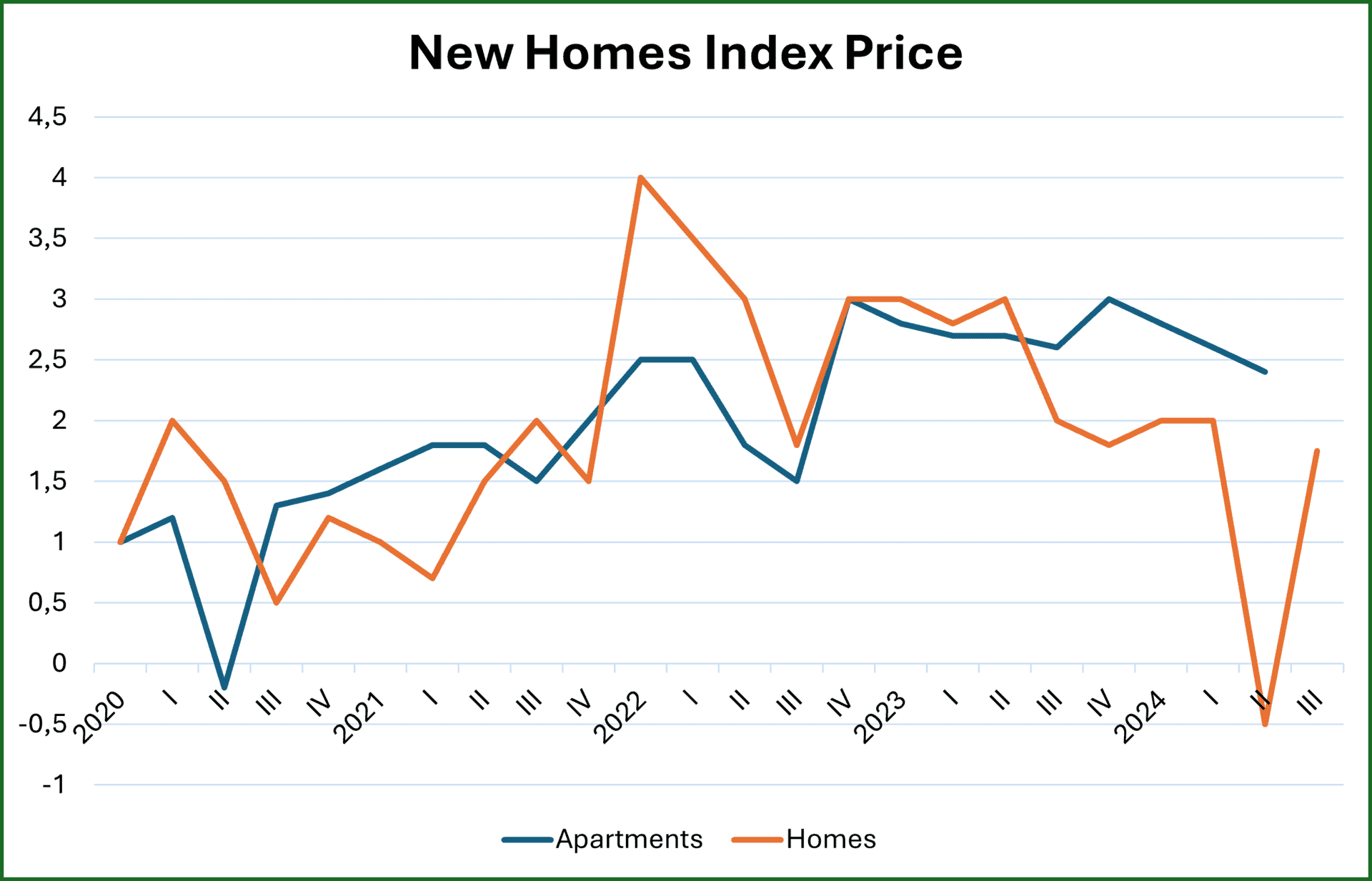

The New Housing Price Index (IPVN), published by Colombia’s National Administrative Department of Statistics (DANE), records price variations in new residential properties, both apartments and houses.

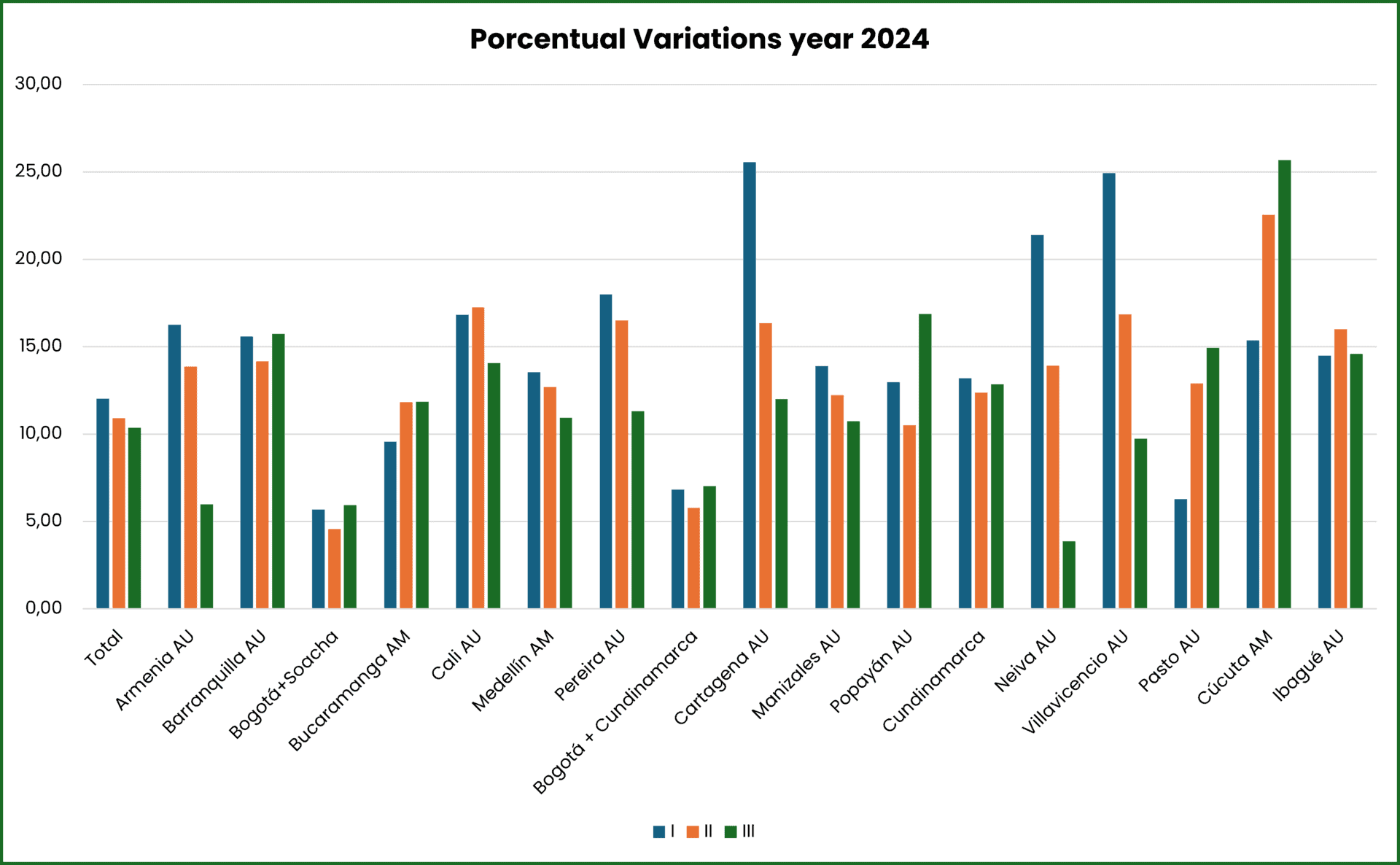

In the third quarter of 2024, the IPVN recorded an increase of 2.37% compared to the previous quarter, which is 0.50 percentage points less than the 2.87% growth observed in the same period of the previous year.

Breaking down by property type, apartment prices increased by 2.40%, while home prices saw a 1.75% increase during this quarter.

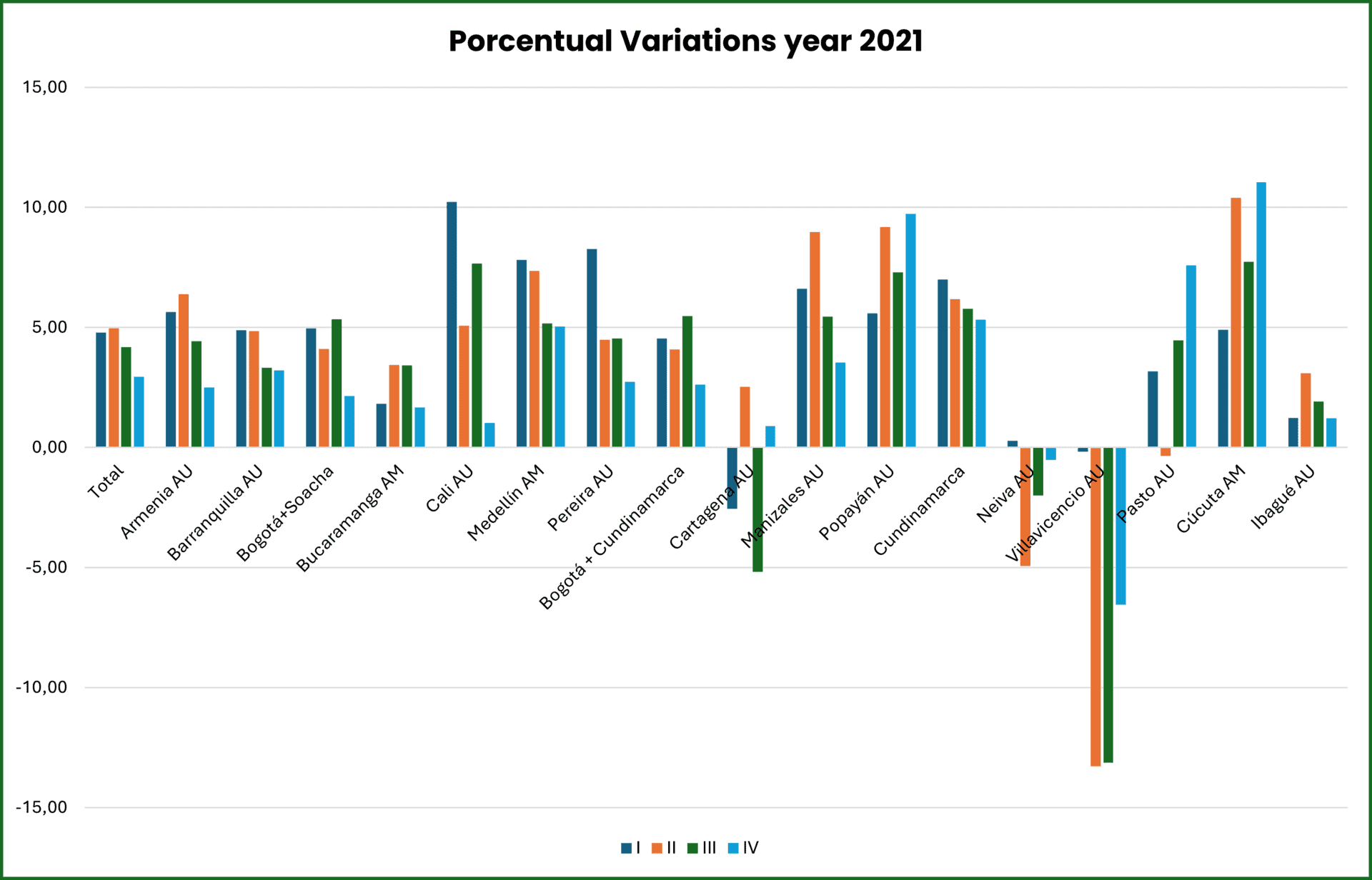

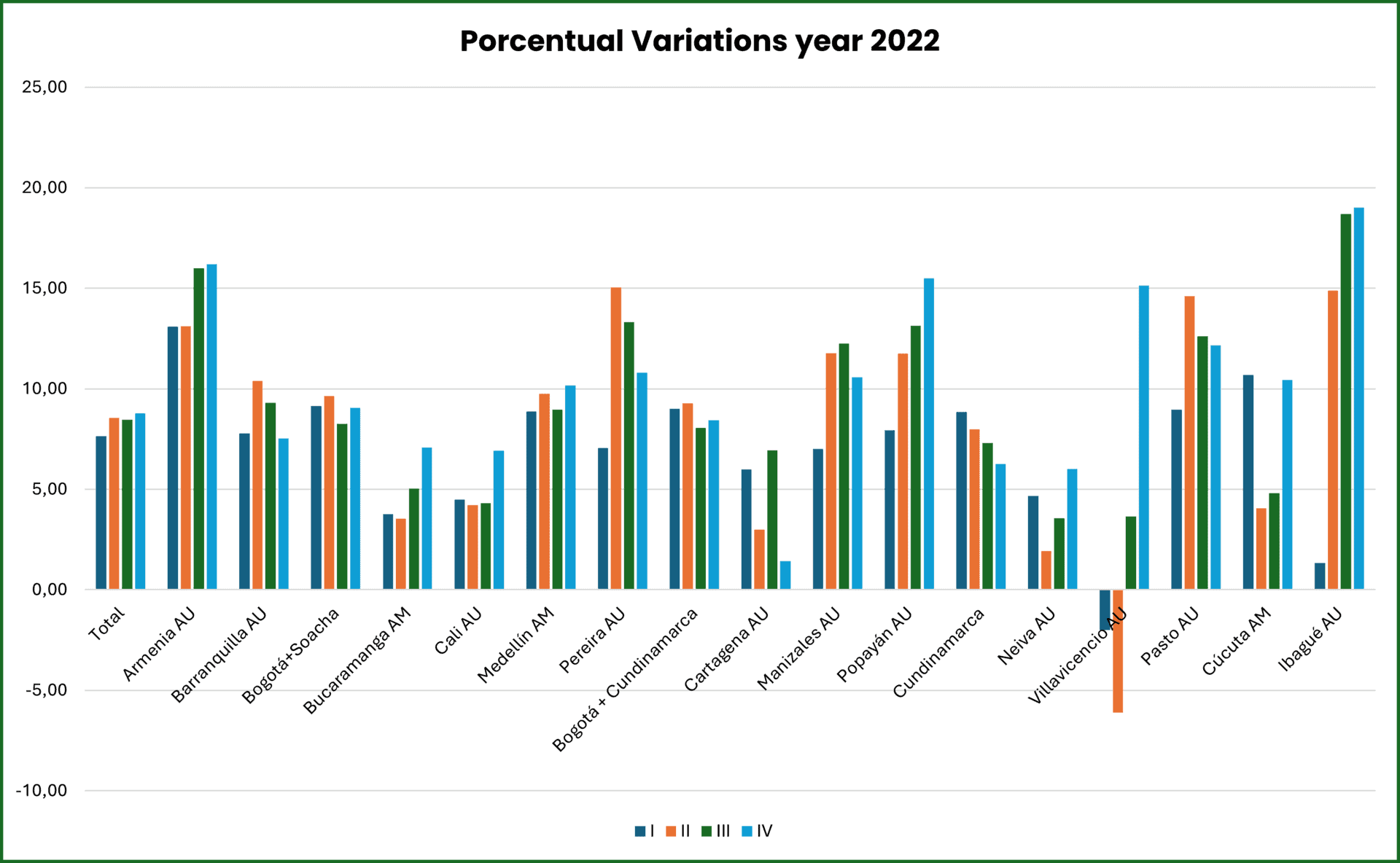

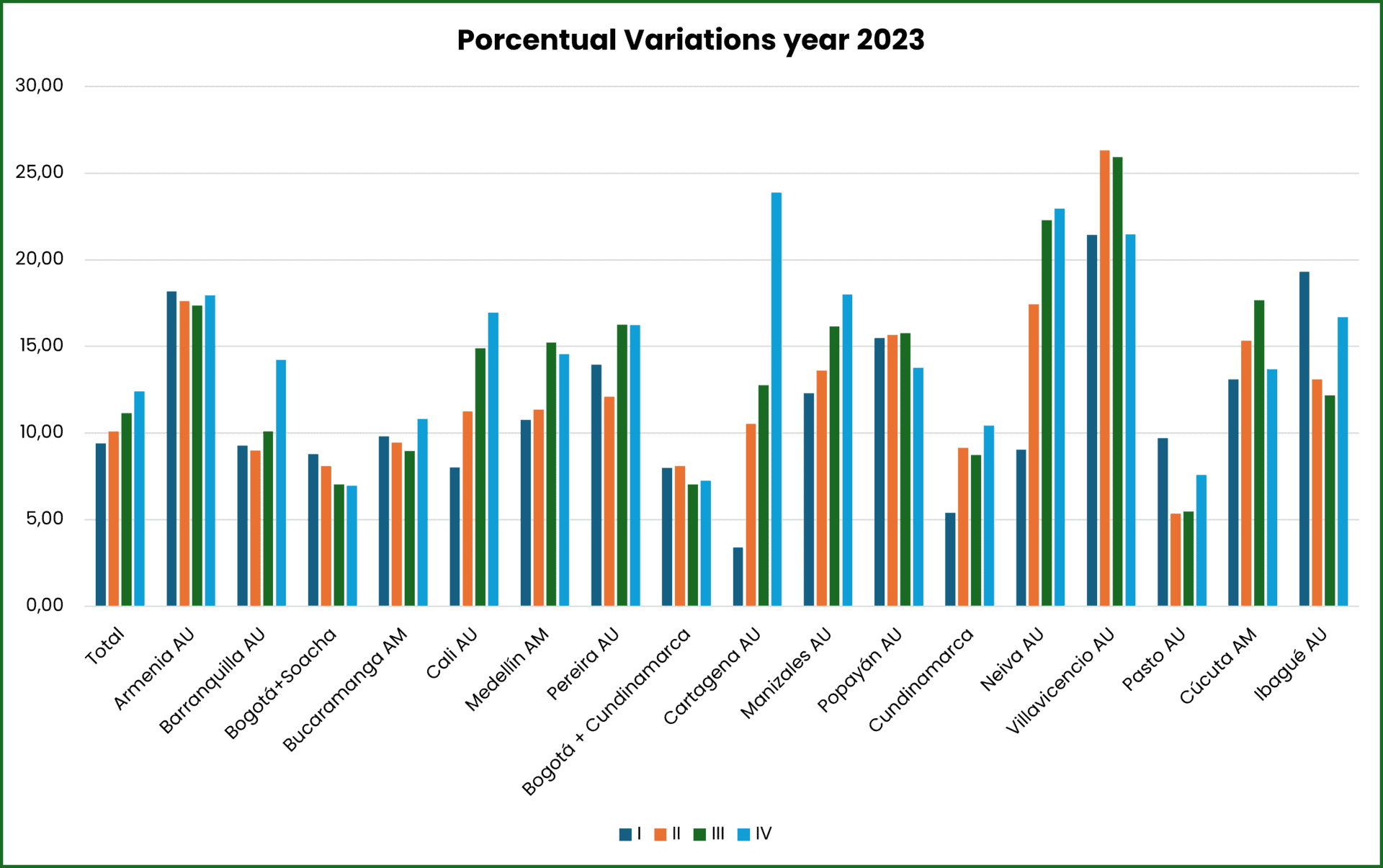

In recent years, the IPVN has shown a consistent upward trend:

- 2020: The annual variation ranged between 2.95% and 4.96%.

- 2021: Annual increases ranged from 3.19% to 6.76%.

- 2022: The index experienced growth between 7.65% and 8.78%.

- 2023: In the first quarter there was an increase of 2.98% compared to the previous quarter, with an annual increase of 9.39% compared to the same quarter of 2022.

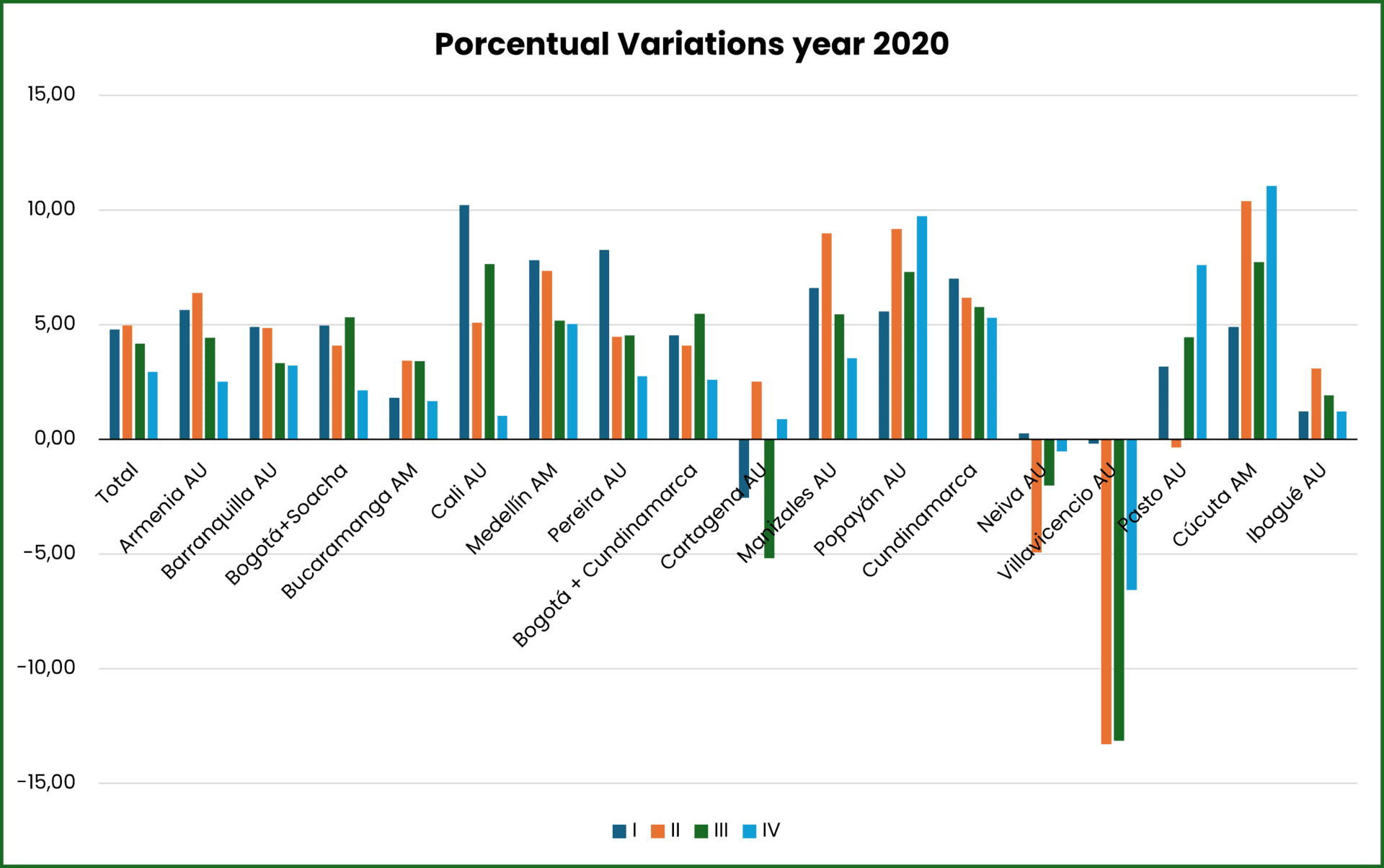

Graphs: New Housing Price Index (IPVN) in variations by urban and metropolitan areas.

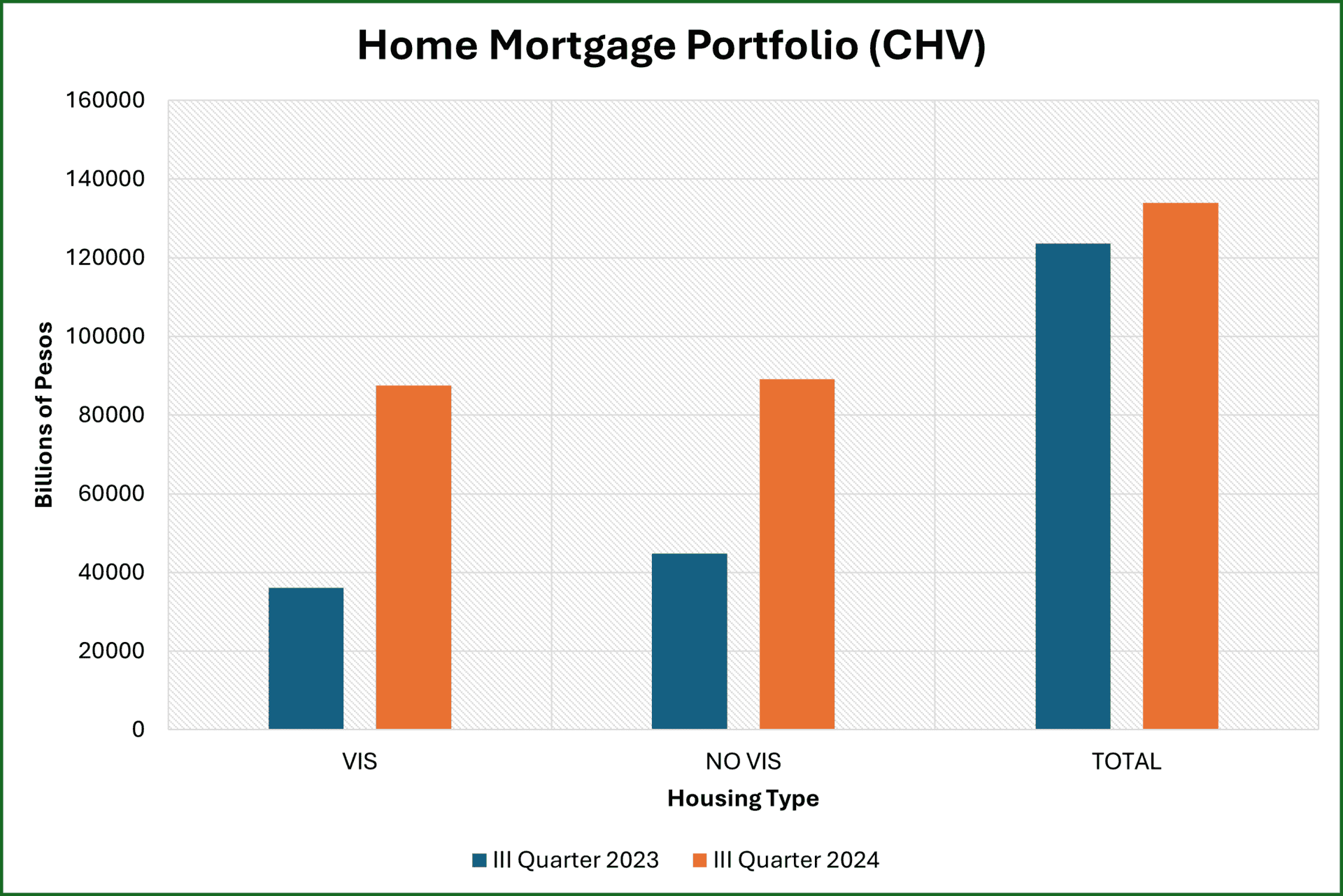

Home Mortgage Portfolio (CVH)

The mortgage portfolio reflects the health of the housing credit markets. Recent data indicate a stable but prudent credit environment, in which financial institutions maintain strict lending criteria. This prudent attitude ensures the quality of the portfolio but may limit access to credit for certain segments of borrowers.

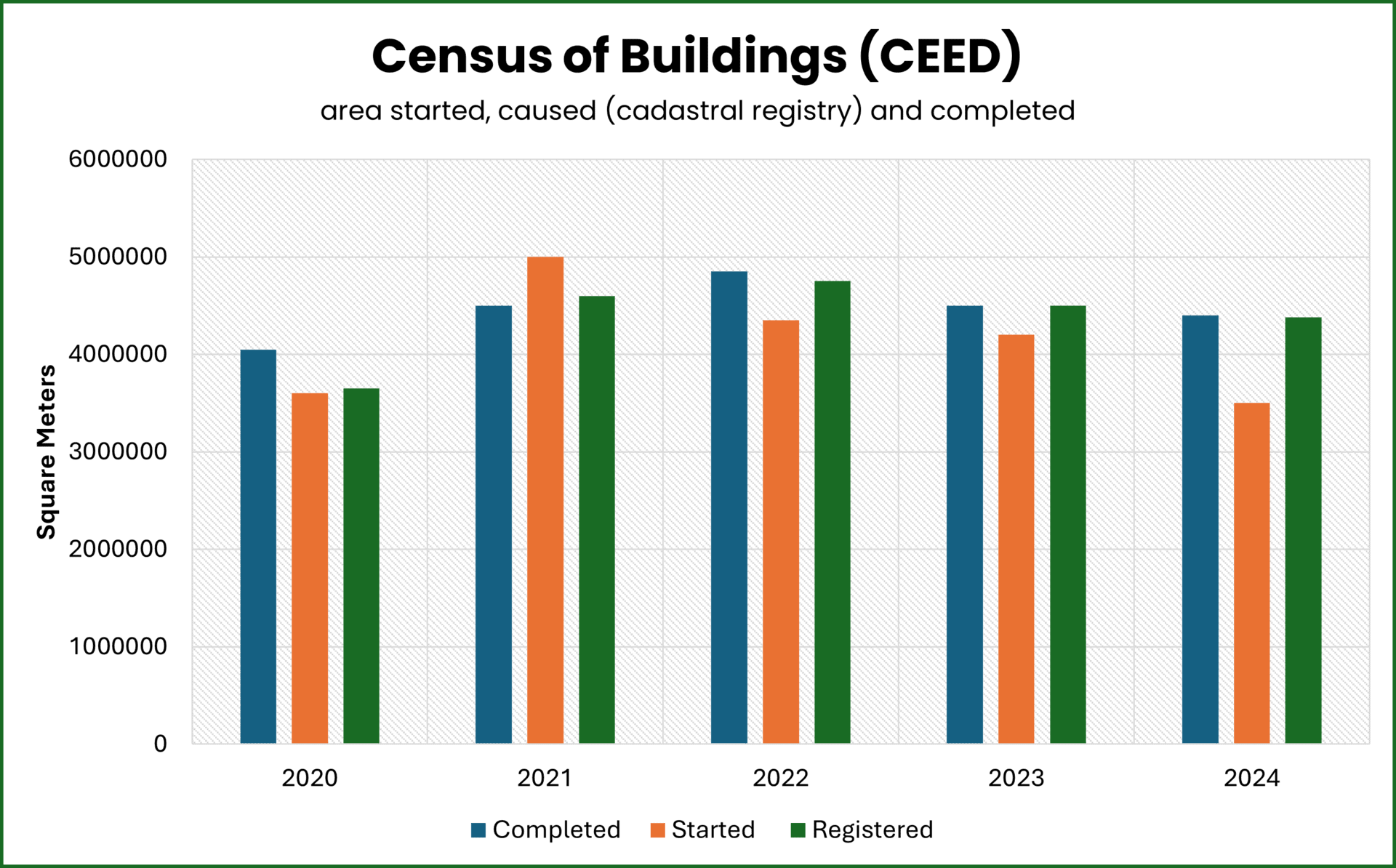

Census of Buildings (CEED)

The construction census provides a comprehensive view of construction activities across the country. Recent data indicate a concentration of new construction in urban centres, with a particular focus on residential and mixed-use projects. This city-centric growth reflects ongoing urbanization trends and demand for housing and commercial space in large cities.

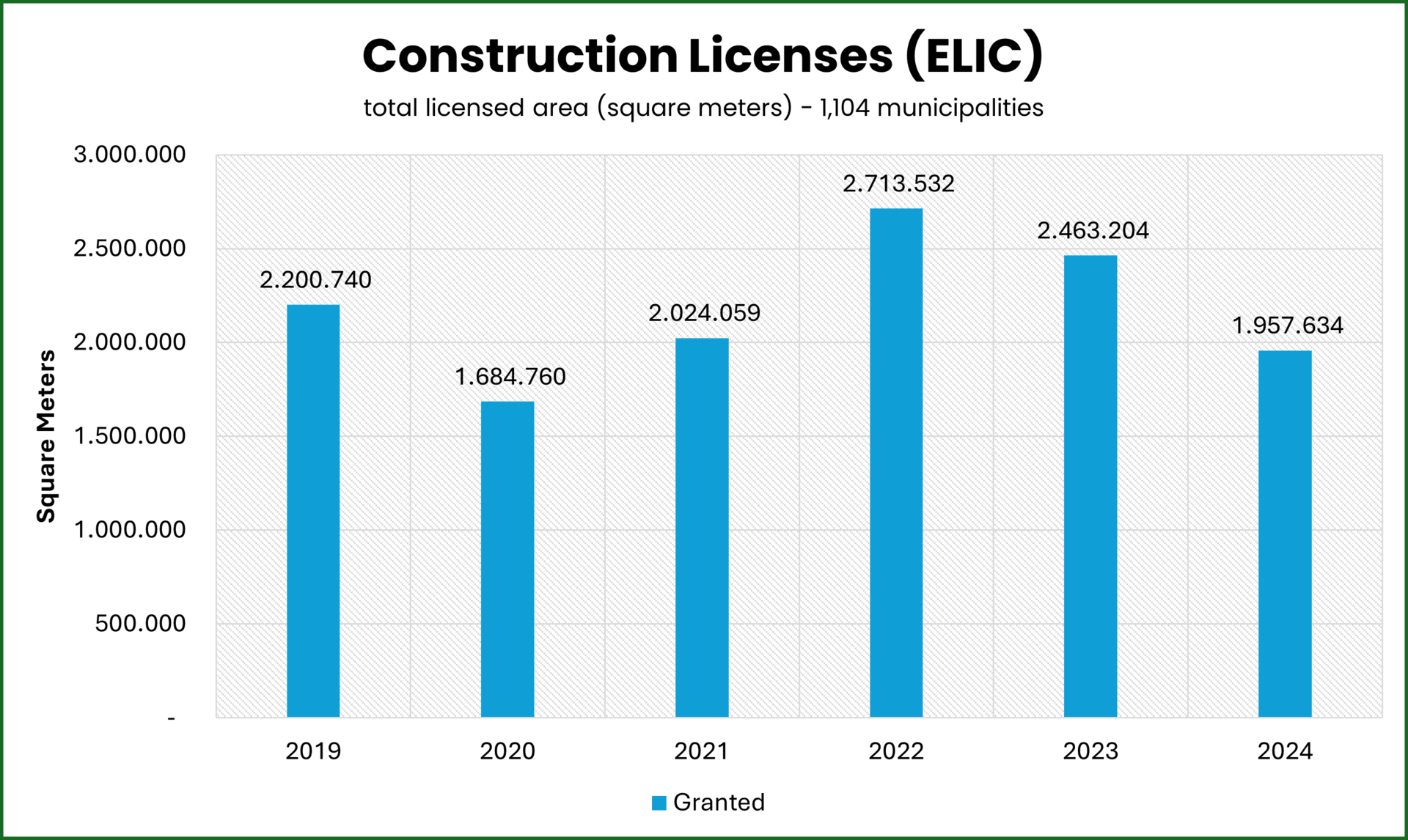

Construction License Statistics (ELIC)

Construction licenses are a leading indicator of future construction activity. The latest reports show a fluctuation in the number of licences granted, with variations between different regions and building types. These trends suggest a cautious approach on the part of developers, possibly due to economic uncertainties and changes in market demand.

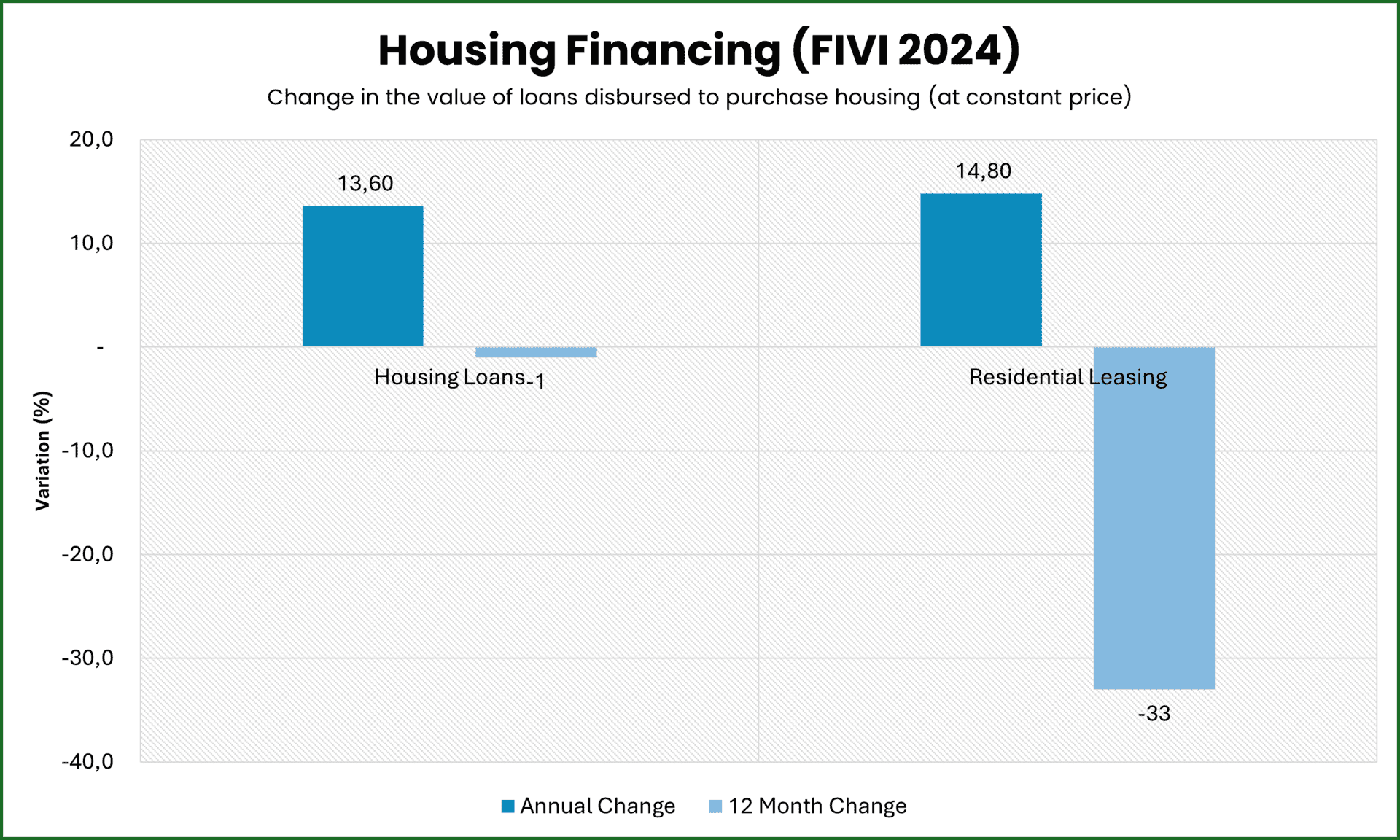

Housing Finance (FIVI)

Housing finance trends reveal changes in mortgage lending and affordability. Recent statistics show a decline in home sales, especially in the social interest housing segment, which decreased by 49.7% in 2023. This decline is attributed to factors such as economic conditions and political changes, including the suspension of the Mi Casa Ya subsidy program due to fiscal constraints. The suspension has significant implications for prospective homeowners and the construction industry, highlighting the need for sustainable housing finance solutions.

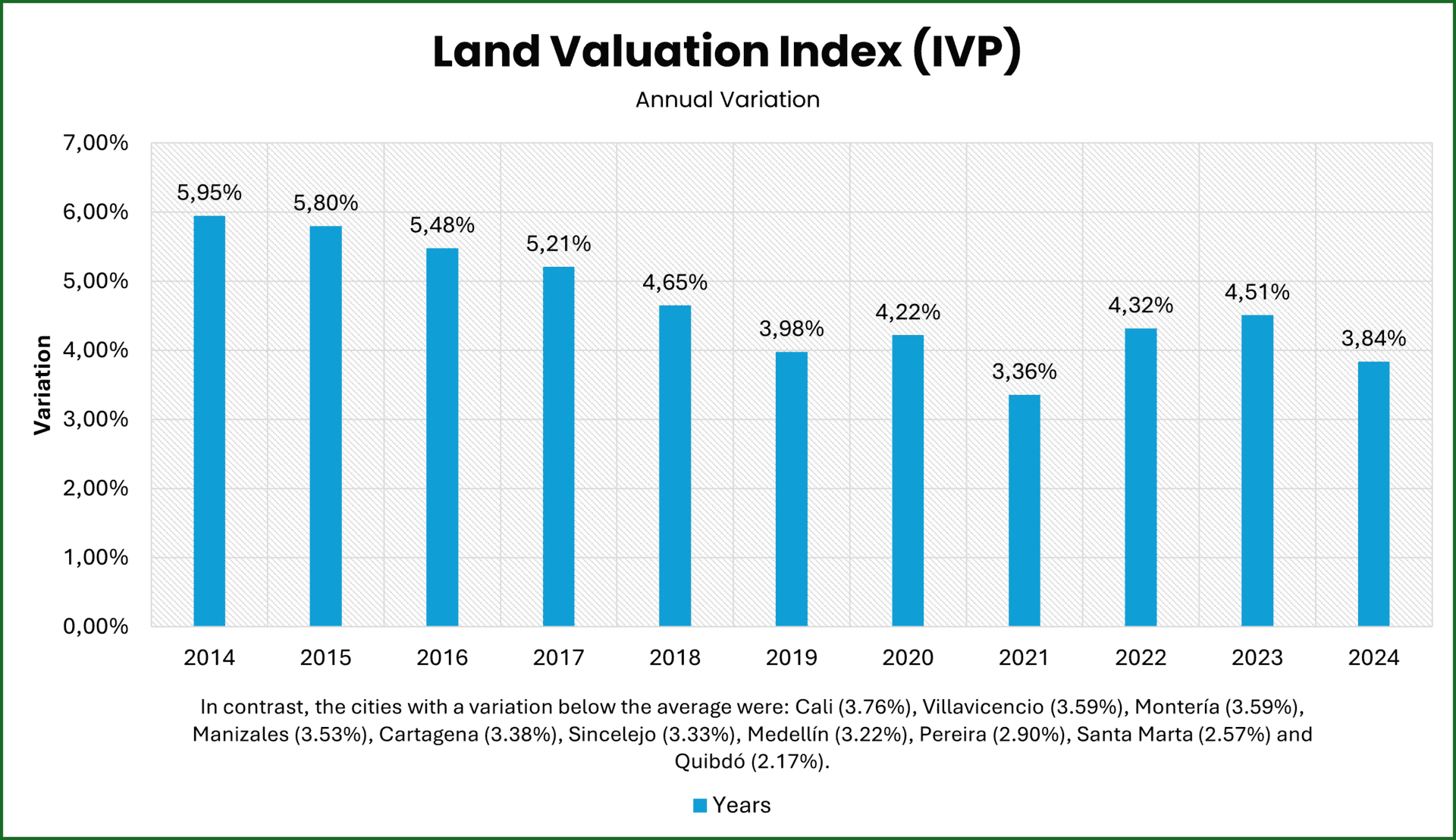

Land Valuation Index (IVP)

The Property Valuation Index (IVP) is an indicator developed by the National Administrative Department of Statistics (DANE) to measure the average percentage variation in the prices of urban properties for housing in Colombia, excluding Bogotá. This index is calculated from commercial appraisals of a representative sample of properties in 22 capital cities of the country.

According to DANE’s technical bulletin, in 2022, the IVP registered an annual variation of 4.31% at the national level, evidencing an acceleration in the increase in property values compared to the 3.36% reported in 2021. This behavior suggests an upward trend in residential real estate prices in the country’s main cities.

Foreign Investment Trends in the Colombia Real Estate Market

Colombia’s extensive network of 17 trade agreements with various countries and regions, including the United States, the European Union, and South Korea, has significantly increased its attractiveness to foreign investors by facilitating market access and reducing trade barriers.

The country’s investor-friendly legal framework ensures equal treatment for foreign and domestic investors in the Colombia real estate market, allowing foreigners to buy, own and sell property without restrictions. This opening has made sectors such as hospitality and industrial real estate particularly attractive. The hospitality sector benefits from Colombia’s growing tourism industry, while the development of free-tax zones and improved export infrastructures have increased demand for industrial parks, logistics centers, and warehouses.

However, foreign investors face challenges such as currency volatility, which can affect investment returns, and the need to navigate complex regulatory environments. Recent policy changes, such as imposing a 35% tariff on steel imports from countries without trade agreements, are intended to protect local industries, but may increase construction costs, which would impact real estate development.

In addition, proposed financial regulations requiring banks to allocate a portion of their loans to specific sectors could have an impact on the availability of financing for real estate projects.

Despite these challenges, Colombia’s strategic trade agreements and investment support laws continue to make this country an attractive destination for foreign investment in the real estate sector.

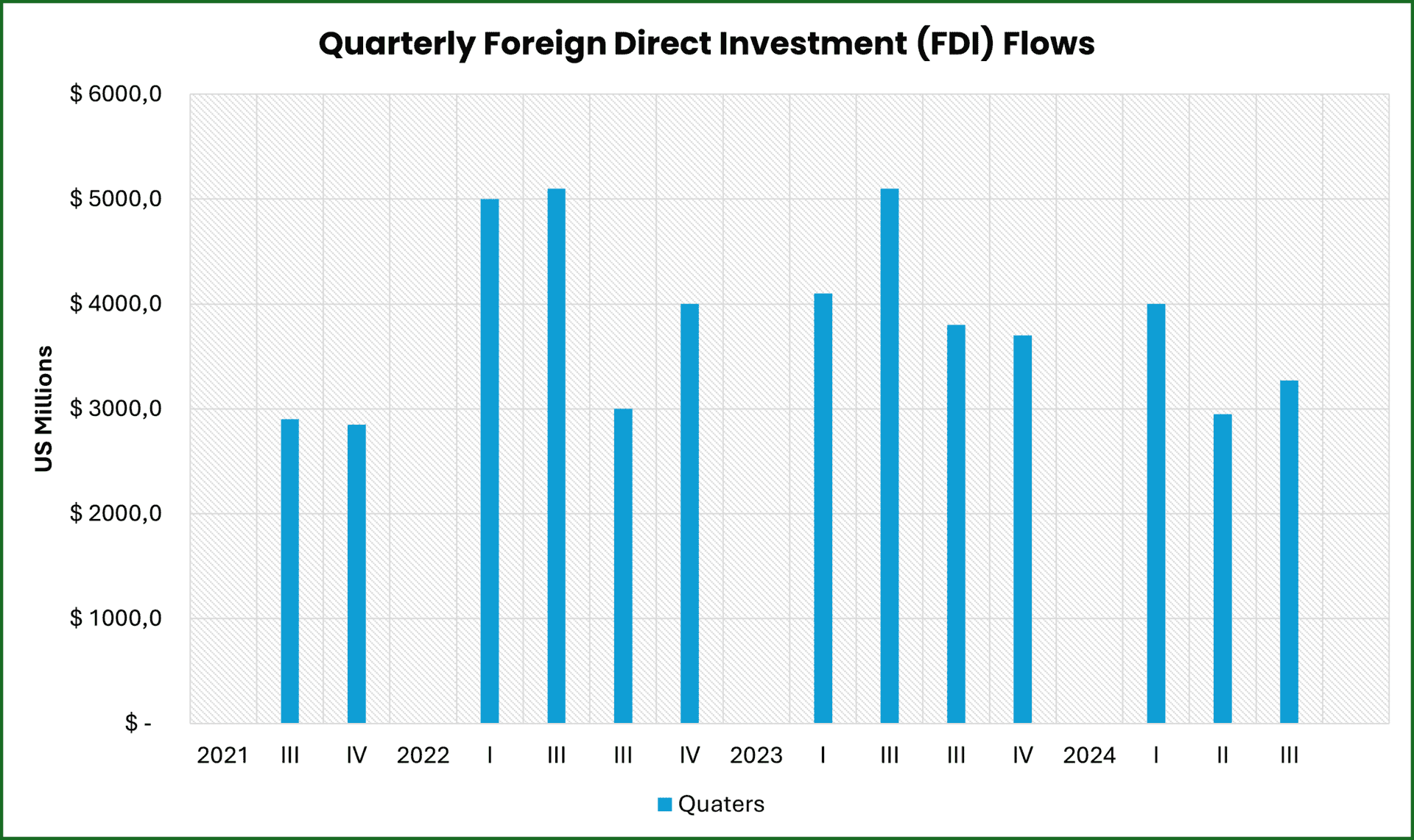

According to figures from the Ministry of Commerce, Industry and Tourism (MINCIT), Foreign Direct Investment (FDI) in Colombia reached US$17,446 million in 2023, which represents an increase of 1.5% compared to the previous year. Of this total, 65.6% was allocated to non-mining-energy sectors, evidencing a diversification of investment towards other areas of the economy.

Significant growth in the manufacturing industry stands out, which received US$3,086 million, an increase of 104.6% compared to 2022. Likewise, the commerce, hotel and restaurants sectors captured US$1,709 million, increasing by 10.8% compared to the previous year.

Foreign Direct Investment in the Construction Sector

In 2024, Colombia experienced an 18.32% contraction in Foreign Direct Investment (FDI), accumulating USD $9,979 million through November, compared to USD $12,217 million in the same period in 2023.

Despite this decline, the construction sector remains an economic pillar, accounting for 5.1% of Gross Domestic Product (GDP) and 3.4% of total FDI inflows. With an estimated value of USD $52,900 million, a compound annual growth rate of 10.1% is projected for the period 2020-2025, consolidating it as one of the most dynamic sectors in Latin America.

However, the sector faces significant challenges. In January 2024, civil construction costs increased by 2.46% compared to December 2023, driven by increases in labor (4.81%), materials (2.40%) and transportation (1.92%). In addition, factors such as inflation, high interest rates and changes in housing policies complicate the picture.

Technological advances:

The rise of PropTech – the integration of technology into real estate – has been substantial. In 2023, the PropTech sector attracted 29% of the country’s technology investments, underscoring its critical role in the sector’s digital transformation. Notable companies such as LaHaus raised $62 million in a Series C funding round, while Habi raised $156.3 million through three debt deals, highlighting investor confidence in technology-driven real estate solutions.

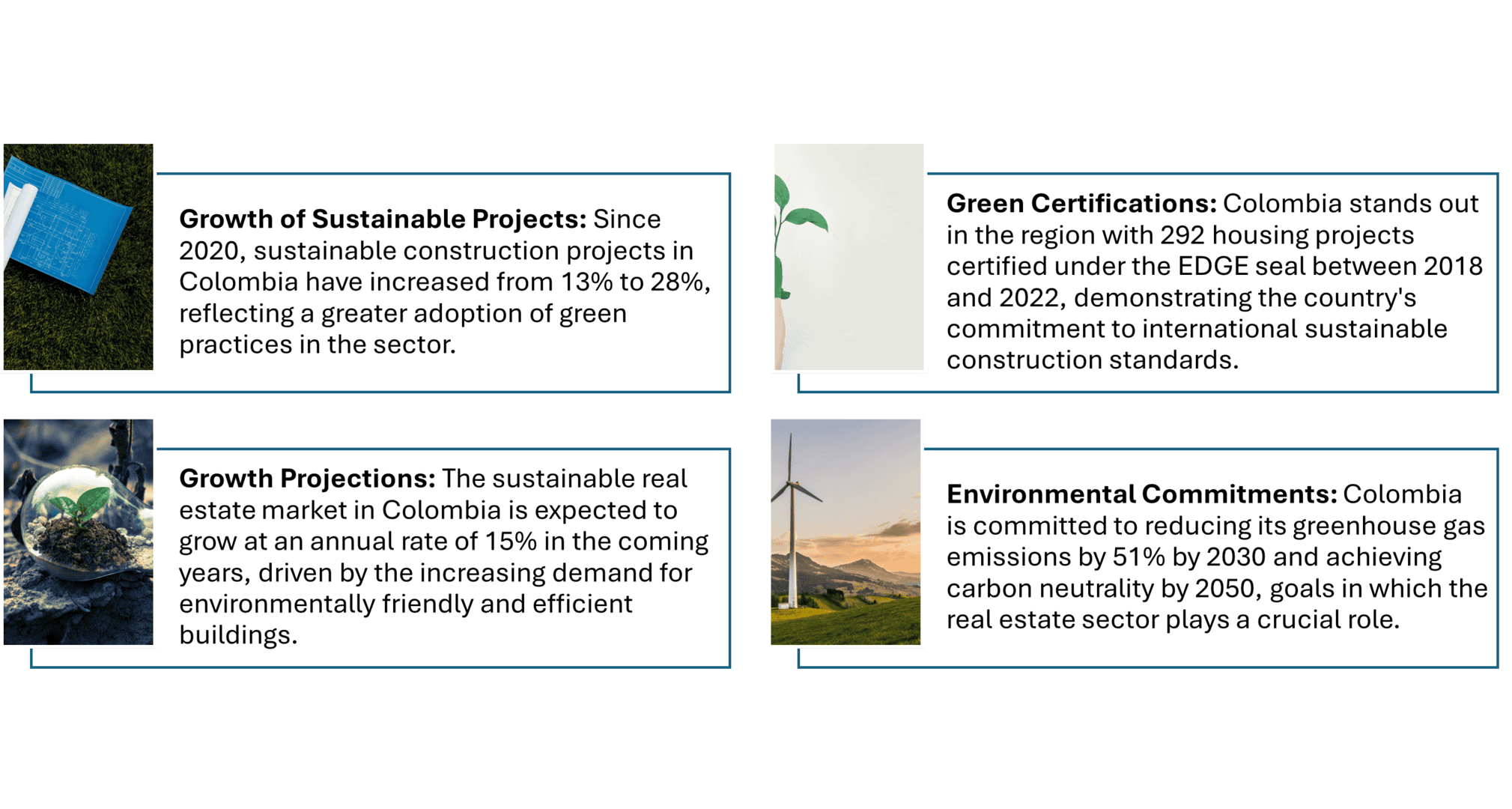

Sustainability initiatives:

Sustainable development is gaining momentum, with green building certifications becoming more prevalent. Between 2021 and 2022, 27% of new buildings in Colombia achieved green certification through tools such as EDGE, which translates into approximately 11.5 million square meters of certified space. This trend reflects a growing commitment to environmental responsibility among developers and investors.

Market dynamics and demographic changes:

Demographic changes are reshaping the demand for housing. Millennials, who are entering home-buying age, show preferences for urban living, technological integration, and sustainable features. In addition, urban migration patterns continue to influence real estate development, which focuses on creating mixed-use spaces that satisfy the desire for proximity to work, leisure, and essential services. The emergence of micro-cities, designed to offer all the necessary services within a radius of 15 minutes, exemplifies this shift towards more self-sufficient and sustainable urban planning.

Real estate events in Colombia for 2025:

- Macroeconomic view and real estate context. Bogota – January 29, 2025 – 10:00am – 11:30am | CUNA (GMT-5).

Members of the Club can participate in the first Club Rally of the year, where we will be joined by Juana Téllez, Chief Economist of BBVA Research. During the meeting, the economic projections and outlook for the Colombian market for 2025 will be discussed. Join the GRI Club members and discover the trends in the real estate sector in Colombia for this year. Organizers – GRI CLUB

- Caribbean Real Estate Showcase (VIMO) 2025. Barranquilla- June 20 – 22, 2025 – 10:00am – 8:00pm | CUNA (GMT-5).

The Caribbean Real Estate Showcase is the fair that, for three days, presents the largest offer of housing projects; as well as commercial, industrial and tourist properties in the region. Organizers: Camacol Atlántico and Corferias Inversiones SAS.

- Great Real Estate Show 2025. Bogotá – August 21 – 24, 2025 – 10:00am – 8:00pm | CUNA (GMT-5).

Gran Salón Inmobiliario celebrates 19 years of experience, consolidating itself as a key fair in the real estate sector, bringing together the most complete offer of new and used residential, commercial, tourist and business projects, both nationally and internationally. In addition, it offers complementary services that guarantee an ideal environment for the generation of business and memorable experiences. Organizers: Lonja de Bogotá and Corferias Inversiones SAS.

- Real Estate 2025. Bogotá – August 21, 2025 – 10:00am – 8:00pm | CUNA (GMT-5).

In its 10th edition, Colombia GRI Real Estate arrives to connect the most important C-level leaders and executives in the industry in an intimate and informal environment. In a space of diverse and decisive players for the expansion of the real estate sector, you will find an agenda of simultaneous debates and behind closed doors where they will debate the main trends of the day, exchange ideas and solutions for decision-making and discuss in private business meetings. Organised by: GRI CLUB.

- Real Estate Convention Colombia 2025. Cartagena, Bogotá, Medellín, Ibagué – February 10 – 22, 2025.

If you are a pre-construction company with real estate projects in international markets and you want to access a select audience of investors interested in these markets, this event is for you. The convention will be held in 4 key cities in Colombia. Organizers: Claudia Rivera.

- National Economic Forum. Bogotá – March 4, 2025.

The event will represent an ideal opportunity to learn about the current economic outlook, understand market trends and access key tools that allow informed decisions to be made or effective strategies to be implemented throughout the year. Organized by: Fedelonjas.

- 16th Housing Forum. Bogotá – May 6, 2025.- 08:00 a.m. | CUNA (GMT-5).

The event will represent an ideal opportunity to learn about the current economic outlook, understand market trends and access key tools that allow informed decisions to be made or effective strategies to be implemented throughout the year. Organizers: Asobancaria.

- Expoinmobiliaria. Bogota – March 7 – 9, 2025.- 10:00am – 8:00pm | CUNA (GMT-5).

It is a commercial space that brings together a select offer of apartments, houses, suites, lots, hotels, premises, offices and offices, offering a wide variety to satisfy different interests and preferences. This event is aimed at an exclusive segment of high-level projects in Antioquia, where construction companies and developers affiliated with Camacol Antioquia present the best in comfort, elegance, innovation, design and sustainability. Organized by: CAMACOL.

Explore upcoming opportunities, expand your network, and stay up to date with key industry trends.

Check our calendar here: A.CRE Events.

Some of the main Real Estate Projects in Colombia

Colombia is experiencing a boom in landmark real estate developments looking to transform and revitalize its major cities. Below are some of the most significant projects underway:

- Serena del Mar in Cartagena: This ambitious project covers 2,500 hectares and integrates residential, cultural, commercial, educational and health components. Designed by renowned urban planners and international architects, Serena del Mar is located 12 kilometers from the historic center of Cartagena and 8 kilometers from Rafael Núñez International Airport. Currently, it has more than 6,000 residents and 4,500 people working on its infrastructure. Among its outstanding developments are the Serena del Mar Hospital and the Caribe headquarters of the Universidad de los Andes.

- Atrio Project in Bogota: Located in the International Center of Bogota, Atrio is an emblematic architectural development that includes two towers: a 44-story one already completed and another 62-story under construction. Designed in collaboration with British architect Richard Rogers, the project includes spaces for offices, commerce and a cultural center, contributing significantly to the urban renewal of the Colombian capital.

- Sustainable Microcities: Companies like Santa Ana are leading the construction of sustainable microcities in Colombia, Panama and Chile, with plans to build more than 4,000 homes in the next seven years. These communities are designed so that residents can access essential services in less than 15 minutes on foot or by bicycle, promoting green and sustainable infrastructure.

Conclusion: The Future of Investment in Colombia Real Estate Market

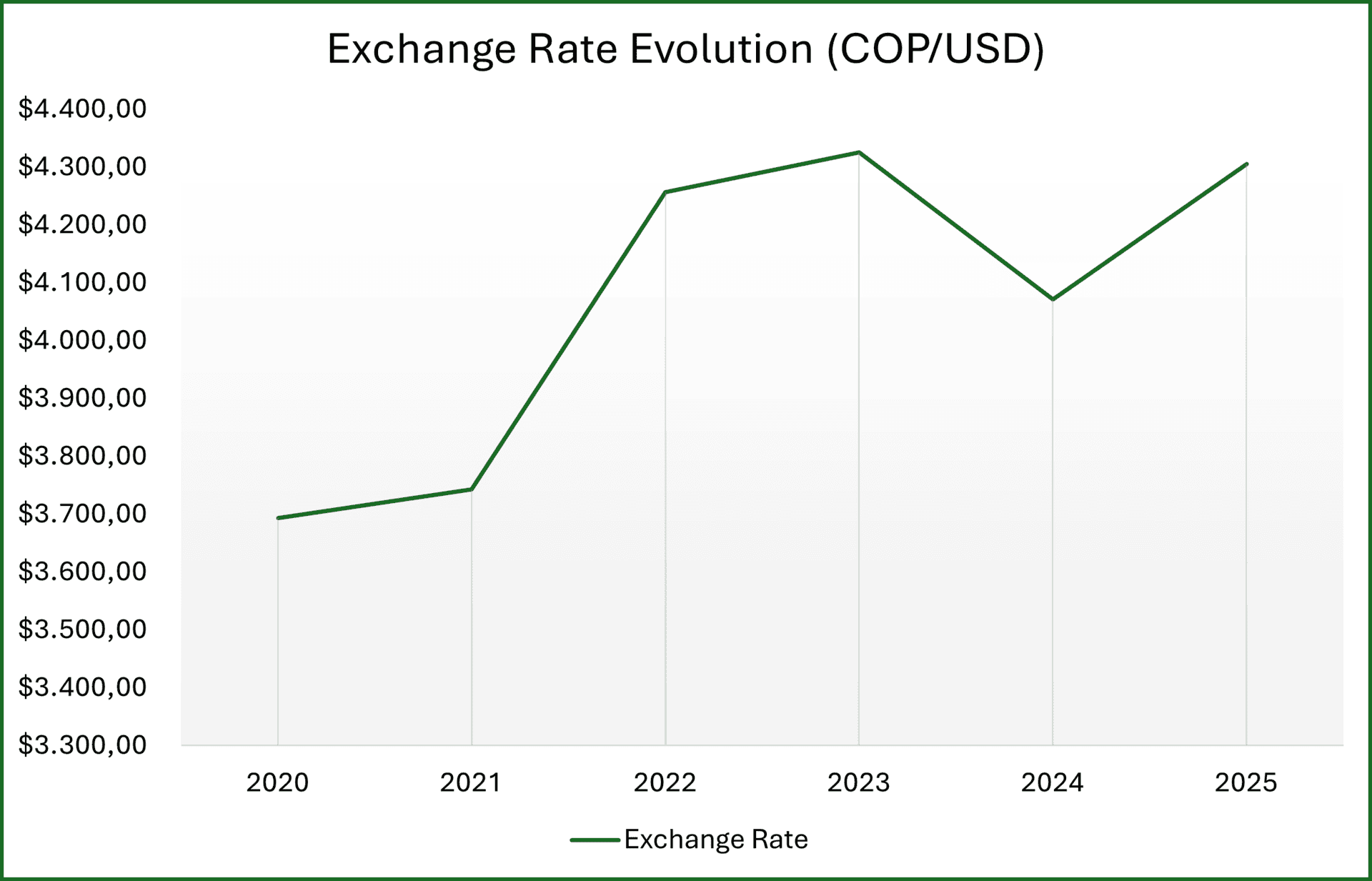

The Colombia real estate investment is going through a period of transformation determined by economic policies, foreign investment trends, technological advances, sustainability efforts, and demographic changes. While challenges such as a fiscal deficit of 21 trillion pesos, currency depreciation (-7%) and trade imbalances create macroeconomic uncertainty, opportunities arise in the industrial, logistics and foreign investment in the real estate sector, as the government actively diversifies trade agreements and promotes domestic industrial production.

Foreign investment continues to drive growth, especially in hospitality, industrial parks, and free zones, with investor-friendly laws facilitating capital inflows. However, the 18.32% contraction in FDI during 2024 raises concerns about the country’s attractiveness, especially amid regulatory challenges and currency fluctuations. However, the real estate sector continues to attract interest due to its resilience and long-term growth potential, particularly in sectors linked to trade and infrastructure.

The residential market is facing mixed signals: inflation has fallen to 5.2% and interest rates have been reduced to 9.25%, improving the accessibility of mortgages and stimulating demand for housing. However, rising construction costs, driven by rising material prices and regulatory changes, could limit new developments. In addition, demographic trends indicate a growing preference for rental properties, especially among millennials migrating to urban centers, reinforcing the demand for mixed-use developments and co-living spaces.

Colombia is embracing PropTech, drawing major investments into digital real estate platforms. Meanwhile, the adoption of green building certifications (27% of new projects) underscores the growing importance of sustainable real estate development, aligning with global ESG (Environmental, Social, and Governance) standards.

Looking ahead, the Colombian real estate market will continue to evolve in response to macroeconomic conditions, government policies, and investor confidence. The industrial and logistics sectors remain strong bets, while the residential and commercial markets must adapt to changing consumer behaviors and financial accessibility. Despite short-term volatility, long-term fundamentals remain promising, positioning Colombia real estate investment as a strategic opportunity for investors navigating Latin America’s dynamic real estate landscape.

References

- Bank of the Republic. (2024). Portfolio analysis in the financial market – September 2024. Bank of the Republic. Retrieved from link.

- Bank of the Republic. (2024). Representative market exchange rate (MRR). Bank of the Republic. Retrieved from link.

- National Administrative Department of Statistics (DANE). (2024). New Home Price Index (IPVN). DANISH. Retrieved from link.

- National Administrative Department of Statistics (DANE). (2024). Economy Monitoring Indicator (ISE). DANISH. Retrieved from link.

- The Economic Note. (2024). The impact of the real estate sector on the economy: 8.5% contribution to national GDP in 2024. The Economic Note. Retrieved from link.

- Ministry of Commerce, Industry and Tourism (MINCIT). (2024). Economic report – third quarter 2024. MINCIT. Retrieved from link.

- Ministry of Commerce, Industry and Tourism (MINCIT). (2024). Economic statistics and reports. MINCIT. Retrieved from link.

- (2024). What is the current situation of the construction sector in Colombia in 2024? Numan. Retrieved from link.

- Analitik assesses. (2024). Colombia and Foreign Investment: Contraction in 2024 and Opportunities in 2025. Analitik assesses. Retrieved from link.