A.CRE 101: How To Use The Discounted Cash Flow (DCF) Method To Value Income Producing Property (Updated Aug 2024)

The Discounted Cash Flow Method is a method to value a project by taking all future projected cash flows of the project and discounting them back to time zero (date of purchase) using a predetermined discount rate (the discount rate when used in a DCF to look at an investment can be looked at as synonymous to an investor’s targeted IRR). The value that is deduced from doing this is what an owner/investor would be willing to pay today in order to receive the projected cash flows from the project in the future and take on the risk.

Example

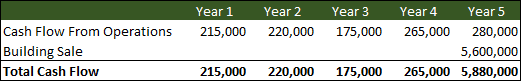

An investor is looking at an office building to purchase and hold for five years. The investor will use all his own cash to buy the project and after underwriting he believes the project will produce the following cash flows:

This investor knows he can put this same money in a slightly less risky investment at 7% and so in order to consider this opportunity over the other, he values the incremental risk at a 1% premium and thus, requires that the cash flow above results in an 8% return. In other words, he is looking to achieve an 8% IRR on this cash flow. The investor now needs to resolve what he would pay today in order to earn 8% on the money invested.

Solving Formulaically

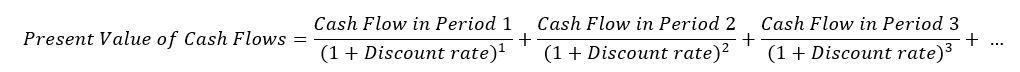

To solve this formulaically for annual periods, we need to apply this formula to the cash flow above:

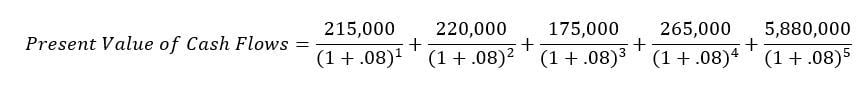

Inputting our assumptions gives us the following:

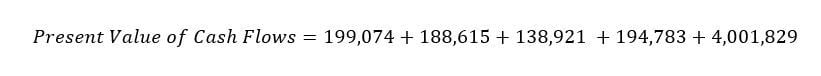

Which Equals:

Simply adding this all up provides us with a purchase price of $4,723,211. So, if our investor were to consider this deal, he would need to be able to close on this property at $4,723,211 or less.

Solving DCF with Excel

Implementing a DCF Analysis using Excel is actually quite simple with the =NPV() formula. Click the mouse into a blank cell and type

=NPV(

Once you do that, the formula guide will ask for a rate. Type

.08,

after you type the comma, take the mouse and highlight all the cells that have the cash flows in it and press Enter. This should return the present value of the cash flows discounted at the required rate. If this is not fully clear to you, please watch the video below for further explanation of the DCF Method.

DCF Method Video

Conclusion

In conclusion, the Discounted Cash Flow (DCF) Method is a valuable tool for investors to assess the value of a project by calculating the present value of future cash flows using a predetermined discount rate. This method helps investors determine how much they should be willing to pay today for the potential future returns of a project, accounting for the associated risks. By using tools like Excel, investors can efficiently perform DCF analysis to make informed decisions about potential investments. Understanding and applying the DCF Method is essential for evaluating investment opportunities and achieving targeted returns.

To continue expanding your knowledge of discounted cash flows and other commercial real estate concepts, consider checking out our A.CRE AI Assistant. This tool uses AI to provide personalized guidance, answer your CRE questions, and help you with financial modeling and analysis. You may also want to explore our Data Analysis GPT for Commercial Real Estate. This tool uses AI technology to help streamline your complex data analysis tasks. Whether it’s enhancing your entitlement process like we discussed in this article or tackling other CRE tasks, the Data Analysis GPT and A.CRE AI Assistant can provide powerful support.

Frequently Asked Questions about Using the Discounted Cash Flow (DCF) Method to Value Income-Producing Property

What is the Discounted Cash Flow (DCF) Method in real estate?

The DCF Method is used to value a project by discounting all future projected cash flows back to time zero using a predetermined discount rate. “The value that is deduced… is what an owner/investor would be willing to pay today in order to receive the projected cash flows… and take on the risk.”

How does an investor choose the discount rate for DCF analysis?

The discount rate typically reflects the investor’s required return based on the risk of the project. In the example, “the investor knows he can put this same money in a slightly less risky investment at 7%… and thus, requires… an 8% return.”

How do you solve a DCF formulaically?

You apply a formula where each future cash flow is divided by (1 + discount rate) to the power of its time period. Adding all discounted values gives the present value: “Simply adding this all up provides us with a purchase price of $4,723,211.”

How can you calculate DCF using Excel?

Use Excel’s =NPV() formula. Enter the discount rate (e.g., .08), followed by the range of cash flow cells. “This should return the present value of the cash flows discounted at the required rate.”

Why is DCF important for evaluating income-producing property?

DCF helps investors determine what they should pay today for expected future cash flows, accounting for risk. “It is a valuable tool… to assess the value of a project… and make informed decisions about potential investments.”

What tools are available to assist with DCF modeling?

The post recommends using the A.CRE AI Assistant for personalized guidance on DCF and related topics, and the Data Analysis GPT for CRE to support complex real estate data tasks.

Where can I learn more about DCF and other real estate modeling topics?

Explore more on A.CRE by watching the DCF Method video linked in the post and browsing the A.CRE Accelerator curriculum and AI tools for deeper learning and modeling practice.