Real Estate Financial Modeling Accelerator (Updated Jan 2025)

Before launching the Accelerator program, Michael and I received countless emails requesting a more structured, step-by-step real estate financial modeling training program.

Over the years, we've covered hundreds of real estate modeling…

Exploring Latin America’s Real Estate Markets: Colombia

Latin America's real estate markets are as diverse as its economies, influenced by factors like economic cycles, supply and demand dynamics, and shifting political landscapes. While some may see these conditions as risky, Colombia Real Estate…

A.CRE at Real Estate Exhibition Bogotá 2024

Within the framework of the Real Estate Exhibition Bogotá 2024, my A.CRE colleague, Arturo Parada, and I, Emilio Tovar, had the privilege of participating in one of the most outstanding events in the Colombian real estate market. During our…

A.CRE at the Smart City Expo Bogotá 2024

A year ago, my A.CRE colleague Arturo Parada and I attended our first real estate event in Bogotá, Smart City Expo Bogotá 2023, where we had the opportunity to connect with industry leaders and explore emerging trends in urban development…

Case Study #10 – Class A Industrial Warehouse + Rooftop Solar PV Plant (Case + Solution)

This case study explores a development of a 40-acre warehouse in Kasara, near Nashik, India. This industrial case study combines rental income with solar energy initiatives. In this article, we'll examine the financial strategies, including…

Using Geometric Mean (or CAGR) as an Alternative to IRR (Updated May 2024)

The internal rate of return (IRR) and compound annual growth rate (CAGR) are both metrics used to analyze investment returns. They're both commonly used in commercial real estate financial modeling, but what's the difference? When should you…

Case Study #11 – Residential Development Business Model: Build And Sell (Case + Solution)

This residential development case study explores the strategic planning and execution of Pinkstone Group's latest project, Serene Homes, amidst the backdrop of the COVID-19 pandemic. As remote working becomes the norm and the demand for quality…

Obstacles and Opportunities in the Colombian Real Estate Market: What the Smart City Expo Taught Us

During the celebration of the Smart City Expo 2023 in Bogota, Colombia, we were presented with valuable opportunities to learn and have a better understanding of the country's real estate market. This outstanding event brought together experts,…

How This Land Aggregation Strategy Helps Developers Raise More Debt and Scale Up Fast

Let's talk land aggregation strategy. Consider this, you have put together a portfolio of some great opportunistic development deals, each with immense upside potential. All you need is the initial big chunk of investment in land to get started.…

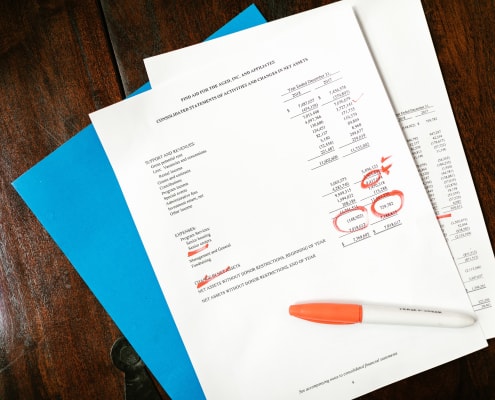

How to draw-up 3-part Financial Statements from your CRE Financial Model

Sometimes, your investors will want to see financial statements. Though this is usually something left to accounting, it's not a difficult thing for you to draft up on your own. It actually just takes the simple steps of familiarizing yourself…

Why CRE Deals May be Better Off Following a Project Finance Structure

In this article, we discuss the anatomy of two business structures - Project Finance and Corporate Finance - and why a Project Finance Structure is best suited for CRE deals by making the fund management process more investor friendly.

How…

Land Equity – Collaborative Development Strategies with the Landowner

In this article, we'll talk about land equity development strategies where the landowner contributes their land to the partnership. In these situations, land ownership is either immediately conveyed or deferred until development is complete.…