Real Estate Financial Modeling Accelerator (Updated Jan 2025)

Before launching the Accelerator program, Michael and I received countless emails requesting a more structured, step-by-step real estate financial modeling training program.

Over the years, we’ve covered hundreds of real estate modeling topics in our blog, published hours of video, and shared 70+ real estate Excel models in our Library. Nonetheless, no matter how many posts we publish or models we share, we continue to get the same questions. What does it take to become fully proficient? What do I focus on and in what order?

So, in early 2019 we developed a solution: The A.CRE Real Estate Financial Modeling Accelerator. The Accelerator is a case-based, comprehensive real estate financial modeling training program that prioritizes the right information in the ideal order.

Since the program’s inception (and as of early 2025), we’ve graduated upwards of 2,000 Accelerator members, trained over 8,000 real estate professionals, partnered with nearly 100 top universities and global real estate companies, and collaborated with trade organizations such as ICSC to train the next generation of real estate professionals. The curriculum has expanded to include virtually every concept necessary to master this skill.

And the Accelerator Certificate of Completion has become a recognized mark of excellence in the industry, with employers around the world valuing its distinction. Search LinkedIn, and you’ll find Accelerator graduates at nearly every major real estate firm, with many early graduates now holding senior leadership roles.

With the launch of Accelerator 3.0, we’ve taken this transformative program to the next level. In this post, I’ll share what the Accelerator is, why we built it, and how it can help you accelerate your career in real estate

- Not yet an Accelerator member? Consider joining today.

The new Accelerator 3.0 home page (i.e. The Hub) where members learn crucial technical skills and expand their network.

Accelerator Constantly Improving – The Accelerator 3.0

Since our initial launch in 2019, we’ve continually updated and enhanced the Accelerator to provide the most practical and effective real estate financial modeling education available. Over the years, we’ve added dozens of advanced concept modules, supplementary tutorials, a library of case studies with detailed videos and solutions, a networking and careers in real estate course, and responded to thousands of questions in the Accelerator Q&A. Find at the bottom of this page the Accelerator changelog for a comprehensive list of the hundreds of new features, updates, and enhancements made since 2019.

In early 2025, we launched Accelerator 3.0: the same proven curriculum, enhanced with exclusive networking, AI integration, and advanced features. Delivered through our proprietary learning platform, Accelerator 3.0 was designed to elevate the learning experience with:

- Redesigned navigation for a smoother, more engaging interface.

- New community and networking features to connect members with like-minded professionals.

- Live Events such as AMAs and company info sessions.

- Expanded tools and resources, including lessons on how to apply AI to streamline financial modeling and analysis tasks, preparing members for a rapidly evolving industry.

We’ve also continued to update the Accelerator regularly, incorporating feedback from members like you to ensure it remains the industry’s gold standard in real estate financial modeling education.

Want to learn more? Check out the Accelerator changelog for the latest updates or consider joining the Accelerator today.

What is the Real Estate Financial Modeling Accelerator 3.0?

The Accelerator 3.0 is a comprehensive, case-based real estate financial modeling training program designed to help members master institutional-quality financial modeling. The program’s flagship Core Curriculum includes 17 core courses with accompanying case studies, Watch Me Build videos, and an interactive student-instructor Q&A featuring over 1,000 answered questions (and growing daily).

Nearly 2,000 top professionals and students have graduated from our flagship program.

The Accelerator was originally launched with 16 core courses and a student-instructor forum. Over time, based on feedback from members, we added dozens of supplementary materials, advanced concept modules, and tools to enhance the learning experience. As the program grew, we introduced Specialty Endorsements to organize this advanced content into intuitive curricula for deeper mastery of specific topics.

With the launch of Accelerator 3.0, we’ve expanded these endorsements and introduced new tools to ensure members have everything they need to succeed. The Specialty Endorsements currently available are:

- Mastering MS Excel for Real Estate

- Advanced Modeling – Real Estate Debt

- Advanced Modeling – Partnership Cashflows

- Advanced Modeling – Development

- Advanced Modeling – Property and Portfolio

- Career Advancement in Real Estate

- Artificial Intelligence & CRE

- A.CRE Ask Me Anything Recordings

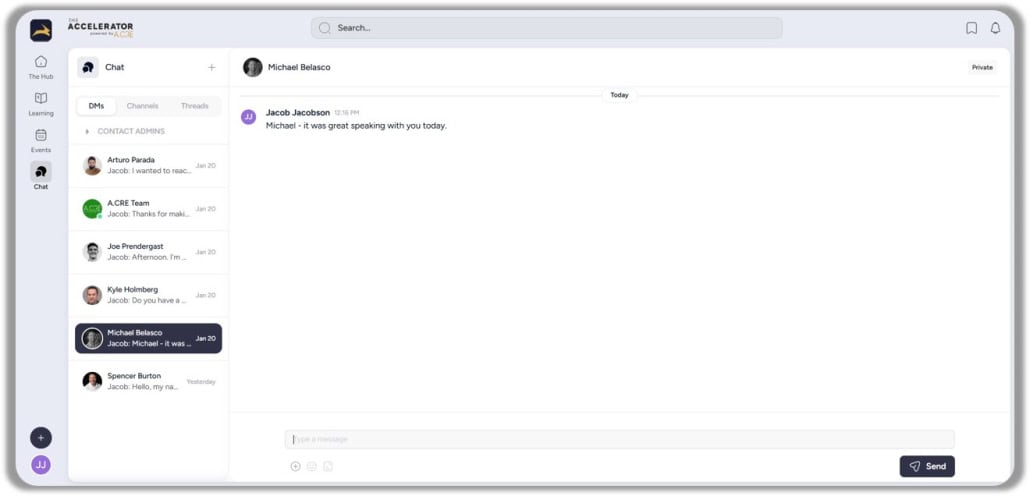

Accelerator 3.0 also emphasizes the importance of networking, recognizing that building connections is vital for career advancement in commercial real estate. The new platform includes community and networking features such as enhanced user profiles, direct messaging, and opportunities to engage with other members during live events like AMAs and company info sessions. These tools are designed to help you expand your professional reach, collaborate with like-minded individuals, and build meaningful relationships in the industry.

The new Artificial Intelligence & CRE endorsement is particularly exciting, offering practical tutorials and conceptual insights to help members understand and apply AI in commercial real estate tasks like underwriting and market analysis.

Going forward, the A.CRE team will continue to refine and expand endorsements, incorporating feedback from members to keep the program at the forefront of real estate education.

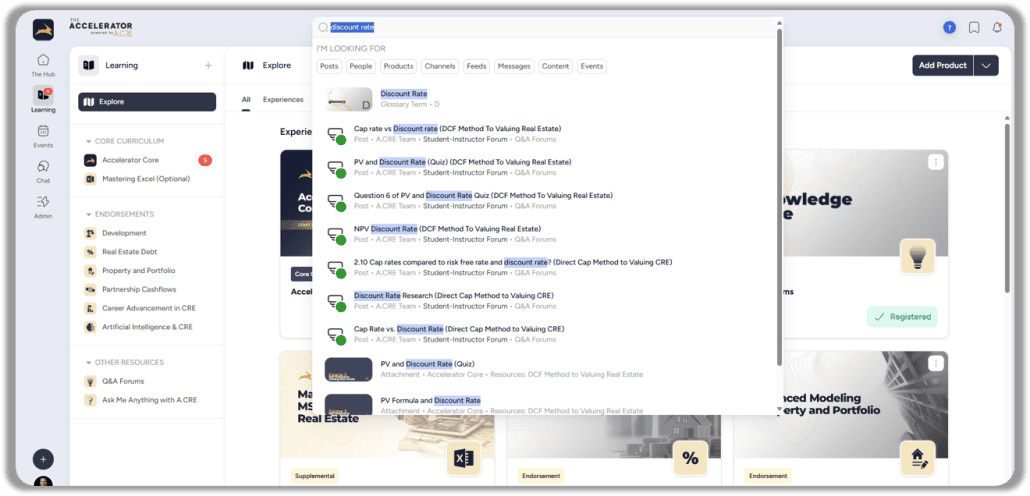

Six years and over 1,000 Q&As, hundreds of lessons, posts, and tutorials plus our comprehensive Glossary of CRE terms all now easily searchable.

Who is the Accelerator For?

The Accelerator 3.0 is designed to meet you wherever you are in your real estate financial modeling journey, catering to three types of individuals:

- Beginners: Those with limited real estate financial modeling skills who want to model their own deals, transition into a new role in CRE, or land their first job in the industry.

- Intermediate Professionals: Those with some modeling experience but gaps in their knowledge—such as a lack of institutional modeling expertise, property-type specialization, or exposure to specific investment strategies.

- Advanced Practitioners: Those with significant experience who are lifelong learners looking to refine their skills or gain accreditation in specialized modeling areas. Advanced members will particularly benefit from the Endorsement curricula, as well as the more advanced courses in the Core Curriculum.

With Accelerator 3.0, virtually every concept related to modeling direct investments in real estate is covered, whether in the Core Curriculum or one of the Specialty Endorsements. Additionally, new features like community networking and live Events provide opportunities to connect with others, ask questions, and engage in collaborative learning.

If there’s ever a topic you’d like to explore further, our interactive Q&A section enables you to request custom tutorials or materials. This ensures the Accelerator evolves to meet your learning needs, offering something valuable for every real estate professional.

Why a Real Estate Financial Modeling Accelerator?

In a paste episode of the Adventures in CRE Audio series, we dove into why we created the new real estate financial modeling Accelerator. If you’re considering the Accelerator, I highly recommend you watch this episode as we take a more pronounced look into the why behind this the transformational program.

Accelerator – More Than Just Real Estate Financial Modeling Courses

When we started, what we didn’t want to end up with was a typical online real estate financial modeling course. We’ve all taken them and while they are a piece of the puzzle, they lack the sort of true-to-life application that leads one to true proficiency.

On top of that, Michael and I had already covered virtually every concept on our blog. Compiling our 300+ posts into a course might have been profitable, but it wouldn’t have created the value we wished we’d had during the early stages of our careers.

So, we set out to build something different—an Accelerator.

Accelerator (noun): “A person or thing that causes something to happen or develop more quickly.”

The Accelerator is designed to take someone who’s already motivated and get them to their destination faster and more efficiently. Think of it as the express lane for real estate financial modeling mastery.

You could read all 300 of our blog posts, deconstruct all 60 of our real estate models, and eventually piece it all together. Or you could cut to the chase, spend 8 to 12 focused weeks with the Accelerator Core Curriculum, and achieve the same level of mastery in a fraction of the time.

With Accelerator 3.0, the goal remains the same: to bring laser focus to the learning process. To teach you the right information in the right order. And to provide the tools, resources, and real-world application necessary to master real estate financial modeling—without wasting energy on irrelevant information.

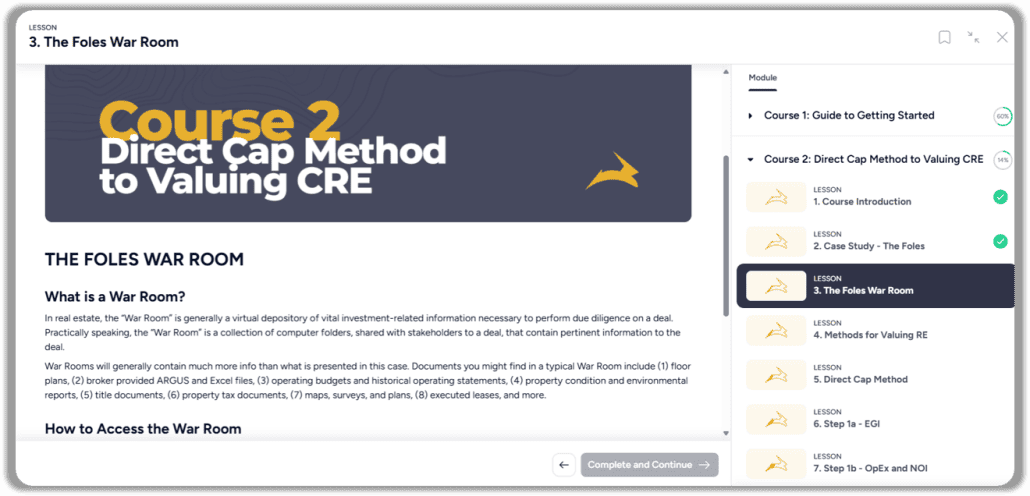

Accelerator 3.0 – same proven case-based curriculum.

A Real-World Curriculum

Michael and I believe that you don’t truly learn real estate financial modeling until you actually do it in the real world.

The challenge is most employers expect you to already have the skills before they interview you. And since most schools only teach the theoretical and the online courses are lacking in depth and applicability, most of us are left to our own devices to learn.

To accelerate the learning process, we’ve developed a case-based curriculum that focuses on what really goes on out here.

In our combined 25 years in real estate, we’ve modeled hundreds of institutional deals worth $20+ billion; saying nothing of the thousands of hours spent on A.CRE projects. We’ve worked carefully to create course content that parallels the realities of the industry.

For example, many of the hypothetical deals used in the Accelerator come from our hypothetical brokerage firm – East Lang Ellis.

East Lang Ellis – The fictitious brokerage firm providing the offerings for the Accelerator case studies.

For many of the case studies, this hypothetical firm shares a link to a deal War Room where you’ll find realistic looking offering (or financing) memoranda, operating statements, rent rolls, and other deal-specific documents.

Furthermore, the cases use real-to-life jargon, processes, and examples so that you learn real estate financial modeling as if an actual boss was giving you real deals to underwrite.

Modern, Easy-to-Navigate, Proprietary Interface

Besides developing true-to-life content, having a learning interface that was attractive, easy-to-navigate, and housed within our Adventures in CRE site was essential. This piece took some time to come together, and we continue to make regular improvements based on feedback from Accelerator members. But thanks to a couple of people far more technically capable than we are, we have a learning platform we’re really excited about.

A screenshot of the Accelerator 3.0 Platform released January 2025, where learning meets networking.

What’s New – Accelerator Changelog

- We’re thrilled to announce the official launch of Accelerator 3.0, the latest evolution of the industry-standard program for mastering CRE skills and advancing careers. Highlights of this release include:

- Redesigned platform for a seamless and engaging learning experience.

- Enhanced networking capabilities, including community features and exclusive opportunities to connect with fellow members.

- New Events feature, offering live AMAs, company info sessions, and more.

- Introduction of the AI in CRE Endorsement, with lessons designed to help members apply artificial intelligence to real-world underwriting, market analysis, and other CRE tasks.

- Simplified navigation and updated tools to accelerate your mastery of real estate financial modeling.

- Learn more about the Accelerator 3.0

- Added note and clarifying example to Course 4: Anatomy of the Real Estate DCF – Lesson 12. The Assignment

- Added new lessons to the Endorsement: ‘A.CRE Ask Me Anything Recordings’

- Ask Me Anything with Spencer Burton — June 27, 2024

- Ask Me Anything with James Nelson — July 11, 2024

- Ask Me Anything With John Bemis — July 18, 2024

- Ask Me Anything with Spencer Burton — July 25, 2024

- Ask Me Anything With James Nelson — Aug 15, 2024

- Ask Me Anything with Spencer Burton — Aug 29, 2024

- Ask Me Anything With Mike Tepedino — Sept 12, 2024

- Ask Me Anything With James Nelson — Sept 19, 2024

- Ask Me Anything with Spencer Burton — Sept 26, 2024

- Updated course material in Course 4: Techniques for Modeling Real Estate in Excel of the ‘Mastering MS Excel for Real Estate’ Endorsement

- Added new lessons to the Endorsement: ‘A.CRE Ask Me Anything Recordings’

- Ask Me Anything with Spencer Burton — May 30, 2024

- Ask Me Anything With Greg Friedman — June 6, 2024

- Ask Me Anything With Albert Cruz — June 20, 2024

- Added new (optional) section ‘Apply AI – Using LLMs to Assess Tenant Credit Quality’ to lesson 18 ‘Watch Me Build’ of the ‘Modeling Short + Long-Term Leases’ course

- Updated course material in course 3: ‘DCF Method To Valuing Real Estate’

- Lesson 11 ‘Step 1 – Build a 10-Year DCF’

- Lesson 13 ‘The Foles Part 2 Assignment’

- Lesson 16 ‘Watch Me Build’

- Created new Endorsement: A.CRE Ask Me Anything Recordings

- Updated case files and notes in course 11: ‘Modeling Short + Long-Term Leases’

- Lesson 11 ‘LTL – Rent Roll’ in

- Lesson 15. ‘LTL – Leasing Costs’

- Lesson 18. ‘Watch Me Build’

- Added new (optional) section ‘Apply AI – Use Our Custom GPT to Produce Unlimited Practice Case Studies’ to lesson 8 ‘Watch Me Build’ of the ‘Calculating Key Risk/Return Metrics’ course

- Updated notes in lesson ‘Reversion Tab’ in course 16: ‘Building An Acquisitions Model’

- Updated case files in lesson 11 ‘Wrapping It Up’ in course 16: ‘Building An Acquisitions Model’

- Updated formula in lesson 3 ‘Key Return Metrics’ in Course 5: ‘Calculating Key Risk/Return Metrics’

- Added new (optional) section ‘Apply AI – Watch Me Build a Custom GPT in ChatGPT’ to lesson 14 ‘Watch Me Build’ of the ‘Anatomy of the Real Estate DCF’ course

- Added new lesson ‘Apply AI + Let’s Accelerate’ in the Guide to the Accelerator course

- Added new (optional) section ‘Apply AI – Use AI To Read And Extract Data From Files’ to lesson 3 ‘The Foles War Room’ of the ‘Direct Cap Method to Valuing Real Estate’ course

- Added new (optional) section ‘Apply AI – Using AI to Perform Sale Comp Analysis’ to lesson 14 ‘Watch Me Build’ of the ‘Direct Cap Method to Valuing Real Estate’ course

- Added new (optional) section ‘Apply AI – Using AI to Model Real Estate’ to lesson 9 ‘Net Present Value (NPV)’ of the ‘DCF Method to Valuing Real Estate’ course

- Updated notes in lesson ’10-Yr OpSt Tab’ in course 16: Building An Acquisitions Model

- Added new lesson ‘Modeling a Property Tax Abatement’ in the Advanced Modeling – Property and Portfolio course

- Added a new question to the quiz in the ‘Advanced Modeling – Property and Portfolio’ course

- Updated course materials in Course 10 ‘Industrial Income Statement’, lesson 4 ‘Income + Expense Line Items’

# Version 2.3.4 – December 29, 2023

- Added new lesson ‘Interest Rate Risk Management’ to the ‘Advanced Modeling – Real Estate Debt’ course

- Added two new questions to the quiz in the Advanced Modeling – Real Estate Debt course

- Updated case files for Course 3 DCF Method To Valuing Real Estate

- Lesson 13

- Update on Specialized Endorsement – Career Advancement in Real Estate

- Included solution to lesson 5. The Stones Hotel – Hotel Acquisition

- Updated case files and completed model template for Course 2 Direct Cap Method to Valuing CRE

- Lessons 6, 7 and 8

# Version 2.3 – October 31, 2023

- Updated case file in Course 16 to match file from Watch Me Build lesson

- Bug fix to Accelerator for Enterprise platform – ‘Certificate of Completion’ menu option

- Q&A Attachment bug fix – file compatibility patch

- Management tools improvement

- Created new lesson in Advanced Modeling – Development course: Merchant-Build to Long-Term Hold – Adding a Cash Sweep Option

- Update on Specialized Endorsement – Advanced Modeling – Development

- Updated files on lesson 4, lesson 6, lesson 7, lesson 8, lesson 10, lesson 11, lesson 12, and lesson 13

- Updated videos on lesson 8, lesson 10 and lesson 13

# Version 2.2.6 – August 26, 2023

- Created a new video tutorial covering a third (and more flexible) methodology for calculating GP Catch Up

- Added ‘Third Method’ to the GP Catch Up lesson, in the ‘Advanced Modeling – Partnership Cash Flow’ course within the ‘Advanced Modeling – Partnership Cash Flow’ endorsement

- Added two new files: Template and Completed file for a Catch Up where GP is distributed less than 100% of distributions in the catch up tier

- Embedded third video into the same lesson

# Version 2.2.5 – August 14, 2023

- Banner notification fix on Membership Details page

# Version 2.2.4 – July 24, 2023

- Bug fix for Q&A attachment feature

- Improvement of internal admin tools

# Version 2.2.3 – June 29, 2023

- Bug fix for certificate of completion generation on various enterprise applications

- Database improvements

- Minor course content updates

# Version 2.2.2 – May 9, 2023

- Q&A Search feature improvement. Search results will now display replies as well

- Fix Q&A email notification when someone replies to their question

# Version 2.2.1 – April 27, 2023

- Added ‘Watch Me Build Custom Rent Schedule Module’ lesson to the ‘Property and Porfolio – Watch Me Build’ course of the ‘Advanced Modeling – Property and Portfolio’ endorsement

# Version 2.2 – March 31, 2023

- Implemented Dynamic Message Banner

- Minor content fixes to the Advanced Development Modeling endorsement

# Version 2.1.9 – February 28, 2023

- Backend updates to improve performance efficiency

- Bug fix to certificate of completion creation

- Minor content fixes

# Version 2.1.8 – January 21, 2023

- Created an Answer Key for the ‘Just the Facts – Retail Sale-Leaseback’ case study in the ‘Additional Case Studies + Technical Interview Exams’ course (available to Accelerator Advanced Members)

- Fixed an issue where in certain cases the Certificate of Completion was not automatically created (note this issue is still being actively worked on for ICSC members)

- Various backend fixes to the admin dashboard for course creators/instructors

# Version 2.1.7 – January 1, 2023

- Various performance updates

- Updated logic for Q&A sorting

- Minor content fixes

# Version 2.1.6 – November 16, 2022

- Added ‘Watch Me Solve a REPE Technical Interview’ lesson to the ‘Additional Case Studies and Technical Exams’ course of the ‘ Career Advancement in Real Estate’ Endorsement

- Added an ‘Operating Shortfall Reserve’ module to the ‘Watch Me Solve a REPE Technical Interview’ lesson

- Added ‘UK Debt Advisory Firm – Debt Origination’ lesson to the ‘Additional Case Studies and Technical Exams’ course of the ‘ Career Advancement in Real Estate’ Endorsement

- Updated ‘Guide to the Accelerator’

# Version 2.1.5 – October 31, 2022

- Additional database security enhancements

- Staging server setup for smoother update deployments

- Internal checkout development for enterprise admins to add licenses

# Version 2.1.4 – September 9, 2022

- New lesson: Add or Delete Rows with VBA to the course: Techniques for Modeling Real Estate in Excel

- Fix: Broken link in Real Estate Partnership Structures lesson of Partnership-Level Waterfall modeling course

# Version 2.1.3 – August 12, 2022

- Change icsc title, description

- Q&A private thread

- Fix: omitted extra spaces when editing post/reply

- Fix: account page, nav bar changes for enterprise user roles

- Fix: download report issue

- Fix: remove glossary items from heading

- Fix: email/password wrong notification

- Fix: enterprise user membership expiration date

- Feature: different Q&A user avatar for acre admins

- Feature: enterprise download report as excel file

# Version 2.1.2 – July 31, 2022

- Added feature to change name and date of Certificate of Completion

- Uploaded completed file for Building a Development Model from Scratch capstone course

- Various bug fixes and UI/UX updates

# Version 2.1.1 – June 25, 2022

- Updated Watch Me Build – American-Style Waterfall Model lesson to include details about partnership structure, clear up confusion around specifics

- (feature) Enhanced avatars to better differentiate between instructors and students

- (fix) Fix issue where certificate of completion was not publicly visible

- (fix) Fix issue where certificate wasn’t appearing in some instances for new graduates

- [Enterprise] Officially released ICSC retail real estate underwriting program

# Version 2.1.0 – May 13, 2022

- (feature) Ability to attach video to Q&A post and reply for all users

- (fix) Fix long name issue on certificate

- (fix) Fix issue with glossary term with a link

- (fix) Fix issue with endorsement certificate

- [Enterprise] Use different favicon, title, description for Enterprise, ICSC

- [Enterprise] Fix issues around enterprise and ICSC

- [Enterprise] Reset Password/Forgot Password features

- Admin Dashboard Updated to # Version 1.0.5 – May 13, 2022

- Enterprise user’s password reset ability

- Ability to update enterprise user’s program expiration date & progress

- Added “Admin, non-student” role for enterprise users

# Version 2.0.14 – April 3, 2022

- [Enterprise] Organization Admin can manage organization theme & logo

- [Enterprise] Two logos at top header bar

- [Enterprise] ICSC – homepage background image, core curriculum card image

- [Enterprise] Fixes for Management page

- [Enterprise] Ability to download Organization/Group progress report as a CSV

- Fix Certificate of Completion permalink to be public

- Fix to show membership expiration message when only less than 90 days left

- Ability for admin to attach video to Q&A post and reply

- Add Typeform

# Version 2.0.13 – March 11, 2022

- [Enterprise] Managers can manage organization theme

- [Enterprise] Fix program permission issues for organization

- Fix “Mark Complete” button issue to go to next course when completing the last lesson

- Fix course link issue in Q&A notification

- Ability to resume learning from account/membership pages

- “Get Started” button redirects user to first course’s first lesson

- Fix Q&A post text style issues

- Fix excel file upload issue in Q&A post

# Version 2.0.12 – February 11, 2022

- Show membership expiration banner in Programs page

- Force single session per user

# Version 2.0.11 – January 28, 2022 (Beta Platform)

- Launch of the Accelerator 2.0

- Show lesson title under course title in Course page

- Add upgrade to advanced option to Header and Membership Details page

- Show Membership Level in Membership Details page

- Show membership expiration banner in Membership Details page

- Show option to add Financial Models Bundle or Career Coaching in Membership Details page

- Show missed questions even if user passes a quiz

- Show membership remaining days in Membership Details page

- Fix an issue with glossary term search

- Fix courses order in Progress page

- Released new core course: Course 14: Modeling Development Debt

- Added the ‘Ground Lease Valuation Model‘ to the Financial Models Bundle

- Added a ‘Calculating Gross Returns vs. Net Returns’ section to the Adding GP Fees lesson in the Modeling Partnership Cash Flows course

- Created a ‘Calculating Gross Returns vs. Net Returns’ tutorial video

- By popular demand, we’ve replaced the old video intros and outtros with new and improved intros and outros

- Added custom case study thumbnails to each of the case study specific videos

- Added custom course thumbnails to each of the course introduction videos

# Version 2.0.0 – January 27, 2022 (Beta Platform)

- Official launch of the Accelerator 2.0 platform

# Version 1.0.10 – January 21, 2022 (Beta Platform)

- Add “Mastering MS Excel for Real Estate” to A.CRE Accelerator Core

- Fix locked endorsement redirection issue

- Updated Q&A email subject (“[Accelerator Q&A] …”)

# Version 1.0.9 – January 20, 2022 (Beta Platform)

- Auto-logout when user’s session is expired

- Completed new Endorsement: Advanced Modeling – Property and Portfolio

# Version 1.0.8 – January 07, 2022 (Beta Platform)

- Make entire endorsement card clickable in Programs page

- Remove “[Optional]” text from endorsement description

# Version 1.0.7 – January 03, 2022 (Beta Platform)

- Fix issues in mobile version Endorsement page

December 2021

Beta Platform:

- Implement sort for Q&A topics

- Add SEO friendly URL for each course

- Show course link in Q&A topic notification email

- Add link to “What’s new?” (i.e. Changelog) in the main menu and profile page

- Implement “A.CRE Accelerator Core” membership type authentication

- Add an option to upgrade plan for “A.CRE Accelerator Core” members to unlock endorsements

- Fix white space issue in Certificate of completion page

- Expandable/Collapsible left sidebar

- Update “All Curricula” page for “A.CRE Accelerator Core” members

November 2021

- Updated solution file for ‘Watch Me Solve a REPE Test’ tutorial; includes a few misc. fixes and improvements

Beta Platform:

- Enterprise dashboard page for group managers

- Add “Copy permalink” for core curriculum certificate

- Add “A.CRE” link to header bar

- Add “Continue” button for each curriculum in program progress page

October 2021

- Opened beta of new Accelerator platform to all existing Accelerator members, if they so choose to try the beta version of the new platform

- Released a blog post discussing the new Accelerator platform, which includes why we’re building it, what’s new, and when it will replace the existing platform

- Wrote an FAQ for the new Accelerator platform

- Updated UK Debt Advisory Firm Modeling Test solution to correct an error in debt service calculation methodology

Beta Platform:

- Automatic error tracking & reporting feature added

- Updated progress percentages to reflect all progress including lesson progress

September 2021

- Added 26 new terms to the Glossary of CRE Terms

- Added a new case study: UK Debt Advisory Firm Modeling Test

- Added the solution to UK Debt Advisory Firm Modeling Test Case Study

August 2021

- Added new Advanced Concept Module: Modeling Irregular Contributions of Equity

- Setup authentication for all Accelerator members to the new Accelerator learning platform (to be launched in September); all members now have access to both the existing platform and the new platform

- Edited Instructor-Student forum lesson with Spencer and Michael’s updated bios

July 2021

- Added a new case study: Walgreens vs. Walgreens – STNL Investor

- Added the solution to Walgreens vs. Walgreens – STNL Investor case study

- Added video tutorial for The Cellon Group – Asset Management Analyst Test

June 2021

- Updated the forward rate curve file in the ‘Modeling Floating (Variable) Rate Debt’ Advanced Concept module to May 29, 2021

- Added Floating Rate debt to Glossary

- Added Fixed Rate debt to Glossary

- Added Prepayment Penalty to Glossary

- Added Yield Maintenance to Glossary

- Created new Advanced Concept Module: ‘Mortgage Prepayment Fees, Including Yield Maintenance and Defeasance’

- Added a mini-video tutorial to the Modeling Long-Term Leases section that teaches an alternative formula for escalation month

May 2021

- Misc. server-side performance enhancements

- Added instructions for joining the LinkedIn Accelerator graduates group to course 11, lesson 3.2

April 2021

- Added New Advanced Concept module: “Dynamically Forecasting Development Cash Flows”

- Fixed typo in ‘Boss’ Notes’ in Direct Cap Method to Valuing Real Estate

March 2021

- In response to forum question, created mini-video tutorial that talks through the discounted cash flow method for valuing real estate

- 18 new questions in the Accelerator forum

- 55 new replies in the Accelerator forum

- Misc. code updates to improve performance

February 2021

- Added Tag Cloud to sidebar of Accelerator Forums, making it easier to browse for topics of interest

- ‘My Forums and Topics’ section added to sidebar of Accelerator Forums, making it easier to find your personal topics

- ‘Latest Topics’ section added to sidebar of Accelerator Forums, making it easier to browse latest content

- Expanded Advanced Concept Module on how to breakout partnership preferred return, return of capital, excess cash flow, and promote, to include a new tutorial on how to breakout the cash flows by period

- New mini video tutorial added to the Library of Supplementary Tools with additional guidance for modeling complex, multi-partnership structures

January 2021

- New case study: The Cellon Group – Real Estate Asset Management Analyst Test

- Added solution to ‘The Cellon Group – Real Estate Asset Management Analyst Test’

- Added loading screen to Learning Dashboard to alert users when the slow load is due to the system updating/building the Learning Dashboard page

- Updated the front page image for Q1 2021

December 2020

- Part I of the Definitive Guide to Microsoft Excel for Real Estate – The Functions That Matter added to the Library of Supplementary Tools

- Part II of the Definitive Guide to Microsoft Excel for Real Estate – The Features That Matter added to the Library of Supplementary Tools

- Added to the Guide to Getting Started, a link to the Definitive Guide to Microsoft Excel for Real Estate

- Fixed link in course 1, lecture 2.2 to resource about cap rates

November 2020

- Code update to video player to accommodate browsers on newer iPhones (In Progress)

- Guide to Getting Started now compatible with newer iPhones

- Direct Cap Method to Valuing Real Estate now compatible with newer iPhones

- DCF Method to Valuing Real Estate now compatible with newer iPhones

- Added new Advanced Concept Module: Using Stochastic (Probabilistic) Analysis and Monte Carlo Simulations

- Added new mini-video tutorial: How to Visualize an IRR Matrix Using Excel’s Charting Tools

- Added introductory video to ‘Using Stochastic (Probabilistic) Analysis and Monte Carlo Simulations’

- Added Watch Me Build video, showing how to add probabilistic assumptions to the 10000 Fitness Way model

- Added Watch Me Build video, showing how to add a Monte Carlo Simulation module to the 10000 Fitness Way model

October 2020

- Added a complimentary download link to the A.CRE Geocoding Excel Add-in to the Library of Supplementary Tools

- Added mini video tutorial ‘Modeling Total Potential Gross Rent in Long-Term Leases’ to the Library of Supplementary Tools

- Video tutorial for extending analysis period added to Advanced Concept module ‘Modeling a Construction Loan Takeout’

- Mini-tutorial added to Library of Supplementary Tools: Technique for Extending Analysis Period in an Existing Model

- Added section on ‘LinkedIn Skills Endorsements’ to the How to Leverage Your Accelerator Certificate of Completion

- Added mini video tutorial ‘XIRR Dynamic to Project Start Date’ to the Library of Supplementary Tools

September 2020

- In response to a forum question, created a mini-tutorial on how to model a CapEx Reserve Account

- Added How to Model CapEx Reserve Account to ‘Forum Post Videos’ section of the Library of Supplementary Tools

- Slight edit to question 3 in the Retail Income Statement Quiz, to make the question more clear

- Update to the core platform code to reduce load time between lectures

- Created tutorial for building Dynamic Portfolio (Fund) models in Advanced Concept module 1.8: Considerations in Portfolio-Level Modeling

- Added new Watch Me Build video to Library of Supplementary Tools: Partitioning an IRR and Equity Multiple

- Added new Case Study to Library of Supplementary Tools: Hamilton Park VIII: Industrial Development Residual Land Analysis

- Added solution file to Hamilton Park VIII Case Study

- Added solution video to Hamilton Park VIII Case Study

August 2020

- Added ‘Watch Me Build – American-Style Real Estate Equity Waterfall Model’ to the Library of Supplementary tools

- Updates to the Guide to Getting Started to provide further guidance for members with an advanced proficiency modeling real estate

- New Advanced Concepts Module: ‘Advanced Lender Risk Metrics – Duration and Average Life’

- In response to a forum question, created a quick Excel example of how a mortgage loan can actually lower the IRR of an investment

- Added a ‘Troubleshooting Issues’ subsection to the ‘Add a Recalculate Button to Avoid Circular References’ Advanced Concept module

- Update front page background image

- Expanded main menu to provide easier access to supplementary and advanced tools available beyond the core courses

July 2020

- New Case Study: ‘Just the Facts – Retail Sale-Leaseback’ added to the Library of Supplementary Learning Tools

- DCF Valuation Revisited – a video created in response to a forum post about using present value in real estate

- New Modeling Test / Case Study: ‘The Stones Hotel – Acquisition’ added to the Library of Supplementary Learning Tools

- Added Instructor bios to the Guide to Getting Started to better introduce Spencer and Michael to new Accelerator members

- New Case Study: ‘The Jefferson – Branded Condo Development’ added to the Library of Supplementary Learning Tools

- The Jefferson – Branded Condo Development’ case solution added

- New mini-tutorial: “Modeling a Custom Rent Schedule’ added to the Library of Supplementary Learning Tools

- In response to question regarding IRR*12 in lender cash flow, created an example Excel model with 120-period amortization table

- The video solution for The Presidio was added to the case study lecture

- The solution to the extra credit was added to The Presidio Case Study

June 2020

- Updated Accelerator home page background image

- In response to a forum post, created a short tutorial for how to calculate land value in a ‘Covered Land Play’ scenario

- New Advanced Concept Module: Break Out Promote, Preferred Return, Excess Cash Flow, Return of Capital Plus Separate Returns Before and After Fees

- Update lecture 2.3 of the Waterfall Modeling course to include a link to the new Advanced Concept course that expands the model built in lecture 2.3

- New Case Study: ‘Presidio’ added to the Library of Supplementary Learning Tools

- New Case Study: ‘Renovo Tower’ added to the Library of Supplementary Learning Tools

- Created a video tutorial with Excel file showing how to amortize debt with semi-annual (and other) interest compounding

- Added a solution file to the ‘Presidio’ case study

- Added a solution file to the ‘Renovo Tower’ case study

- Added a ‘Watch Me Solve’ video to the ‘Renovo Tower’ case study

- Merged practice tests and case studies subsections of the Library of Supplementary Learning Tools

- Updated ‘East Lang Ellis’ with ‘Renovo Tower’ investment details

- Updated Main Menu for improved navigation

- Added a short video tutorial on calculating monthly hurdle rate using an actual month and 365 day year

- Fixed typo in ‘The Foles’ boss’ notes

- 79 new replies and 28 new forum topics in the Accelerator forums

May 2020

- Framework for Modeling Bridge + Construction Loan added to the Library of Supplementary Tools

- Capital Stack with Customer Deposits added as Source added to the Library of Supplementary Tools

- Added new Watch Me Build module to Library: Watch Me Build – Capital Stack with Mezzanine Debt

- A mini-tutorial in response to a question about building an absorption module

- Walk through of how to perform a residual land value analysis

- Video tutorial plus Excel file to illustrate the concept of cap rate vs. unlevered IRR

- New Advanced Concept Module: Modeling Variability in Income and Expense Line Items

- Updates/fixes to Accelerator Forums

- Added to lecture 3.2 of the last course of the Accelerator, helpful tips for sharing your Certificate of Completion on LinkedIn

- 94 new replies and 40 new forum topics in the Accelerator forums

April 2020

- Added template and completed Excel files to Lecture 1.4 of course 4d. Real Estate Income Statement – Multifamily

- Updated Lecture 1.1 of course 4e. Real Estate Income Statement – Industrial

- Added note to lecture 3.7 of course 5. Introduction to Modeling Leases related to modeling 1st generation leasing costs (see this forum thread for more color)

- Created a mini-tutorial with Excel template for how to model a land loan bridged to construction loan financing structure in real estate development

- Created a mini video tutorial that shows one way to model a capital stack with three sources of capital, where one source consists of customer deposits

- Added a follow-up video to supplement the mini-tutorial on bridge to construction loan structure

- Explanation of bell curve vs. s-curve, together with two charts to visualize as well as a simple Excel model to further illustrate

- 121 new replies and 54 new forum topics in the Accelerator forums

March 2020

- Video response to question related to modeling existing debt

- Lengthy forum response related to performing comp analysis

- Added ‘Watch Me Build Data Tables for Real Estate Sensitivity Analysis’ tutorial to Library of Supplementary Learning Tools

- Numerous forum post threads and responses

- Server upgrade with speed, performance, and security improvements

- Significant enhancements made to the Accelerator Forums

- New ‘Welcome Back’ section on main forum page with links to ‘New posts since last visit’ and ‘User Profile’

- ‘New topic’ and ‘New reply’ badges next to new content posted to forums

- Added sidebar sections including ‘Topics Views List’, ‘Forum Information’, and ‘Topic Information’

- Added more robust topic/reply text editor with many new features (align, font color and size, lists, links, strikethrough, indent, horizontal line, etc)

- Both WYSIWYG and HTML text edit options

- Attachments now supported for inserting Excel files, PDFs, Docs, etc

- Updated Topic/Reply notification email template

- Added a ‘Need Help?’ section to the 4E. Industrial Income Statement course to help members complete the final case assignment

- Recorded a new 20 minute Watch Me Build video showing you how to transpose a detailed industrial property income statement to a summary industrial property income statement

- Built a new Advanced Concept module entitled “Ground Leases, Valuation, and Impact on Cash Flow” with accompanying Ground Lease Valuation model

- 65 new replies and 26 new forum topics in the Accelerator forums

February 2020

- Added ‘Modeling Existing Debt’ forum video to Library of Supplementary Learning Tools

- Added guidance on how to include the A.CRE Accelerator Certificate of Completion on graduates’ resume

- Note added to ‘Waterfall Model #1 – Annual Cash Flows and a Cash-on-Cash Hurdle’ lecture to address an optional modification to the model

- Forum thread discussing modification to Cash-on-Cash Waterfall model that would improve consistency

- Added ‘Mezz Debt – Interest Partially Capitalized’ video tutorial to Library of Supplementary Learning Tools

- Added note to ”Modeling Alternative Interest Calculation Methods’ lecture related to using one method for charging interest, while using a separate method for setting debt service payment

- Created video forum response related to question about ‘Variability in Operating Expenses Based on Occupancy’

- Posted new Modeling Test ‘Hotel Investment Opportunity’ to the Library of Supplementary Learning Tools

- Posted new Modeling Test ‘Apartment Acquisition’ to the Library of Supplementary Learning Tools

- 91 new replies and 27 new forum topics in the Accelerator forums

January 2020

- Added new section to ‘Library of Supplementary Learning Tools’ entitled ‘Forum Post Videos’, providing quick access to video tutorials created in response to forum questions

- One Technique for Manually Auditing an Excel Model

- Creating Custom Conditional Formatting Rules

- Troubleshooting Slow Excel Workbooks

- Modeling a Simple Interest Preferred Return

- Combining Multiple Uses from Two Models into One

- Modeling Lease-Up Income During Construction

- Waterfall with Mid-Hold Capital Event

- Two Methods for Modeling Residential Lease-Up

- Greater Explanation of Circuit Breaker

- Adding an Operating Shortfall to Model

- How to Model Multi-tenant Industrial Building Converted to Condo

- Hiding/Showing Excess Rows and Columns

- Catch Up Provision Example

- Added new module to ‘Advanced Concepts’ course entitled ‘Creating In-Cell Buttons, Toggles, and Navigation Buttons’ in Excel

- Created video response to forum question related to making real estate financial models more intuitive and user-friendly

- Updated Guide to Getting Started to highlight the new and expanding supplementary resources

- Updated ‘The Foles’ offering memorandum to correct a rounding error in average SF (790 vs 791)

- Updated ‘Crescent Apartments’ Sales Comps Excel file to use weighted average square feet rather than average

- In course 8. Partnership-Level (Waterfall) Modeling, changed the Equity Multiple calculations for the GP and LP in lectures 2.5 and 3.1-3.2 to the more robust SUMIF() logic

- In response to a forum post, a lengthy discussion on why use Yield-on-Cost in value-add underwriting

- 68 new replies and 20 new forum topics in the Accelerator forums

December 2019

- Launched bonus ‘Guide to Networking and Careers in CRE’ course for all Accelerator Members. Includes three career case studies, nearly two hours of audio lectures, and lecture notes for how to land that next (or first) job in commercial real estate

- Added lecture: Introduction to Careers in CRE

- Added lecture: Building Your Value in Real Estate – Deal Seasoning and Quality of Network

- Added lecture: A Framework for Landing that First (or Next) Job in CRE

- Added lecture: Step 1: Choose Your Focus – Property Type, Location, Firm Type, and Role Type

- Added lecture: Step 2: Create Your “LAMP 4 CRE” List

- Added lecture: Step 3: Identify Contacts at Companies on Your List

- Added lecture: Step 4: Reach Out and Build Your Network

- Added lecture: Step 5: Submit “Warm” Applications

- Added lecture: Practice Regular Follow-Up and Give Back as Your Career Grows

- Added lecture: Appendix: The Real Estate Resume

- Updated five videos in Long-Term Leasing section of Introduction to Modeling Leases course to fix three minor errors visible in each of the videos

- Updated the Watch Me Build video and final Excel file for the Introduction to Modeling Leases course

- Added ‘Watch Me Expand a Single Family Home Construction Pro Forma to Analyze Multiple Homes’ to library of supplementary tools.

- In response to a forum post, a lengthy discussion on why use Yield-on-Cost in value-add underwriting

November 2019

- Released the ‘Modeling Annual Partnership Distributions with Monthly Property-Level Cash Flows’ module in the Advanced Concepts course

- Released the ‘Framework for Modeling Mixed-Use Investments’ module in the Advanced Concepts courses

- Reorganized the layout of the Advanced Concepts course, separating the various modules into three sections to make it easier to navigate the course

- Video response to forum post related to partnership distributions upon mid-hold cash-out refinance events

- Created new bonus course entitled: Library of Supplementary Learning Tools

- Moved Watch Me Build videos from Advanced Concepts course to this new course

- Added section where we will begin to add supplementary Case Studies

- Added section where we will begin to add supplementary Technical Interview Exams

- Added section where we will begin to add supplementary Excel files

- Updated ‘Modeling Multiple Tranches of Capital Sources Dynamically’ module to include an optional tutorial for modeling irregular timing of contributions of capital

- Video response to a forum post about how to handle irregular timing of contributions of capital

- Video tutorial created, in response to a forum question, showing how to create custom Conditional Formatting rules to improve user experience

- Minor update to the ‘Step 2’ video in the ‘Working with Apartment Rent Roll Exports’ lecture of the Real Estate Income Statement – Multifamily course

October 2019

- Added 10-part ‘Watch Me Build’ supplementary series to the Advanced Concepts in Real Estate Financial Modeling course. Lectures include:

- Lecture 2.1 – Introduction to this Watch Me Build Section

- Lecture 2.2 – Watch Me Build a Residential Land Development Model

- Lecture 2.3 – Watch Me Build a Multifamily Real Estate Model

- Lecture 2.4 – Watch Me Build a Tenant Rollover Analysis Model

- Lecture 2.5 – Watch Me Build a 4-Tier Equity Multiple Waterfall Model

- Lecture 2.6 – Watch Me Build a Construction Draw Schedule

- Lecture 2.7 – Watch Me Solve a REPE Technical Interview Modeling Test

- Lecture 2.8 – Watch Me Build a Dynamic Mortgage Amortization Table in Excel

- Lecture 2.9 – Watch Me Build 30/360, Actual/365, Actual/360 Amortization Tables

- Lecture 2.10 – Watch Me Build a 3-Tier Real Estate Equity Waterfall Model

- Released the Accelerator for Enterprise, a platform for the Accelerator real estate financial modeling training program tailor-made for organizations

- New Master Accounts and Sub-accounts

- Add new licenses as needed

- Separate login and forum for Enterprise

- Enterprise Dashboard where Master Account holder can add/edit/remove users

- Weekly email progress sent to Master Account for each sub-account; view progress of sub-account user at anytime view the Enterprise Dashboard

- Video response to a forum post on how to calculate simple interest preferred return (i.e. preferred return calculated on contributed capital); the video also covers the difference between a Cash-on-Cash vs. IRR preferred return hurdle

- Video response to a forum post on using multiple single-use models to analyze a mixed-use opportunity

- Minor error fix: In the videos for course 1. Direct Cap Method to Valuing Real Estate, the operating expenses /Unit heading reads ‘/Unit/Mo’ but it should read ‘/Unit/Yr’. The template and completed files have been corrected.

- Built and shared a multi-tiered cash-on-cash return waterfall model to help answer a forum post

- Updated General Vacancy and Credit Loss language in Boss’ Notes on The Foles case to make it more clear that the assumption should be 5% of Gross Revenue

- Video tutorial in response to forum question around how to fix a slow Excel Workbook

- Added text-searchable captions to all 217 videos within the following courses/sections

- All videos posted to forum threads

- i. Guide to Getting Started with A.CRE Accelerator

- 1. The Direct Cap Method to Valuing Real Estate

- 2. The DCF Method to Valuing Real Estate

- 3. Anatomy of the Real Estate DCF

- 3a. Calculating Key Risk and Return Metrics

- 4a. Real Estate Income Statement – Retail

- 4b. Real Estate Income Statement – Hotel

- 4c. Real Estate Income Statement – Office

- 4d. Real Estate Income Statement – Multifamily

- 4e. Real Estate Income Statement – Industrial

- 5. Introduction to Modeling Leases

- 6. Introduction to Development Cash Flow Modeling

- 7. Introduction to Real Estate Debt

- 8. Introduction to Partnership-Level (Waterfall) Modeling

- 9. Building an Acquisitions Model from Scratch

- 10. Building a Development Model from Scratch

- 11. Solving a Real Estate Financial Modeling Test

- Advanced Concepts in Real Estate Financial Modeling

- Added link to forward rate curve on How to Model Floating Rate Debt module

- Replaced a broken link in lecture 2.3 of course 1. The Direct Cap Method to Valuing Real Estate, that had referenced now unavailable information on RUBS

September 2019

- Minor update to the ‘Guide to Getting Started’

- Updated Boss’ Notes in Course 1 to clear up confusion around Gross Potential Revenue vs. Gross Market Rent

- A video response to a forum question about modeling multifamily lease-up during construction

- In response to a forum question, the guys offer one methodology for determining the discount rate to use when calculating the present value of a tax abatement benefit

- 17 new topics added to the Accelerator forums

August 2019

- Released ‘Considerations in Portfolio-Level Modeling’ module in the Advanced Concepts course

- Prior quiz results are now archived after each attempt so you can see past results

- Added functionality to be able to review quiz results after completion

- In response to a forum post, Spencer created a quick tutorial for partitioning the IRR of an investment with a mid-hold cash-out refinance

- A forum question and multiple responses around how to calculate cash-on-cash return in the context of a construction loan takeout with equity proceeds

- Released ‘Modeling Partnership Crystallization / Ownership Reset’ module in the Advanced Concepts course

- Misc. updates to 6. Introduction to Development Cash Flow Modeling

- 15 new topics added to the Accelerator forums

July 2019

- Added link to the A.CRE Job Board in the main menu; A.CRE Jobs is a great free resource for Accelerator members to search for jobs in CRE

- Released ‘Add a Recalculate Button to Your Development Model with Non-Circular References’ module in the Advanced Concepts course

- In response to a forum post, Michael uploaded a video where he expands on the discussion of adding a Circuit Breaker when using circular references in Excel

- A greater explanation of the logic used to calculate GP Distribution is now provided in Lecture 2.3 of Course 8. Introduction to Partnership-Level (Waterfall) Modeling

- Update Accelerator Member home page to include button to Accelerator Forums

- Revamped Hotel Income Statement course to provide greater clarity and improve video tutorials

- Updated video to Course 7, Lecture 3.5 – Projecting Debt And The Interest Reserve Over the Development Period – Without Circular References – to improve debt cumulative balance calculation formula.

- In response to a forum post, Spencer uploaded a video tutorial of two methods for modeling residential lease-up

- Added video to lecture 2.3 of ’11. Solving a Real Estate Financial Modeling Test’ showing an alternative (and preferred) method for calculating the mezzanine loan debt service payment in this case

- 19 new topics added to the Accelerator forums

June 2019

- Created ‘What’s New – Accelerator Changelog’ page for helping users track changes and be made aware of new features

- Edited ‘Guide to Getting Started’ with link to Accelerator Changelog page

- Added links to Changelog on member home screen

- Released ‘One Technique for Modeling an LP Clawback Provision’ module in Advanced Concepts course

- Released ‘Modeling a Construction Loan Takeout’ module in the Advanced Concepts course

- In the ‘Guide to Getting Started’, combined “More Than Just a Real Estate Financial Modeling Course” lecture with the “What is the Accelerator?” lecture

- Updated ‘Key-Excel-Functions.xlsx’ to ‘Key-Excel-Functions-v1.1.xlsx’, a Workbook included in the Guide to Getting Started, fixes issue where INDEX/MATCH, VLOOKUP, and HLOOKUP were not calculating correctly

- In response to a forum question, uploaded a video tutorial for adding an Operating Shortfall to my ‘Watch Me Complete’ a WSO REPE Modeling Test

- Added two new forums

- Non-Course Specific Real Estate Financial Modeling Questions

- Careers in Real Estate Questions

- Added a discussion around IRR*12 vs XIRR in partnership-level waterfall modeling. This can be found under the heading ‘A Comment on IRR Calculation Methods’ in lecture 2.3 of ‘8. Introduction to Partnership-Level (Waterfall) Modeling’

- 11 new topics added to the Accelerator forums

- Misc. content updates and bug fixes

May 2019

- Added enhanced search feature to make finding information in forums and courses faster and easier

- Added to main menu, page sidebar and course sidebar

- In-lecture search functionality to be released in June 2019

- Released ‘Two Techniques for Modeling a GP Catch Up Provision’ module in Advanced Concepts course

- 17 topics added to the Accelerator forums

- Implemented various server-side enhancements and adjustments to improve website speed

April 2019

- Released ‘Real Estate Sensitivity Analysis Using a Data Table in Excel’ module in Advanced Concepts course

- Released ‘Modeling Multiple Tranches of Capital Sources Dynamically’ module in Advanced Concepts course

- 24 topics added to the Accelerator forums

- Misc. content updates and bug fixes

March 2019

- Added ‘Advanced Concepts in Real Estate Financial Modeling’ course layout and curriculum

- Released ‘Introduction to Advanced Concepts’ module in Advanced Concepts course

- Released ‘Modeling Floating (Variable) Rate Debt’ module in Advanced Concepts course

- 31 topics added to the Accelerator forums

- Misc. content updates and bug fixes

February 2019

- 20 topics added to the Accelerator forums

- Fixed an issue where courses we’re not appearing properly for some users

- Visual enhancements to Learning Dashboard

- Various content updates and Excel model bug fixes

January 2019

- Initial launch of 16 core Accelerator courses and Accelerator forums

- 31 topics added to the Accelerator forums

- Various content updates and Excel model bug fixes