A.CRE Offering Memorandum Creator Assistant

At A.CRE, we are passionate about innovation and using artificial intelligence (AI) in real estate financial modeling. Our commitment is to offer advanced AI tools and knowledge to our readers and members of the A.CRE Real Estate Financial Modeling Accelerator so that they can transform their approach to the challenges and opportunities in real estate investment today.

In the commercial real estate sector, property presentations to investors, developers, and other key players heavily depend on detailed, well-structured documents that include technical, financial, and market information, all within an attractive and clear format. These memorandums are crucial for investors to make informed decisions about property acquisitions or investments.

After sharing the A.CRE Real Estate Case Studies Creator Assistant, we wanted to take another step towards continuous improvement in education and professional practice in the industry by facilitating the task for those seeking to simulate complex and realistic scenarios in their financial analyses. Today, we proudly introduce the A.CRE Offering Memorandum Creator Assistant!

This new initiative, developed by A.CRE team member Arturo Parada, is designed to enhance the experience of those working with real estate case studies, allowing them to generate real, detailed, and customized offering memorandums based on real estate case studies. This GPT complements the A.CRE Real Estate Case Studies Creator Assistant, ensuring advanced professional practice in real estate financial modeling, scenario simulation for professionals and students, and the evaluation of real estate financial skills for recruiters.

- Note: Starting in April 2024, a ChatGPT Plus (i.e., paid) membership will be required to use custom GPTs like this real estate offering memorandum creator.

Why was the real estate offering memorandum creator assistant built?

The A.CRE Offering Memorandum Creator Assistant was designed to complement the A.CRE Real Estate Case Studies Creator Assistant, forming a robust system that enhances analysis, presentation, and decision-making in the real estate sector. Together, they provide an optimized workflow, from creating case studies to generating detailed offering memorandums, resulting in a fully real analysis scenario for real estate professionals.

Now, you won’t only have a fully customized real estate case study, but you will also have a detailed professional document on hand that simulates and communicates the business plan behind the investment!

A.CRE Real Estate Financial Modeling Accelerator will help you build real estate financial models of these real cases to take your career to the highest level!

User Guide – A.CRE Real Estate Offering Memorandum Creator Assistant

1. Prepare your real estate case study

Before starting, you will need a detailed real estate case study, which you can create using the Case Studies Creator Assistant. This should include key details such as the type of property (e.g., retail, multifamily, office), location, financial details (NOI, cap rate, sale price, etc.), property and tenant information, details and projections, etc.

The real estate case study allows the A.CRE Offering Memorandum Creator Assistant to analyze various scenarios and gain a deep understanding of the assets. This workflow reduces the time needed to develop a complete OM from scratch by leveraging the case study analysis and presenting it in a structured way in the OM.

Each case study serves as an engine that feeds both the numerical data and the narrative and contextual analysis, ensuring that each offering memorandum accurately reflects the property’s conditions and the market.

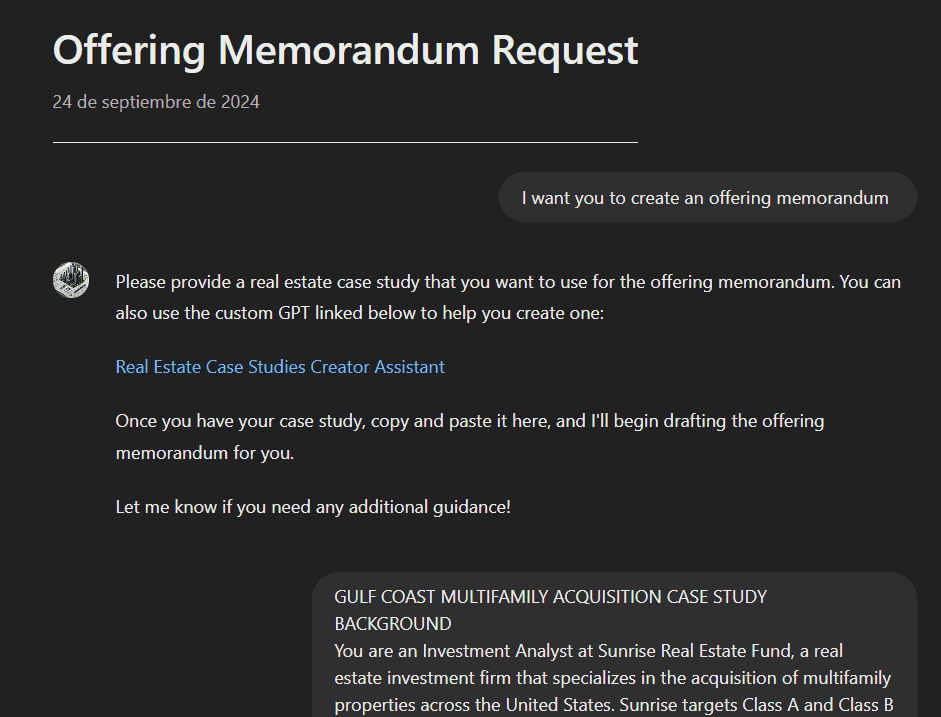

2. Input your case study

Once you have the case study, copy and paste it into the tool for review. This case is then integrated directly into the offering memorandum creator assistant, which transforms the analytical data into a professionally structured and highly detailed document, adding a narrative context, ready to be presented to investors.

This custom GPT will use this information as the fundamental basis to generate the offering memorandum!

Offering Memorandum Structure

Each offering memorandum (OM) will include the following sections. You can provide specific details for each section or allow the assistant to fill in the missing details using assumptions based on trends and real estate industry norms.

1. Cover Page

The cover includes:

- Property name or address.

- Fictitious brokerage firm name.

- Title: “Offering Memorandum.”

2. Table of Contents

A clean, professional table of contents with sections such as Executive Summary, Financial Summary, Market Overview, etc.

3. Executive Summary

The executive summary includes:

- Property Description: Brief description of the property type, size, and location.

- Investment Highlights: Key selling points such as stable cash flow, location advantages, and potential returns.

- Attractive Features: Unique property characteristics and why it stands out.

4. Property Overview

A complete breakdown of property details, including:

- Size, year built, number of units or tenants.

- Property history, recent renovations.

- Building Features: Structural specifications, amenities, parking information, etc.

5. Project Description (For Development Projects)

The project description includes:

- Highlights of development opportunities, including timelines, costs, and expected completion dates.

- Narrative on potential rental prices, development phases, and market demand.

6. Location Description

The location description includes:

- Overview of the geographical area: Description of the surrounding area, amenities, transportation, and economic data.

- Demographic Information: Population trends, income levels, and key market statistics.

7. Financial Summary

- Key investment terms (e.g., down payment, loan amounts).

- NOI Projections and Calculations: A table breaking down income and expenses over a 5 or 10-year period.

- Rent roll, vacancy rates, debt structure, and projected returns.

8. Investment Opportunity

- Detailed description of why the property is an attractive investment.

- Market Trends: Local market performance and projections that support the long-term value of the investment.

9. Market Description

- Economic Data: Key economic factors such as employment growth, GDP, population trends, and local industries.

- Real Estate Market Trends: Data on vacancy rates, rental prices, and capitalization rates (cap rates).

10. Target Audience

- Identification of the ideal investor, e.g., institutional buyers, family offices, or developers.

- Customized messaging tailored to the goals of the target audience.

11. Focus Areas (Risk, Returns, Development Potential)

- Risk Factors: Identification of market, financing, and leasing risks.

- Returns Analysis: Sensitivity analysis and financial projections based on scenarios.

12. Specific Data Points

- Incorporation of key metrics such as rent price per square foot, occupancy rates, cap rate comparisons, etc.

13. Hypothetical Sales Comparable and Projections

- Sales Comparable: Table of comparable sales in the area with prices and cap rates. You can ask the GPT to generate a table of hypothetical comparable sales to be added to the offering memorandum.

- 10-Year Financial Projection: Details on income, expenses, and appreciation projections.

14. Final Page

- Fictitious brokerage firm names.

- Broker contact details.

Video Walkthrough – A.CRE Offering Memorandum Creator Assistant

Use cases for the Offering Memorandum Creator Assistant GPT

The ability of this GPT to create professional offering memorandums based on the case studies provided significantly enhances the educational and professional scenarios outlined by the Real Estate Case Study Creator Assistant, such as:

1. ADVANCED PROFESSIONAL PRACTICE IN REAL ESTATE FINANCIAL MODELING

By generating offering memorandums, the GPT can use the case studies created by the assistant to detail the financial and technical aspects of real or simulated properties, helping users visualize how financial modeling works in real-world contexts.

An offering memorandum provides a detailed insight into the elements that investment analysts, developers, or brokers review before making decisions. This type of document helps users seeking to understand the daily responsibilities of these roles and gives them a realistic view of the tasks and challenges they might face in their careers.

2. REAL ESTATE SCENARIO SIMULATION FOR PROFESSORS AND STUDENTS

The offering memorandums generated provide an in-depth analysis of investment scenarios and the financial performance of real estate properties, aligning with the need to assess risks and returns. By developing complete offering memorandums based on case studies, real estate modeling professors and students gain a clearer understanding of how different market factors can affect investment performance in a fully real context.

3. EVALUATING REAL ESTATE FINANCIAL SKILLS FOR RECRUITERS

This tool serves as another potential resource for CRE employers, allowing them to assess the competence of future professional candidates in real estate financial modeling. Additionally, by using case studies and converting them into complete offering memorandums, the GPT can help employers evaluate candidates’ skills in preparing complex technical documents, including financial analysis, executive summaries, and presenting projections and market analysis, all of which are key elements in real estate investment decisions.