A.CRE 101: CRE Risk Profiles (Updated May 2023)

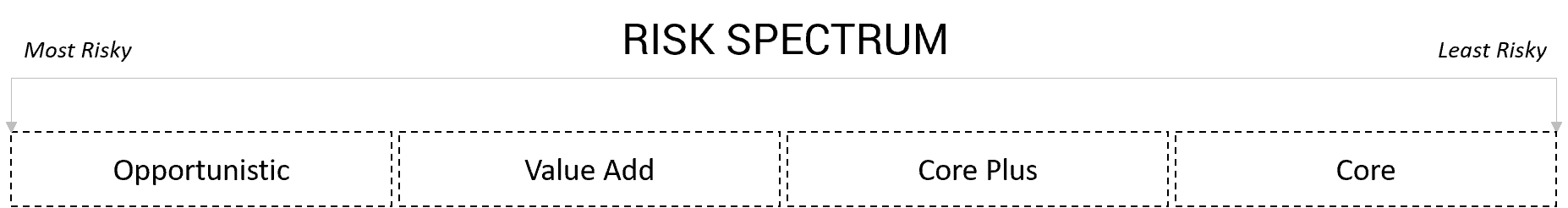

In this post we will go into detail about the four CRE risk profiles commonly ascribed to commercial real estate opportunities. In order of least risky to most risky, they are as follows:

This broad categorization helps commercial real estate professionals to quickly describe the type of risk/reward profile of opportunities they are offering or seeking.

General Overview of Measuring Riskiness

Real estate deals vary in how risky they are and correspondingly, what kind of return one would expect to receive to invest in the risk. The riskier the project, the higher the expected return. For each opportunity, an investors will need to gauge the risk of losing money against the potential for profits based on a multitude of factors.

Some of the more obvious risk factors to analyze are the condition of the asset itself, the business plan for the asset upon acquisition, the personnel in charge of executing the plan, local market conditions, and micro and macro economic factors. Based on the perceived risk of the project, a common approach for a typical real estate investor will then be to determine a price they would be willing to pay for the asset using a discounted cash flow analysis (“DCF”).

A DCF will derive the IRR and Equity Multiple, two of the most common metrics used to value real estate, and the investor can then calibrate the purchase price and other variables so that the IRR and/or Equity Multiple will increase or decrease to show returns that would be in line with their perceived riskiness of the project.

To learn more about the basics of a discounted cash flow analysis check out our A.CRE 101 post: How to Use the Discounted Cash Flow (DCF) Method to Value Income Producing Properties.

The 4 CRE Risk Profiles

Note: Expected return ranges highlighted below for each risk profile are generalized and can vary between one person/institution/deal to the next and can also be subject to fluctuation based on macroeconomic factors that impact the broader investment and interest rate environment.

Core

Core assets are the least risky real estate investments. They are traditionally high quality, centrally located, and well-maintained buildings that have a very low probability of long term vacancy and a predictable cash flow stream into the foreseeable future.

Think of a fully leased Class A office tower with credit tenants that have long term leases in place in a market that historically has very low office vacancy. As you can probably guess, this lower risk asset will command a lower return (i.e. a higher purchase price) when compared to the other risk profiles due to the fairly certain future of the building, market, and its cash flow. A levered IRR for this risk profile may range from ~6% to ~11%.

Core Plus

Core Plus assets are otherwise core assets, but with some component of risk (opportunity) attached to it. Using our office building example from above, a core plus asset could have all the same qualities, but may have a few tenants vacating in the near term and the space needs to be re-leased. Or it could be that the location of the asset is a bit outside of the prime office submarket. A levered IRR for this risk profile could be around ~8% to ~13%.

Value Add

Value add assets are generally properties with opportunities to increase cash flow and property value through making some sort of major improvement. The opportunities to increase value for value add scenarios are numerous and range from simple to very complex.

It may be that a property has significant deferred maintenance or dated and worn out common areas and a major capital improvement plan could attract better tenants and higher rents; or it could be that there are major inefficiencies in the management of the building and an active and more experienced manager could significantly bring down expenses and improve the quality of the tenant experience and the asset.

Risk with these opportunities are greater because there is real possibility that the anticipated results of the value add plan could not come to fruition. For example, if a major capital improvement project fails to attract higher quality tenants and higher rents, substantial amounts of money would have been invested, while the projected increased cash flow will not be actualized and the property would not have reached the anticipated value.

Imagine a scenario where a new owner does not renew a major tenant lease and elects to do a significant and expensive upgrade of the space to attract a higher quality, higher paying tenant only to discover that upon completion that tenant does not exist in the market. This is one of an endless amount of value add business plans that expose investors to increased risk. An anticipated return for these types of real estate investment could be in the range of ~12% – ~16%.

Opportunistic

Opportunistic assets are the riskiest real estate investments that can be pursued. Development opportunities or buying a vacant building to reposition and try to lease up are two examples of opportunistic real estate investments. For more context, development or redevelopment projects will usually require navigating through numerous uncertainties.

Taking on a development or redevelopment will usually require the project to go through an entitlement phase to get approvals to move forward with designing and building the project. There is always a risk that this process could take significant time, sometimes for years, causing the ownership to pay more carrying costs and consultant fees (e.g. fees for the A&E team and lawyers) while market conditions that made the opportunity viable could change.

It is also possible that the project doesn’t get approved at all. Furthermore, there is construction cost risk as time, politics, and labor availability could significantly alter the cost of construction from when the project was first underwritten. Finally, there is a risk on the back end of actually leasing and/or selling the project upon completion for a profit. These are just a few of the more obvious risks that are present for development projects. Anticipated returns for opportunistic deals can be anywhere from ~15% and up.

Understanding CRE Risk Profiles

Understanding these profiles, which include Core, Core Plus, Value Add, and Opportunistic, is essential for both investors and industry professionals. Each profile represents a different level of risk and potential reward, allowing investors to gauge their comfort level and make informed decisions. From the least risky Core assets with stable cash flows to the riskier but potentially more lucrative Opportunistic ventures, the risk profiles provide a framework to assess CRE opportunities. It’s crucial to conduct thorough analysis, consider various factors, and determine the appropriate risk-reward balance for each investment. By understanding and utilizing the CRE risk profiles, investors can navigate the dynamic real estate market with more confidence and strategic foresight.