Hotel Acquisition Model – The Basic Model (Updated 10.9.2019)

The initial goal for the original Hotel Acquisition Model was to design a hotel proforma that would enable users to get deep into the weeds of practically every line item in their hotel analysis. Although I am super happy with how that hotel proforma has turned out, there are many instances where that model may be more than what is required or needed to underwrite a potential hotel acquisition. I also recognize that for those just trying to gain a conceptual understanding of hotel underwriting it may be a bit overbearing. It is with that in mind, that I created the new Hotel Acquisition Model – The Basic Model.

This hotel proforma is still incredibly versatile, but it is much more streamlined and without a lot of the nuance. The model contains only four tabs as opposed to eight tabs on the original model, with two of them coming directly from the original Hotel Acquisition Model without alteration (the Cash Flow Summary tab and the Waterfall tab), one of them coming from the original Hotel Acquisition Model with alterations (the Summary tab), and the Operating Cash Flow tab that is brand new and unique to this model.

Below is a video walk through and a written high level overview. At the very bottom of the page is where you can download the model. Click here to go directly to the download section.

Video

Overview

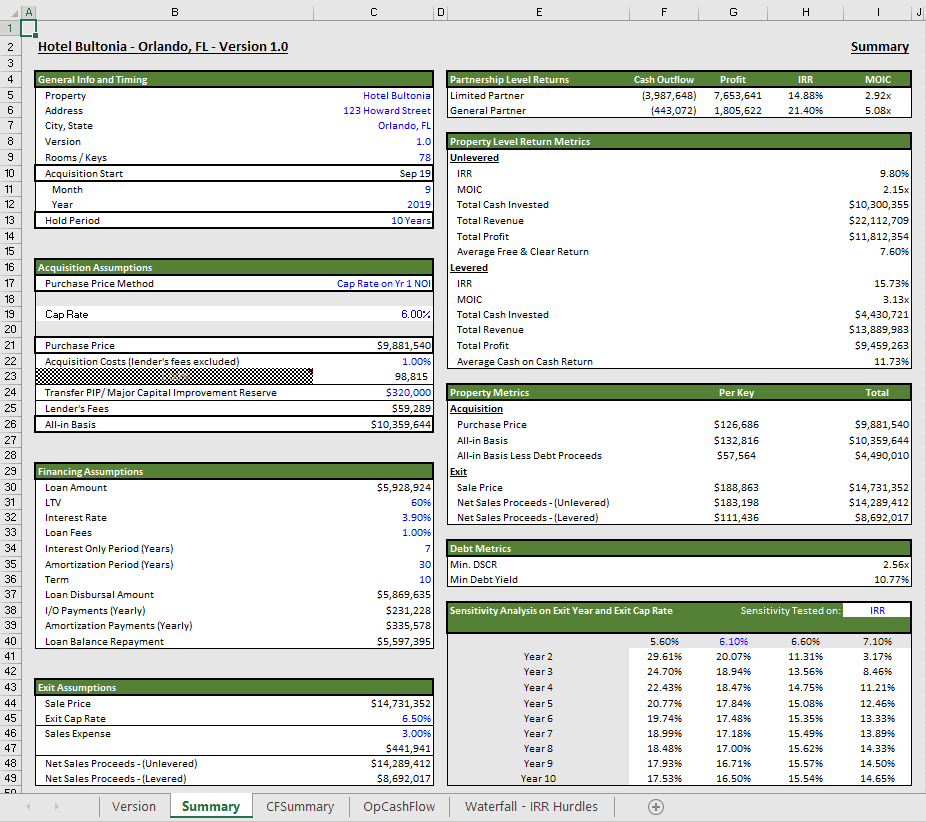

Summary Tab

The tables in the Summary tab of this hotel proforma are identical to the tables presented in the more complex original model, only with a few tables removed. Below we will review the input components here. Please review the image above for addition info about the tab.

General Info and Timing

Here is where you will manually input location information, model iteration, number of rooms, start date, and hold period.

Acquisition Assumptions

In the drop down menu, cell C17, you can select to value the property using three options – (1) cap rate on year 1 NOI, (2) using a discount rate, and (3) or hard coding a value. Rows 18-20 will update accordingly to allow you to update the acquisition assumption based on what methodology you choose. Below that, you will manually put in acquisition costs and cost for the PIP (property improvement plan) in the cells with blue text.

Financing Assumptions

The financing assumptions here are similar to all of our other models. You have the ability to input the LTV, interest rate, loan fees, interest only period, amortization period, and term.

Exit Assumptions

The exit cap rate will be applied to the following year’s NOI after the hold period. You can also put in a percentage rate for sales expenses and review the net sales proceeds on a levered and unlevered basis.

Sensitivity Analysis

Here you can review the impact to unlevered return metrics at different hold periods and exit cap rates. You can manually alter the exit cap rates being analyzed in cell G40. The other exit cap rates in the analysis will alter by 50 basis points from whatever cap rate is input here. In cell I38, there is a drop down menu where you can review how these two inputs effect different return metrics. The drop down menu allows you to review the impacst to IRR, MOIC, and overall profit.

Cash Flow Summary Tab

This tab is virtually identical to the one in our more robust hotel model. Please review the video created for the other model below for an overview.

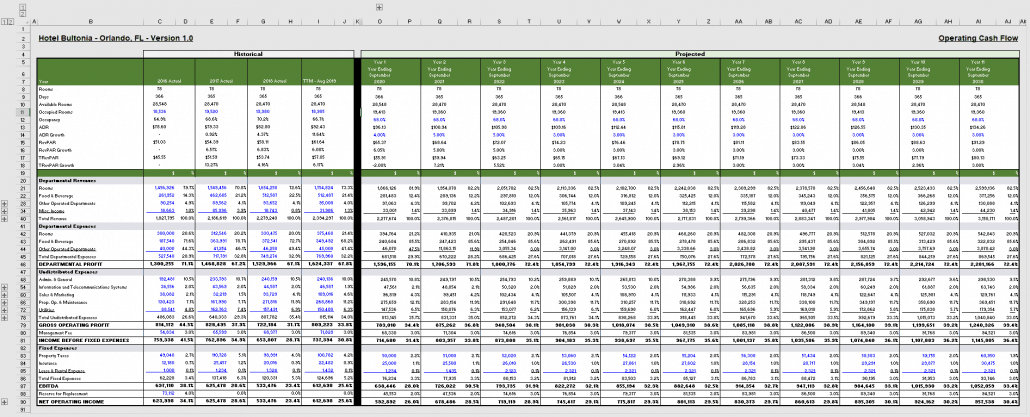

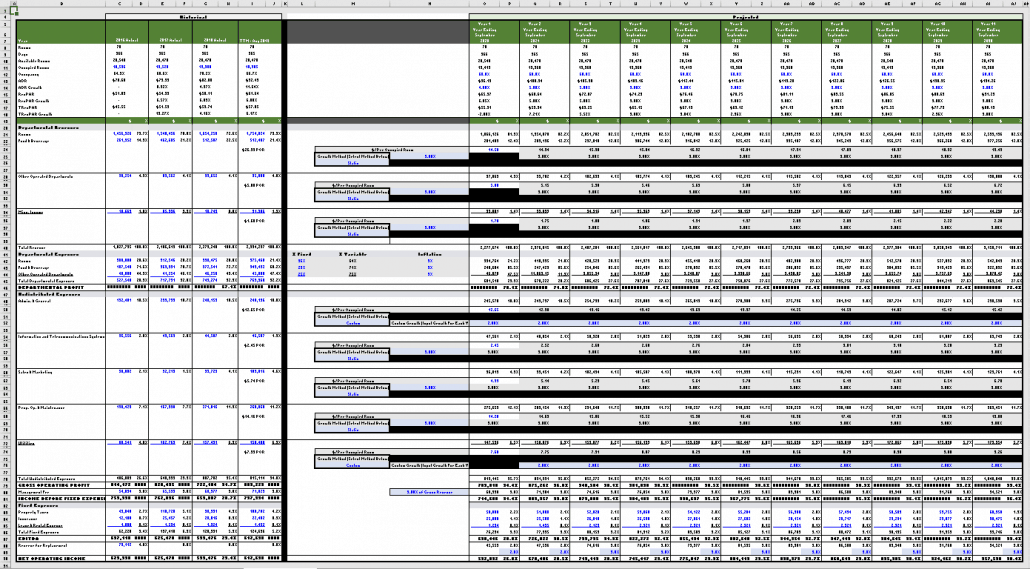

Operating Cash Flow Tab

This tab is where all of the operating inputs are. To the left of the thick black line (Row K), we have our historical operating statements. We have inputs for the last 3 calendar years as well as the TTM. For the historical operating statements, all the line items are blue and should be manually inserted as these are not projections and there should be actuals. To the right of Row K are our projections. First thing I would recommend is to go to the top left corner and click on the two number 2s to open up the hidden cells (see top left of the image above). Once you do that, the sheet should look like below:

At this point, you can now review all of the inputs. For Departmental Revenues and Undistributed Expenses, you have the ability to use a steady growth percentage rate or a custom growth rate for each period (see Row M). In the Departmental Expenses section, you can apply a static growth rate as well as bifurcate what portion of the costs are fixed and variable. Fixed Expenses have manual inputs in each period and reserves are calculated as a percentage of Total Revenue and can be customized in each period. For a more thorough and detailed walk through of this tab, please check out the video at the top of the page.

Waterfall Tab

Like the Cash Flow Summary tab, this tab is virtually identical to the waterfall tab in the original hotel model. Please review the video created for the other model below for an overview.

Download the Hotel Acquisition Model – The Basic Model

To make this model accessible to everyone, it is offered on a “Pay What You’re Able” basis with no minimum (enter $0 if you’d like) or maximum (your support helps keep the content coming – similar real estate acquisition models sell for $100 – $300+ per license). Just enter a price together with an email address to send the download link to, and then click ‘Continue’. If you have any questions about our “Pay What You’re Able” program or why we offer our models on this basis, please reach out to either Mike or Spencer.

We regularly update the model (see version notes). Paid contributors to the model receive a new download link via email each time the model is updated.

Version Notes

Version 1.0 – 2019.9.19

- Initial launch

Version 1.1 – 2019.10.08

- Added CFAF line to the CFSummary tab

- Minor formatting updates