Could You Be Exiting Too Early? Don’t Forget to Analyze Your Reinvestment Rate

When attempting to maximize the value of your money invested in real estate, the timing of your exit is key to maximize your return. Exit too early, and you might leave money on the table. Exit too late, and you might have better used that capital on other opportunities. In this quick post, I discuss how to use the Reinvestment Rate to help assess the proper point to exit a real estate investment.

Example of Timing Your Exit

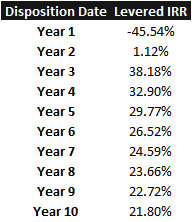

As an example, let’s take a look at the base case from my Multifamily Redevelopment Model that I shared to our library of real estate models years ago. This particular example is for the 123 Fake St property. Below is the projected levered IRRs for that property:

Based on the table above, it is clear that exiting in year 3 would maximize the return on our money. Every year we keep our money in after year 3, we are seeing a diminishing return on our initial investment. This is provided our assumptions for our model hold true, of course. So it would seem like a no brainer that the best option would be to redevelop and exit.

Add Reinvestment Rate to the Analysis

However, a key issue one needs to consider when planning an exit strategy is what will he or she reinvest this money in after the exit. Will there be investment opportunities that will achieve returns on par with 123 Fake St in years 4 through 10?

If you have not planned your reinvestment strategy and have not identified opportunities that meet or exceed the returns in the subsequent years, than it would not be in your best interest to exit in year 3 if maximizing your return on investment is the primary goal.

Example of Using Reinvestment Rate to Analyze Exit Timing

To illustrate, let’s say the maximum holding period on 123 Fake Street was 4 years and the exit is 32.90% in year 4 as stated in the table. You have the option to dispose of the property in year three or four. The only other investment opportunity you have with your proceeds from the sale in year three is a 10% fixed income return in year 4, which will pay monthly. Using this example and reinvesting the proceeds at 10%, the IRR over the four year period is 31.48%. This is 1.43% lower than if we just stayed in the deal until the end of year 4. The attached excel model will show the calculations for our IRRs.

In sum, this is why it is critical to understand what reinvestment options you have when deciding upon exiting a deal. Although you may see diminishing returns by extending the hold of your investment, without another opportunity available that presents equal or better returns the best option will be to stay in the deal.

- Click here to download the file used in the above example