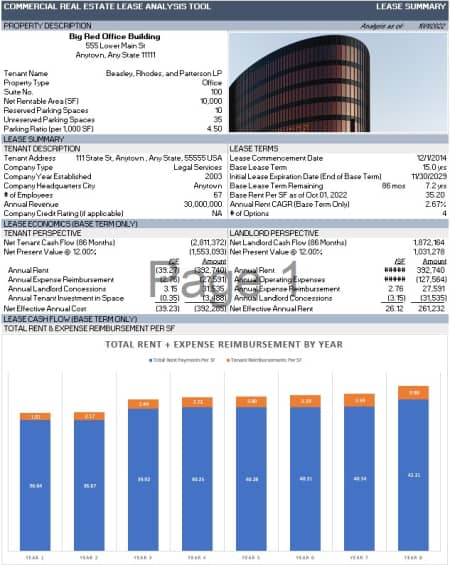

Commercial Real Estate Lease Analysis Tool

A robust, institutional-quality real estate Excel tool for analyzing commercial real estate leases from the perspective of both the tenant and the landlord. Includes a comprehensive Lease Abstract, from which lease cash flows are modeled and their various metrics such as net effective rent, annual rent per SF/M2, and net present value of lease cash flows are calculated. (View description of model)

Note: Compatible with Microsoft Excel 2013 and newer.

To make this tool accessible to everyone, it is offered on a “Pay What You’re Able” basis with no minimum (choose ‘Free’ if you need) or maximum (your paid support helps keep the content coming – typical real estate analysis tools sell for $100 – $300+ per license).

Instructions: 1) set a price, 2) tell us where (email address) to send the model, 3) enter payment details (if applicable), and then 4) click ‘Proceed with Download’. The system will send you a download link, as well as add the file to your ‘My Downloads’ page.

Related products

-

Apartment Acquisition Model with Monte Carlo Simulation Module

From: $0.00Select options This product has multiple variants. The options may be chosen on the product page -

Real Estate Equity Waterfall Model with Cash-on-Cash Return Hurdle

From: $0.00Select options This product has multiple variants. The options may be chosen on the product page -

Waterfall Model For Real Estate Joint Ventures with Catch Up

From: $0.00Select options This product has multiple variants. The options may be chosen on the product page -

Watch Me Build a 3-Tier Equity Waterfall Model – Template and Completed Modules

From: $0.00Select options This product has multiple variants. The options may be chosen on the product page