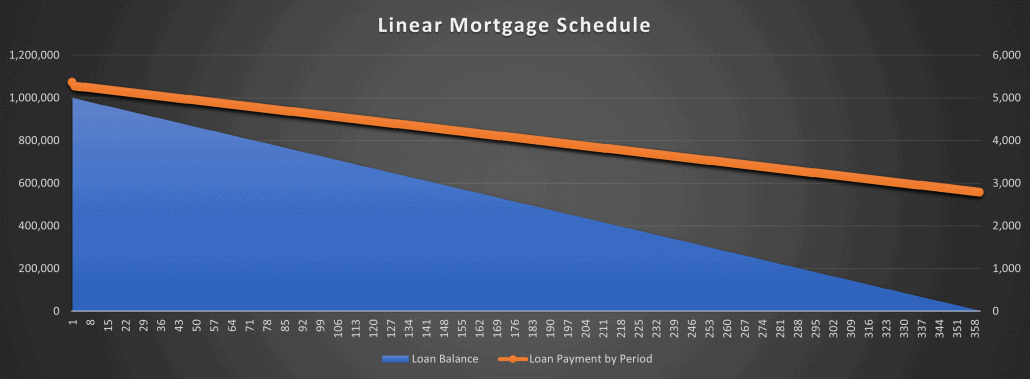

Linear Mortgage

A mortgage loan where the amount of principal due in each period is static. As a result, the loan payment due in each period decreases over time as the amount of interest due decreases and the principal due stays the same. The loan balance likewise decreases in a straight-line (i.e. linear) fashion over the loan term.

Putting “Linear Mortgage” in Context

Scenario Overview

Thames Square Partners, a real estate investment firm, has recently acquired Fleet Street Tower, a 150,000-square-foot Class A office building in the heart of London’s core business district. The property was purchased for £75 million, and the firm secured a £50 million linear mortgage to finance the acquisition. This financing strategy was chosen for its predictable amortization schedule and declining payment structure, which aligns well with the building’s stable rental income.

Loan Structure

The linear mortgage has a 20-year term with a fixed annual interest rate of 5%. Under this structure, the principal repayment is the same each year, while the interest component decreases over time as the outstanding loan balance is reduced. This results in lower total payments as the loan matures.

- Annual Principal Payment: £50,000,000 ÷ 20 = £2,500,000 per year

- Initial Annual Interest Payment: 5% × £50,000,000 = £2,500,000

- Initial Total Annual Payment: £2,500,000 (principal) + £2,500,000 (interest) = £5,000,000

- Final Year Total Payment: £2,500,000 (principal) + £125,000 (interest on remaining £2,500,000 balance) = £2,625,000

Contextual Relevance

This structure benefits Thames Square Partners because the declining payments free up cash flow over time. Early on, when the payments are highest, the building’s NOI (net operating income) is projected to comfortably cover the £5 million payment with a debt service coverage ratio (DSCR) of 1.8x. As rental income increases with annual lease escalations, the reduced debt burden further enhances cash flow available for distributions or reinvestment.

The straight-line reduction in the loan balance also means that Thames Square Partners will benefit from steadily increasing equity in Fleet Street Tower, potentially providing more refinancing or exit options in the future.

Hypothetical Example of First Three Years’ Payments

- Year 1:

- Principal Payment: £2,500,000

- Interest Payment: £2,500,000

- Total Payment: £5,000,000

- Remaining Balance: £47,500,000

- Year 2:

- Principal Payment: £2,500,000

- Interest Payment: £2,375,000 (5% of £47,500,000)

- Total Payment: £4,875,000

- Remaining Balance: £45,000,000

- Year 3:

- Principal Payment: £2,500,000

- Interest Payment: £2,250,000 (5% of £45,000,000)

- Total Payment: £4,750,000

- Remaining Balance: £42,500,000

Conclusion

This hypothetical case demonstrates how a linear mortgage can be a strategic choice for an investor like Thames Square Partners, particularly in a core asset with stable cash flow. The predictable decline in payments provides financial flexibility while ensuring steady equity growth in the property.

Click here to get this CRE Glossary in an eBook (PDF) format.