Construction Draw Schedule: Accounting For True LTC (Updated Apr 2022)

When lenders provide debt for a development project, they lend based on a Loan-to-Cost ratio (LTC), which is simply the percent of the total budget the lender will agree to lend to the borrower. So, if a project costs $10MM, and a lender loans $6MM, the lender is lending at a 60% LTC. However, the true LTC, and thus, the actual dollar amount loaned, gets a bit tricky to calculate in most cases because in addition to lending to a percent of the total project budget, the lender will also allow the borrower to defer and capitalize interest payments until the project is complete and the loan can be paid back or refinanced.

Mitigating A Common and Potentially Costly Error During Development Underwriting when considering LTC

As a result, the lender sets up an interest reserve and includes it as part of the total development budget when calculating the LTC. If the lender does not do this, he or she is effectively lending more money than intended because the lender is now covering 100% of the interest costs of the project over the duration of the loan. See the example below for further clarification.

Example Highlighting the True Cost to a Lender Loaning to an LTC Ratio without Considering the Interest Reserve

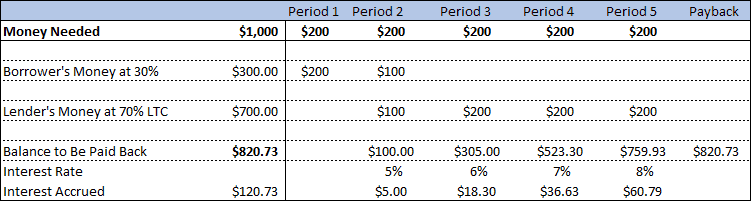

A lender agrees to make a loan based on a 70% LTC ratio. The loan is $700 for a $1,000 project. The project only lasts 5 periods and like most construction loans, there is a floating interest rate, which in this case is projected to start at 5% when the loan kicks in and grow 1% each period. Also, the lender will allow the borrower to capitalize interest and pay it off at the end of the term. The costs incurred over the 5 periods is expected to be $200 a period. So without first considering an interest reserve and loaning at a 70% LTC, the cash flow looks as follows:

Looking at the table above, notice that with the accumulated interest included in the total cost, the project is actually $1,120.73. The lender is lending the borrower $820.73, $120.73 more than desired. The LTC is not really 70%, but 73.2%.

The challenge of modeling for a truly accurate LTC that includes the interest reserve

In the example above, how can we add the interest reserve to the total budget and then redistribute the costs so that the borrower is actually paying 30% of the total cost and the lender is actually achieving the desired 70% LTC?

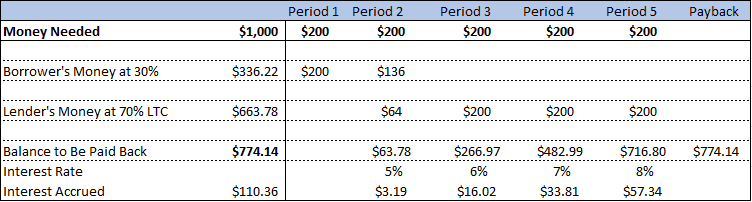

As you may suspect, we cannot simply take the $120.73 interest reserve calculated and split it 70/30 debt to equity because the equity is paid out first and thus, adding the additional $36.22 (30% of the interest reserve) to the upfront equity payment sets off a chain event. The additional equity added up front now changes the amount of debt required, which can also change timing of when the debt is disbursed, and therefore change the interest reserve amount needed. As a result, we still do not get the desired LTC and accurate allocation of capital to debt and equity. See below how this actually plays out:

The LTC is now 69.72% and still not the desired 70% LTC. Although we are close to 70% in this example, this number can change drastically with different scenarios.

The construction draw module below provides an easy solution to this problem and the corresponding video explains how it works. It was a little too painstaking to try and spell it out in text so apologies for not resolving this in writing, but I hope the video makes it clear and easy for you to understand.

Enjoy!

Compatibility

This version of the tool is only compatible with Excel 2013, Excel 2016, and Excel 365.

Download the Tool Source File

To make this source file accessible to everyone, it is offered on a “Pay What You’re Able” basis with no minimum (enter $0 if you’d like) or maximum (your support helps keep the content coming – typical tools sell for $25 – $100+ per license). Just enter a price together with an email address to send the download link to, and then click ‘Continue’. If you have any questions about our “Pay What You’re Able” program or why we offer our models on this basis, please reach out to either Mike or Spencer.

We regularly update the file (see version notes). Paid contributors to the tool receive a new download link via email each time the tool is updated.

Version Notes

v1.0

- Initial release

Video Tutorial – Calculating True Loan-to-Cost