European-Style Waterfall

A common method for distributing investment cash flow between two or more partners. A European-Style waterfall refers to a form of equity waterfall where no promote (i.e. carried interest) is paid to the sponsor (i.e. general partner) until the limited partner has received a full return of capital and earned a preferred return. As such, distributable cash flow during operations and distributable cash flow at a capital event are largely treated the same.

While referred to as European-style, this form of real estate partnership waterfall is common worldwide including in the United States. It is often preferred by limited partners as it reduces the probability that promote distributions made to the GP must be clawed back at a later date due. It is most common to partnerships with institutional partners.

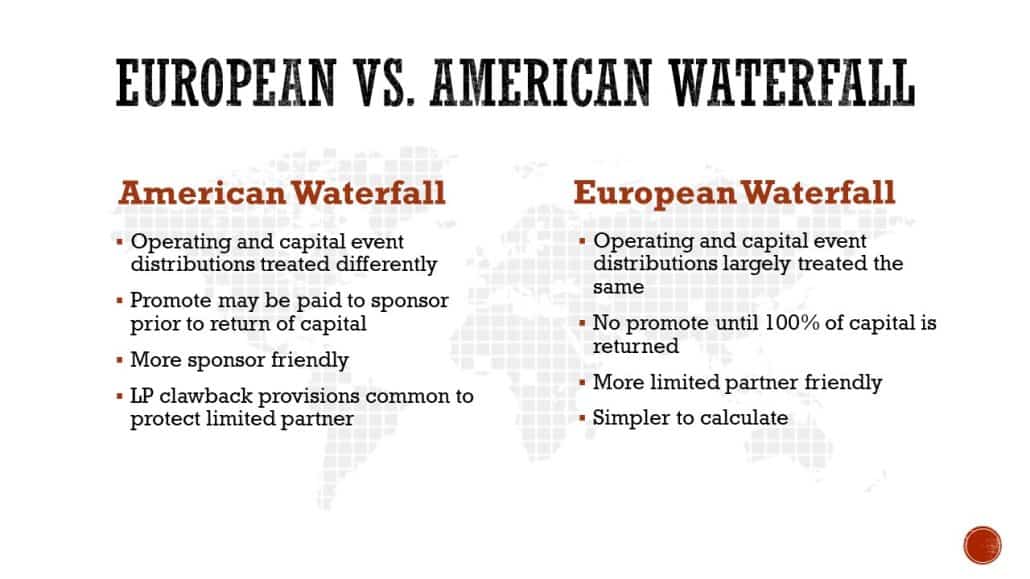

A European-Style Equity Waterfall compared to an American-Style Equity Waterfall

Putting ‘European-Style Waterfall’ in Context

Monterra Development, a prominent Mexican-based developer, partnered with Summit Life Insurance, a U.S.-based institutional investor, to develop the NorthStar Logistics & Manufacturing Park—a 500,000 square foot industrial warehouse and light manufacturing facility located in Monterey, Mexico. The property is strategically positioned near major transportation hubs and is pre-leased to a multi-national corporation with a 10-year lease, denominated in U.S. dollars.

The Partnership Structure

To finance the development, Monterra and Summit formed a joint venture (JV), where Monterra serves as the general partner (GP) and Summit as the limited partner (LP). Summit Life Insurance contributed 90% of the equity, while Monterra contributed the remaining 10%. Given the risk profile of the development and the LP’s institutional nature, both parties agreed to structure the cash flow distributions using a European-Style Waterfall.

How the European-Style Waterfall Works

In this waterfall structure, no promote (i.e., carried interest) is distributed to Monterra (the GP) until Summit (the LP) receives its full return of capital plus a preferred return of 8% per annum. This structure was particularly appealing to Summit Life Insurance, as it minimizes the risk of overpaying promote early in the project’s life and avoids the need for clawbacks.

Here’s how the waterfall functions in the NorthStar Logistics project:

- Initial Cash Flow: During the development phase, distributable cash flow is minimal due to construction costs. Once the property is completed and rent starts flowing in from the multi-national tenant, the first priority is to distribute this cash flow entirely to Summit until they’ve received all of their initial capital back.

- Preferred Return: After Summit receives their return of capital, the next priority is to ensure Summit achieves their 8% preferred return on their invested equity. Any surplus distributable cash flow continues to go to Summit until this hurdle is met.

- Promote to Monterra: Only after Summit has received both the return of capital and the preferred return does Monterra begin to receive its promote, which is typically structured as a 20% share of the excess cash flows. Until then, Monterra only receives distributions proportional to their 10% equity stake.

Example Calculation

Assume the total project cost is $50 million, with Summit Life Insurance contributing $45 million and Monterra contributing $5 million. Upon completion, the facility generates $4.5 million in annual net operating income (NOI) from the tenant’s dollar-denominated lease.

- In Year 1 of operations, the entire $4.5 million would go to Summit to return part of their $45 million investment.

- By Year 3, Summit’s full capital is returned. At this point, any further distributable cash flows go toward the 8% preferred return.

- If by Year 5 Summit has received its full preferred return, only then would Monterra begin receiving their 20% promote on any excess cash flows generated by the property.

Why This Structure is Preferred

The European-Style Waterfall is particularly advantageous in international joint ventures like this one, as it ensures that the institutional LP (Summit) is fully protected and made whole before the GP (Monterra) starts receiving their carried interest. This provides a clear alignment of interests, especially given the potential risks associated with cross-border real estate development. Summit, being risk-averse and more focused on stable long-term returns, preferred this structure to mitigate the chances of needing to claw back any promote distributions in case of unforeseen delays or underperformance.

In this hypothetical case, the use of a European-Style Waterfall gave Summit the confidence to commit $45 million to the project, knowing that they’d be prioritized for return of capital and preferred return, while Monterra was incentivized to complete the project successfully and lease the property to a stable tenant before they could participate in the profit upside.

Frequently Asked Questions about the European-Style Waterfall

What is a European-Style Waterfall in real estate?

A European-Style Waterfall is a method of distributing investment cash flow in which the general partner (sponsor) receives no promote (carried interest) until the limited partner has received full return of capital and earned a preferred return. It treats distributable cash flow during operations and at capital events similarly.

Why do limited partners prefer the European-Style Waterfall?

Limited partners favor this structure because it reduces the risk of overpaying promote to the general partner and potentially needing a clawback later. It ensures LPs are fully repaid before the sponsor participates in profit sharing.

How is a preferred return handled in the European-Style Waterfall?

After the LP has received their full capital back, any additional cash flows go toward fulfilling the LP’s preferred return—commonly 8% per annum—before the GP can earn any promote.

When does the general partner start receiving promote in this structure?

The GP begins receiving promote only after the LP has received both full return of capital and the full preferred return. Prior to that, the GP receives distributions only in proportion to their equity share.

How was the European-Style Waterfall applied in the NorthStar Logistics example?

In the NorthStar Logistics project, Monterra (GP) and Summit (LP) agreed on a European-Style Waterfall. Summit contributed 90% of equity and received all initial distributions until their capital and 8% preferred return were met. Only then would Monterra receive a 20% promote.

Is the European-Style Waterfall used only in Europe?

No. Despite its name, this structure is used worldwide, including the U.S., especially in institutional real estate joint ventures.

Click here to get this CRE Glossary in an eBook (PDF) format.