The Fourth Major Asset Class

David Funk, a professor of mine and the former director of the Baker Program in Real Estate at Cornell University, recently published some interesting research into asset reallocation by institutional investors that more heavily favors commercial real estate. It is definitely worth a read:

Click here to read: ‘Real Estate Takes Its Place as the Fourth Asset Class‘

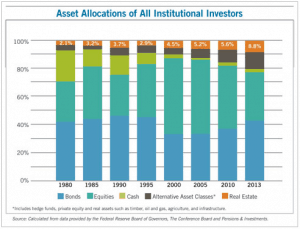

Worldwide, institutional investors (think private and public pension funds, endowments, insurance companies, etc) control nearly $70 trillion of capital, and traditionally have held their capital in cash, equities, and bonds. That tradition is changing. Institutional investors now see real estate as a viable investment vehicle, and are increasing their allocation to reflect that fact.