Real Estate Portfolio Valuation Model

From: $0.00

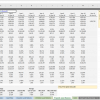

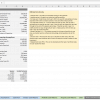

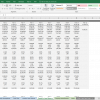

Requires individual property-level cash flows to be calculated in separate model (ARGUS or other DCF). Roll up property-level cash flows to portfolio level on an annual basis. Model portfolio-level debt, investor-level waterfall, and other portfolio-level cash flows. Calculate portfolio-level risk and return metrics. Includes an equity waterfall module with IRR or Equity Multiple hurdles. Account for asset management and other sponsor fees. (View description of model)

To make this model accessible to everyone, it is offered on a “Pay What You’re Able” basis with no minimum (choose ‘Free’ if you need) or maximum (your paid support helps keep the content coming – typical real estate portfolio models sell for $100 – $300+ per license).

Instructions: 1) set a price, 2) tell us where (email address) to send the model, 3) enter payment details (if applicable), and then 4) click ‘Proceed with Download’. The system will send you a download link, as well as add the file to your ‘My Downloads’ page.

Related products

-

3-Tiered Debt Module

From: $0.00Select options This product has multiple variants. The options may be chosen on the product page -

Real Estate Equity Waterfall Model with Cash-on-Cash Return Hurdle

From: $0.00Select options This product has multiple variants. The options may be chosen on the product page -

Excel-Based Restaurant Selection Tool for the Overly Indecisive

From: $0.00Select options This product has multiple variants. The options may be chosen on the product page