Watch Me Build – American-Style Real Estate Equity Waterfall (Updated Apr 2024)

A few years ago, I recorded my screen as I built a 3-tier real estate equity waterfall model. What I didn’t mention in that Watch Me Build video, is that the kind of waterfall I built is colloquially called a European-style equity waterfall. And while that type of waterfall is extremely common, both in the western hemisphere as well as the eastern hemisphere, there is an equally-as-common form of waterfall: the American-style equity waterfall model.

In this latest addition to our real estate financial modeling Watch Me Build series, I open a fresh copy of Excel and record my screen as I build an American-style equity waterfall model from scratch. Download the template and completed file at the end of this video, fire up your dual monitors, and follow along with me!

Are you an Accelerator Advanced member? Access this Watch Me Build video with source files in our ‘Advanced Modeling – Partnership Cash Flow endorsement. You might also review the Modeling Partnership-Level Cash Flow course in the core curriculum to expand on what’s taught in this post. Not yet an Accelerator member? Consider joining the real estate financial modeling training program used by top real estate companies and elite universities to train the next generation of CRE professionals.

While referred to as American and European Waterfalls, these structures both common globally.

European vs. American Equity Waterfall Model

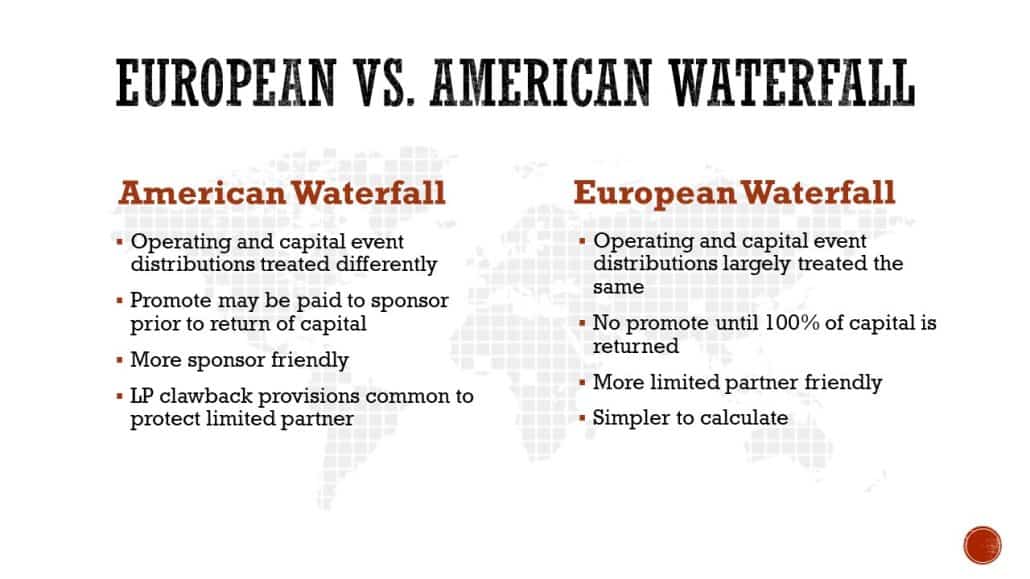

American-Style and European-Style both refer to how distributions are made to partners in a waterfall. But what are the main differences between the two? Before we dive into the Watch Me Build video, I think it’s important to first define what each term means and then outline how each structure differs from the other.

What is an American-Style Equity Waterfall Model?

An American-Style Equity Waterfall model is a common method or sequence for distributing investment cash flow between two or more partners. This form of waterfall is common across investments types, and is particularly common in real estate. While it’s colloquially called an “American-style” waterfall, this form of partnership distribution is commonly used around the world.

What differentiates an American-Style waterfall is that the sponsor (i.e. general partner) is afforded the opportunity to earn a promote (i.e. carried interest) before the limited partner receives a full return of capital and is paid a preferred return. This is because of the distinct treatment of distributable cash flow during operations vs. distributable cash flow at a capital event (ie. reversion cash flow).

An American-Style waterfall is more “sponsor-friendly”, and as a result often comes with special provisions to protect the limited partner (e.g. an LP clawback).

What is a European-Style Equity Waterfall Model?

A European-Style Equity Waterfall model likewise refers to a common method for distributing investment cash flow between two or more partners. And, like its cousin the American-Style Waterfall, it too is used throughout the world despite its name.

What makes the European-Style waterfall unique is that no promote (i.e. carried interest) is paid to the sponsor (i.e. general partner) until the limited partner has received a full return of capital and earned a preferred return. As such, distributable cash flow during operations and distributable cash flow at a capital event are largely treated the same.

Note: Check out the Watch Me Build video where Spencer builds a 3-tier European-Style equity waterfall model

The European-Style waterfall is more limited partner friendly, as it ensure that the LP earns a return before any disproportionate share of cash flow (i.e. promote) is paid out to the sponsor. Since cash flow during operations and at a capital event are largely treated the same, and since special LP protections are less common with this structure, this form of waterfall is easier to model (i.e. calculate).

The Partnership Structure to be Modeled

The first step to building any partnership cash flow module (i.e. waterfall model) is to first understand the structure that is being modeled.

This particular model assumes two tiers during operations, a cash-on-cash preferred return followed by a promote tier. At capital event, a 3-tier IRR waterfall is then modeled, taking into account the cash flow distributed to the partners during operations.

Preferred return is calculated based on initial capital contribution only. It is assumed that the GP and LP contribute pro rata, based on ownership share. And it is likewise assumed that preferred return and return of capital distributions are made pro rata.

The structure might be expressed in a memorandum of understanding between the partners in the following language:

Contributions (Ownership Share)

- General Partner to contribute 10% of required equity

- Limited Partner to contribute 90% of required equity

Distributions – During Operations

Net cash flow during operations to be distributed as follows:

- Partners to be paid an annual 6% preferred return based on the partners’ initial capital contribution only, distributed equally per each partner’s ownership share; any unpaid preferred return to accrue to the partner’s capital account

- Any excess cash flow in each year, after payment of the preferred return, to be distributed to the partners as follows:

- 15% promote paid to the General Partner

- Excess cash flow will be distributed (a) 85% to the partners in accordance with their ownership share, and (b) 15% to the General Partner as a promote

Distributions – Capital Event

Net cash flow at a Capital Event to be distributed as follows:

- First, each capital event distribution will be made to the partners in accordance with their ownership share until the Limited Partner has achieved a 6% annual internal rate of return; and

- Second, excess cash flow will be distributed (a) 85% to the partners in accordance with their ownership share, and (b) 15% to the General Partner as a promote until the Limited Partner has achieved a 12% annual internal rate of return; and

- Lastly, the balance will be distributed (a) 55% to the partners in accordance with their ownership share, and (b) 45% to the General Partner as a promote thereafter.

Watch Me Build Video – American-Style Real Estate Equity Waterfall

Before watching the video, download the template and completed file for this Watch Me Build. Then follow along as I build out the waterfall model.

As always, if you have any questions or comments, please don’t hesitate to reach out.

Download the Source Files for this Watch Me Build Exercise

To make these files accessible to everyone, they are offered on a “Pay What You’re Able” basis with no minimum (enter $0 if you’d like) or maximum (your support helps keep the content coming – similar real estate training exercises sell for $100 – $300+). Just enter a price together with an email address to send the download link to, and then click ‘Continue’. If you have any questions about our “Pay What You’re Able” program or why we offer our models on this basis, please reach out to either Mike or Spencer.

Frequently Asked Questions about Building an American-Style Real Estate Equity Waterfall

Version Notes

v1.1

- Updated Version tab

- Misc. formatting updates

v1.0

- Initial release